Dogecoin price crashes 7% hours after Elon Musk reacts to DOGE founder mocking the bears

- Dogecoin price witnessed a fate similar to every other cryptocurrency on Monday, crashing to $0.0944.

- Dogecoin founder Markus called out the bears' pessimism after DOGE charted a 12-month high this week.

- The ill-timed joke became the embodiment of irony as the meme coin crashed mere hours later.

Dogecoin price could not escape the effect of Bitcoin whale selling on Monday as the meme coin crashed along with the rest of the crypto market. While the crash itself was not surprising, the events that preceded it were, as the meme coin's founder, in a way, transpired, the big red candlestick.

Shibetoshi's bad joke

Dogecoin founder Billy Markus, who is better known as his X, formerly Twitter, alias Shibetoshi Nakamoto, could be seen mocking the bears in the early hours of Monday. Calling out the pessimists, Markus tweeted,

"oh no crypto died everything is dead blah blah blah.

This joke was met with applause by the community as well as the owner of X and DOGEfather, Elon Musk, as Dogecoin price at the time of the tweet was at a yearly high, trading at $0.1020.

— Elon Musk (@elonmusk) December 11, 2023

Unfortunately, the timing of the joke could not have been worse as the meme coin, akin to the rest of the crypto market, crashed just hours later. As investigated by FXStreet, the likely reason for the crash was Bitcoin whales selling $671 million worth of BTC, which had a ripple effect on the crypto market.

In a way, Markus transpired the crash that has now left DOGE vulnerable to an 11.5% crash.

Dogecoin price could see a further decline

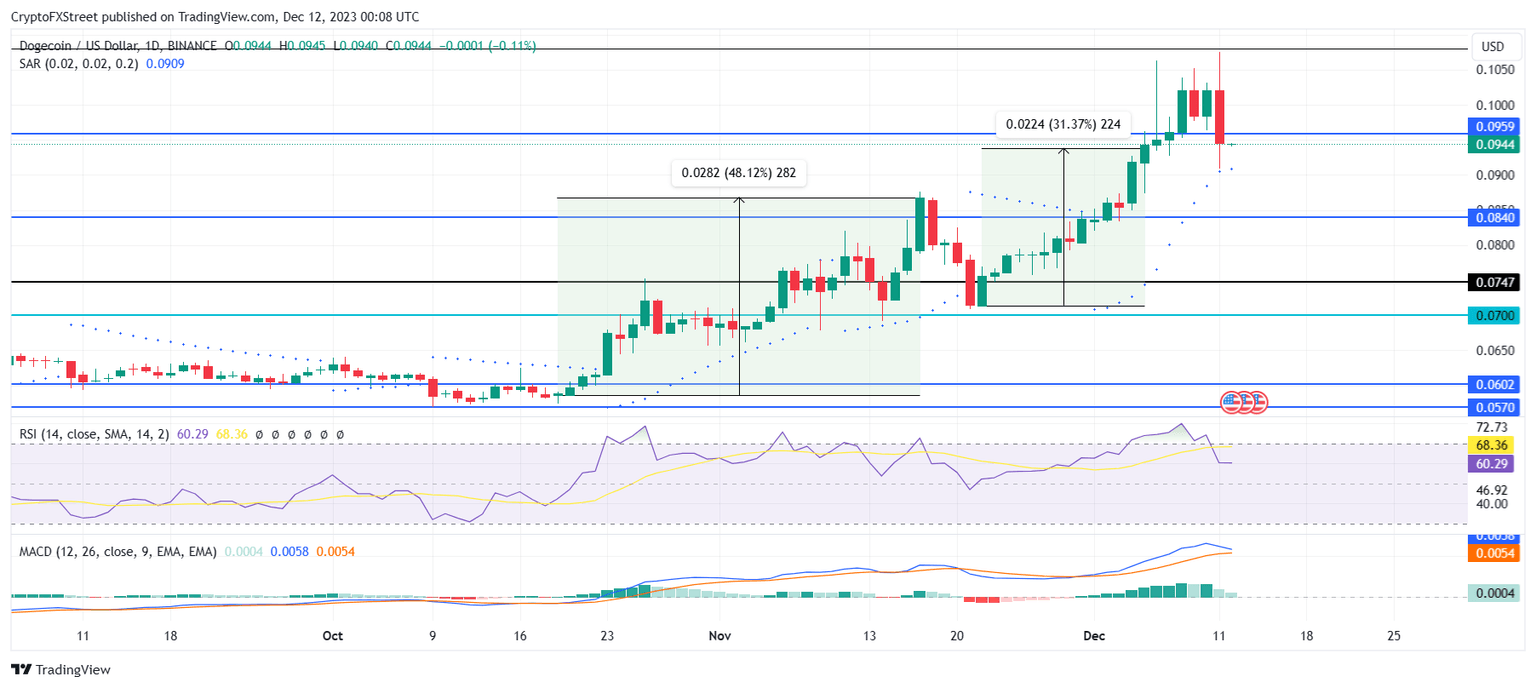

Following the 7.35% crash on December 11, Dogecoin price fell below the support line of $0.959 to trade at $0.0944 at the time of writing. This level is crucial to DOGE as, in the past, this very line acted as resistance to the meme coin, which it failed to breach for nearly 11 months before successfully doing so in the last week.

This crash has now left the Dogecoin price open to a potential further decline that could see the altcoin losing the support of $0.900 as well. The next major support line is at $0.0840, falling to which would mark an 11.5% crash for the cryptocurrency.

DOGE/USD 1-day chart

However, the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator are still exhibiting some bullishness persisting in the market. This could support recovery that could help DOGE reclaim $0.0959 as a support floor. This would boost the meme coin back up to $0.1000 and initiate further increases.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.