Dogecoin price could outperform Dogecoin-killer Shiba Inu as DOGE targets $0.25

- Dogecoin price action continues to recover from ten-month lows.

- DOGE could outperform several major cryptocurrencies on a confirmed breakout.

- There are risks to the downside, but the threat is limited.

Dogecoin price is nearing an important bullish breakout level that could trigger a massive upswing this weekend. It would be the strongest bullish signal in almost a year if confirmed.

Dogecoin price set to return to the $0.25 value area

From an Ichimoku perspective, Dogecoin price action is very close to confirming an Ideal Bullish Ichimoku Breakout. The only condition missing is a daily candlestick close above the Ichimoku Cloud.

On May 31, 2022, the price level that DOGE needed to close at to confirm an Ideal Bullish Ichimoku Breakout was $0.16 – but that threshold has now dropped. The threshold for Saturday is daily close at or above $0.146, and by Sunday, it drops even further to $0.14.

DOGE/USD Daily Ichimoku Kinko Hyo Chart

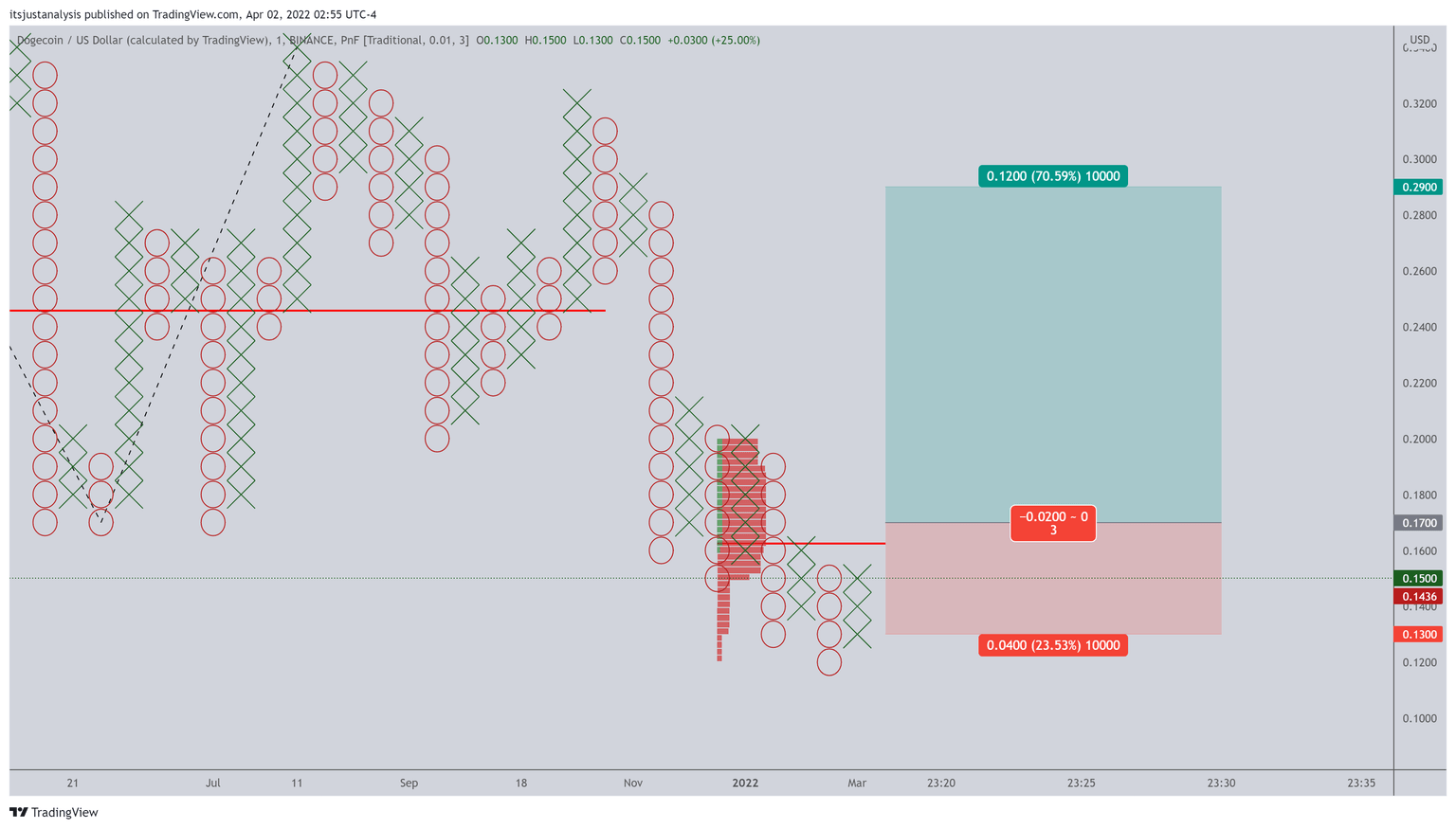

The daily Ichimoku chart compliments a hypothetical long opportunity on the $0.01/3-box reversal Point and Figure chart for Dogecoin price. The long idea is a buy stop order at $0.17, a stop loss at $0.13, and a profit target at $0.29.

The entry at $0.17, if triggered, would confirm the breakout above a double-top and simultaneously establish a Bear Trap pattern in Point and Figure analysis. That the Bear Trap forms at the ultimate swing low of the current downtrend gives the bullish breakout a high probability of succeeding and sustaining for a long time.

The hypothetical long opportunity for Dogecoin price represents a 3:1 reward for the risk. A three-box trailing stop would help protect any profit made post entry. Buyers should anticipate significant selling pressure against the critical psychological price level of $0.25 before moving towards the projected profit target of $0.29.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.