Dogecoin price bullish outlook intensifies as DOGE turns 10

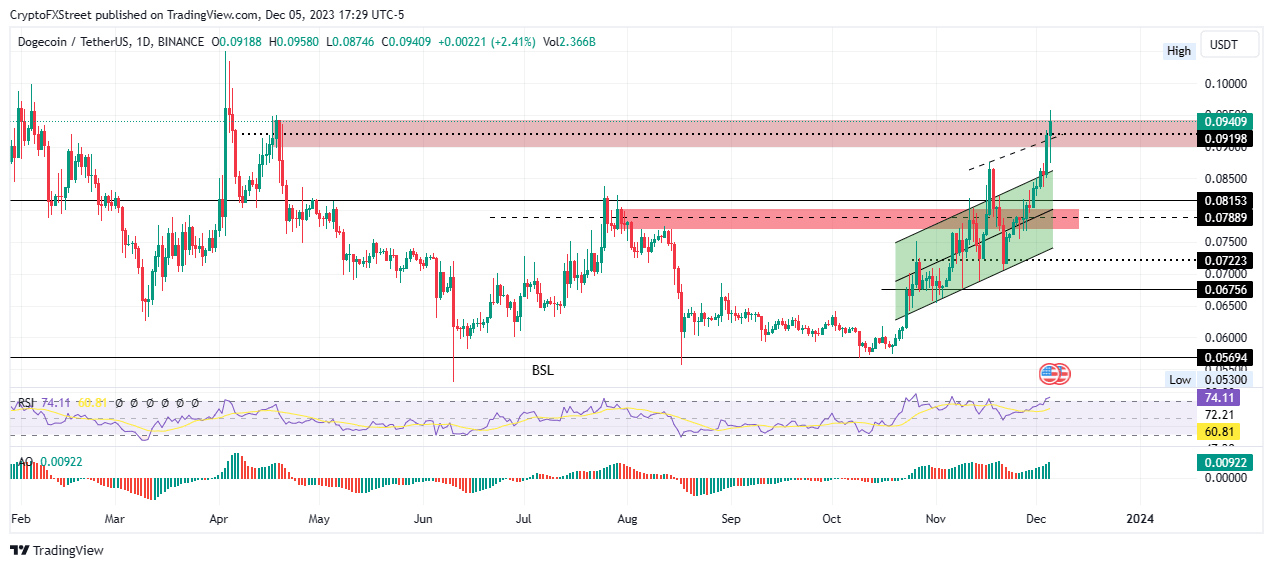

- Dogecoin price has confirmed a move above the supply barrier extending from $0.08980 to $0.09432.

- The foray comes exactly ten years since Dogecoin was created, on December 6, 2013.

- DOGE could extend the gains 6% to tag the enviable $0.10000.

- Invalidation of the bullish thesis will occur upon a decisive daily candlestick close below the midline of the supply zone at $0.09198.

Dogecoin (DOGE) price has sustained the bullish outlook since October 18, when the broader market turned green, leading meme coins in an uptrend, which is no mean feat. The 65% climb has ushered the dog-themed cryptocurrency to its tenth birthday since its official launch on December 6, 2013.

Also Read: Dogecoin Price Prediction: DOGE could hit $0.1 soon if this happens

Dogecoin price eyes 6% surge to $0.10000

Dogecoin (DOGE) price uptrend since October 18 saw the meme coin flip the first supply zone, stretching between $0.07687 and $0.08039 into a bullish breaker, and using it as a jumping off point for the next leap. As it happened, the price is attempting to do the same for the next supply barrier, ranging from $0.08980 to $0.09432, only this time, eyes are peeled on the area above $0.10000.

Despite DOGE being overbought, with the Relative Strength Index (RSI) at 74, there remains some upside potential as the momentum indicator remains northbound to show sustained bullish momentum. Similarly, the Awesome Oscillator (AO) remains in the positive territory with green histogram bars, evidence of bullish presence in the DOGE market.

Increased buying pressure above current levels, therefore, could see Dogecoin price flip the zone into a bullish breaker, as it extends the gains to the $0.10000 psychological level. Confirmation of such a move will be seen once the price records a decisive daily candlestick close above the $0.09198 midline.

In a highly bullish case, the gains could extend for Dogecoin price to tag the $0.10500 range high. Such a move would denote a 12% climb above current levels.

DOGE/USDT 1-day chart

On the flipside, early profit booking could see Dogecoin price get rejected from the supply barrier between $0.08980 and $0.09432. If this order block holds as a resistance level, DOGE could pull south, with a daily candlestick close below its midline at $0.09198 confirming a downtrend.

The ensuing landslide could send Dogecoin price lower, falling back into the fold of the ascending parallel channel. The bullish thesis will be invalidated upon a solid move below the $0.07889 midline of the first supply barrier turned bullish breaker.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.