Dogecoin price defying Bitcoin’s lead might be the key to its recovery

- Dogecoin price managed to prevent excessive drawdown like Bitcoin on May 1, declining by less than 1%.

- DOGE currently has a correlation of 0.3 to Bitcoin, which proved to be advantageous when BTC fell to $28,000 yesterday.

- PEPE taking away all the meme coin attention is contributing to Dogecoin’s disappearing investor count.

Dogecoin price has always been a leader in the meme coin space, but the emergence of PEPE challenged the supremacy of the cryptocurrency. The “OG” meme coin continues to fail to breach an important resistance level, but the altcoin might have found its way around the bearishness surrounding it.

Dogecoin price volatility simmers down

Dogecoin price over the last week has had a rather less volatile, sideways movement in comparison to Bitcoin price’s rise to $30,000 and the subsequent decline. The latter noted another 4% crash on May 1, while DOGE stood virtually unchanged at $0.0789.

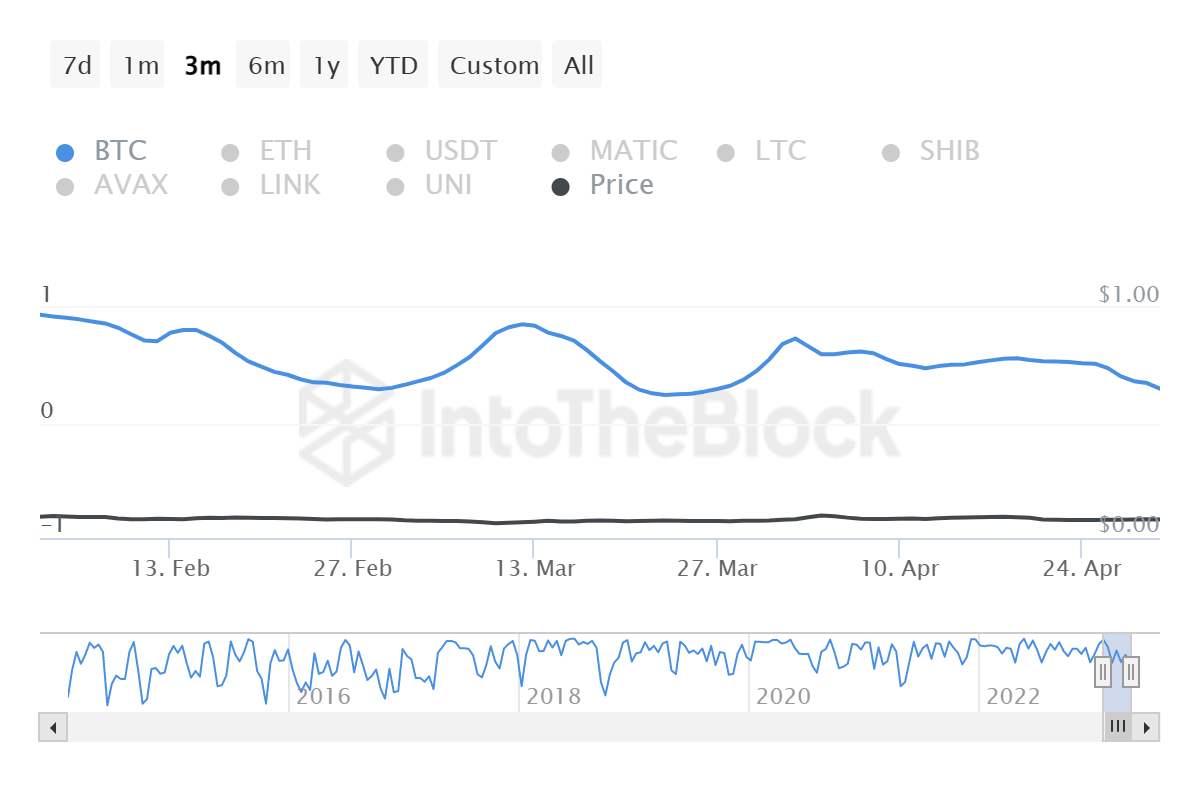

Given that the altcoins currently lack the strength to mark an alt season, all the cryptocurrencies are bound to follow Bitcon’s lead. However, DOGE is one of the altcoins refraining from doing so, given its correlation to the asset stands at a low of 0.3. This is the same reason why the meme coin did not observe much decline over the last 24 hours, even as BTC slipped to $28,000.

Dogecoin correlation to Bitcoin

Read more - MicroStrategy outperforms Apple, Google and Bitcoin price despite BTC dip to $28,000

But beyond a low correlation, Dogecoin needs the support of its investors, that have been disappearing over the last ten days. The addresses conducting transactions on the network declined from an average of 142,000 throughout April to 112,000 for the last couple of days.

Dogecoin active addresses

One of the potential reasons behind this is the absurdly successful meme coin, PEPE, which boasts a market cap of $481 million that it gained over the last two weeks. The hype surrounding the joke coin has been such that the 24-hour trading volume of PEPE surpassed that of Dogecoin.

While DOGE noted a total of transactions worth $321 million conducted in the last day, PEPE traders and holders moved around $521 million worth of supply in the same duration. The trading volume of PEPE even exceeded the total diluted market cap, which speaks volumes to the sensibility and loyalty of meme coin holders.

Dogecoin vs. PEPE 24-hour trading volume

Regardless, DOGE might have a shot upon the PEPE hype easing; until then, not following Bitcoin is likely the best option for the cryptocurrency.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B06.14.19%2C%252002%2520May%2C%25202023%5D-638185859460160430.png&w=1536&q=95)