Dogecoin Price Forecast: DOGE awaits trigger for 30% advance

- Dogecoin price consolidates around $0.367, awaiting a lift-off.

- A decisive close above $0.40 will confirm the start of an upswing.

- The bullish thesis will face invalidation if DOGE creates a new swing low below $0.311.

Dogecoin price shows signs of ending its consolidation as it makes headway. The recent swing high created on June 2 is a palpable sign of the evolving uptrend. DOGE needs to breach past a crucial resistance barrier to signal the start of an impulsive wave higher.

Dogecoin price eyes a higher high

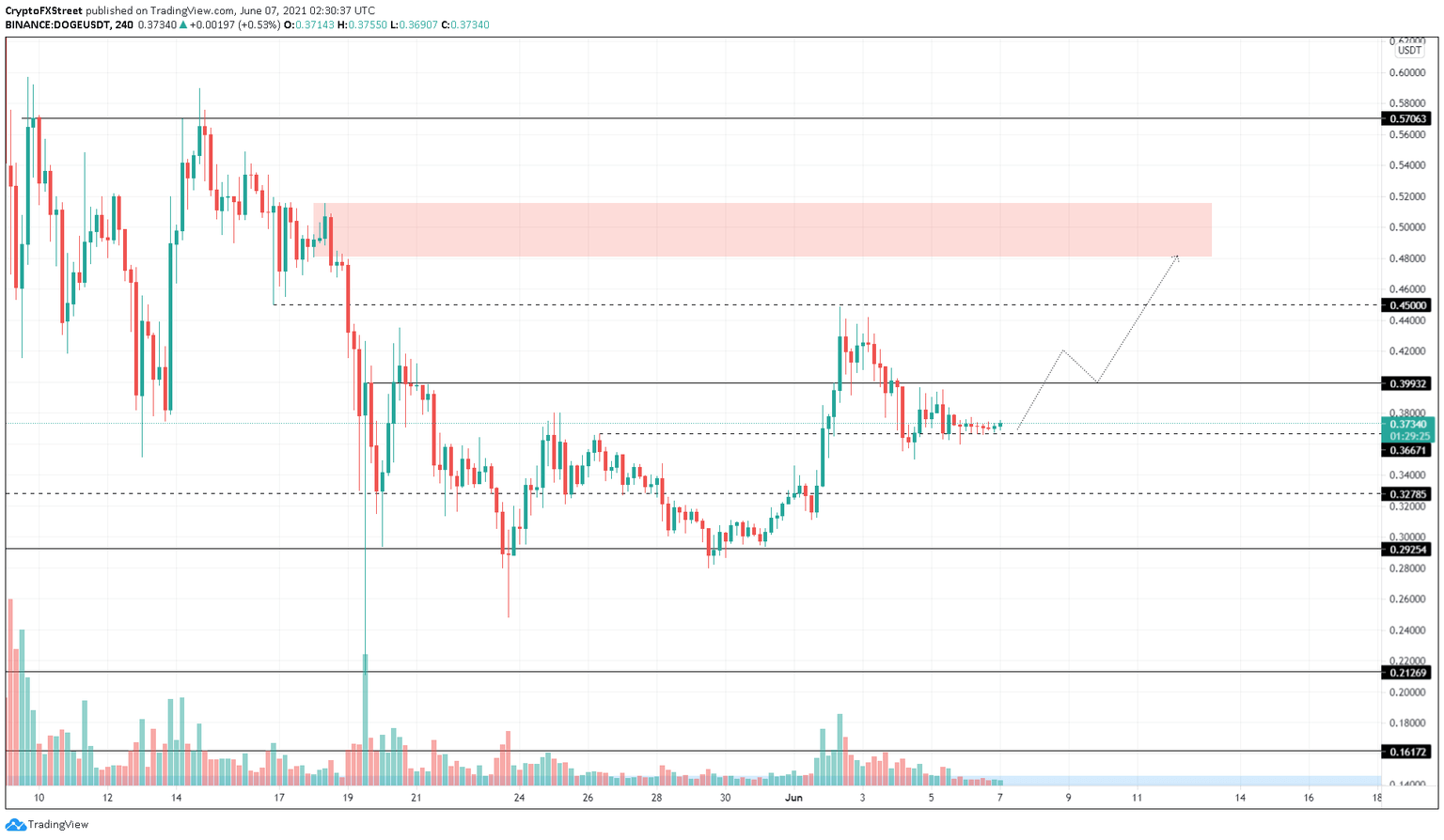

Dogecoin price corrected 60% from May 18 to May 19 as it dropped from $0.515 to $0.213. After this nasty fall, DOGE set up the first swing high on May 20 at $0.435 and the second one on June 2 at $0.448, signaling the evolution of a new uptrend.

So far, the swing lows have been intact with Dogecoin price consolidating in a tiny range, indicating that it wants to move higher. A trigger or a confirmation for this rally will arrive after the meme coin produces a swing high above $0.40.

Clearing the level mentioned above will trigger an explosive 12% leg-up to the immediate barrier at $0.45. If the buyers push past this ceiling, Dogecoin price is likely to test the lower boundary of the supply zone extending from $0.481 to $0.515.

All in all, the move from $0.40 to $0.481 would represent a 30% bull rally.

In an extremely optimistic scenario, DOGE might slice through the resistance area, which will open up the path to $0.571.

DOGE/USDT 4-hour chart

On the other hand, if DOGE price fails to climb above $0.40, it will signal weak buyers. However, the bullish thesis will face invalidation if Dogecoin price creates a new swing low lower than $0.311, which was set up on June 01.

In such a case, there is a chance that the meme coin might witness a 7% sell-off to the immediate support level at $0.293.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.