Short liquidations worth $1.2 billion hit crypto traders like the plague

- As Bitcoin, Ethereum and several altcoins yielded massive gains overnight, a series of short liquidations were triggered.

- Based on data from IntoTheBlock’s dashboard, total shorts liquidations in crypto have surpassed $1.2 billion.

- FTX exchange accounts for nearly 80% of the $1.2 billion crypto liquidations since October 25.

With the recovery of the broader crypto market, there was a round of massive liquidations on exchanges like FTX. Shorts worth $1.2 billion were liquidated since October 25, as altcoins Ethereum and XRP yielded profits for holders.

Also read: XRP Price: Addresses holding XRP cross 4.34 million, hit new milestone

Short liquidations signals a turning tide in crypto

The recent spike in crypto short liquidations is similar to levels seen in July 2021. A liquidation on a long/short position occurs when an exchange forcefully closes a trader’s leveraged position due to partial or total loss of initial margin. When this happens, there is a margin call followed by a partial or total loss of initial margin through liquidation.

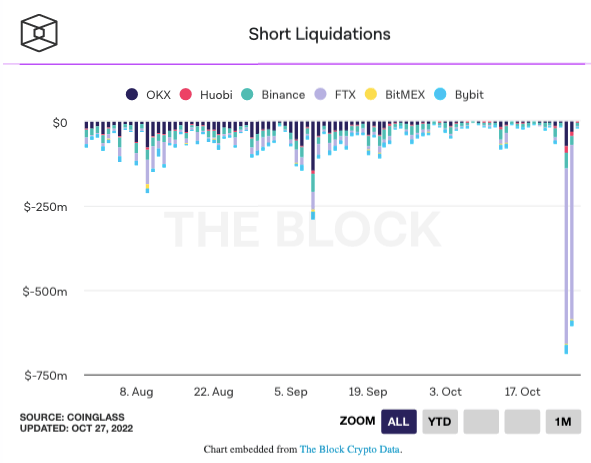

Based on data from TheBlock’s dashboard, more than $1.2 billion in crypto shorts have been liquidated. Analysts believe that the liquidations may have contributed to a short squeeze in cryptocurrencies because of the massive rally in altcoins like Ethereum, Dogecoin and XRP.

Crypto short liquidations from IntoTheBlock data

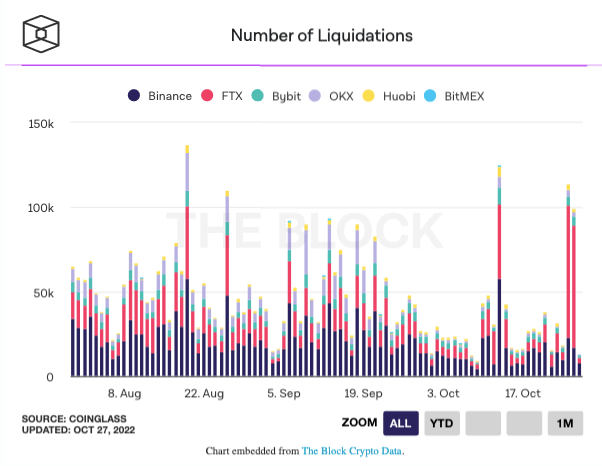

Overall crypto market capitalization climbed 4%, hitting the $1 trillion mark, a level that the industry attained in August 2022. Since October 25, about 205,000 trades have been liquidated across exchanges with the spike in crypto prices. Samuel Bankman-Fried’s FTX exchange accounts for 72% of the short liquidations according to TheBlock’s data dashboard.

Number of crypto liquidations across exchanges from IntoTheBlock data

Traders going long on cryptocurrencies like Bitcoin suffered upwards of $99 million in liquidations across digital asset exchanges. While FTX recorded upwards of $519 million in short liquidations, leading crypto exchange platform OKX recorded $71 million and Binance recorded $46 million.

Liquidations attributed to Bitcoin’s long and short positions were upwards of $368 million. What’s more, there was a spike in open interest, implying traders want to open more positions in anticipation of a price rally in an asset.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.