Dogecoin price signals a 60% bull rally ahead

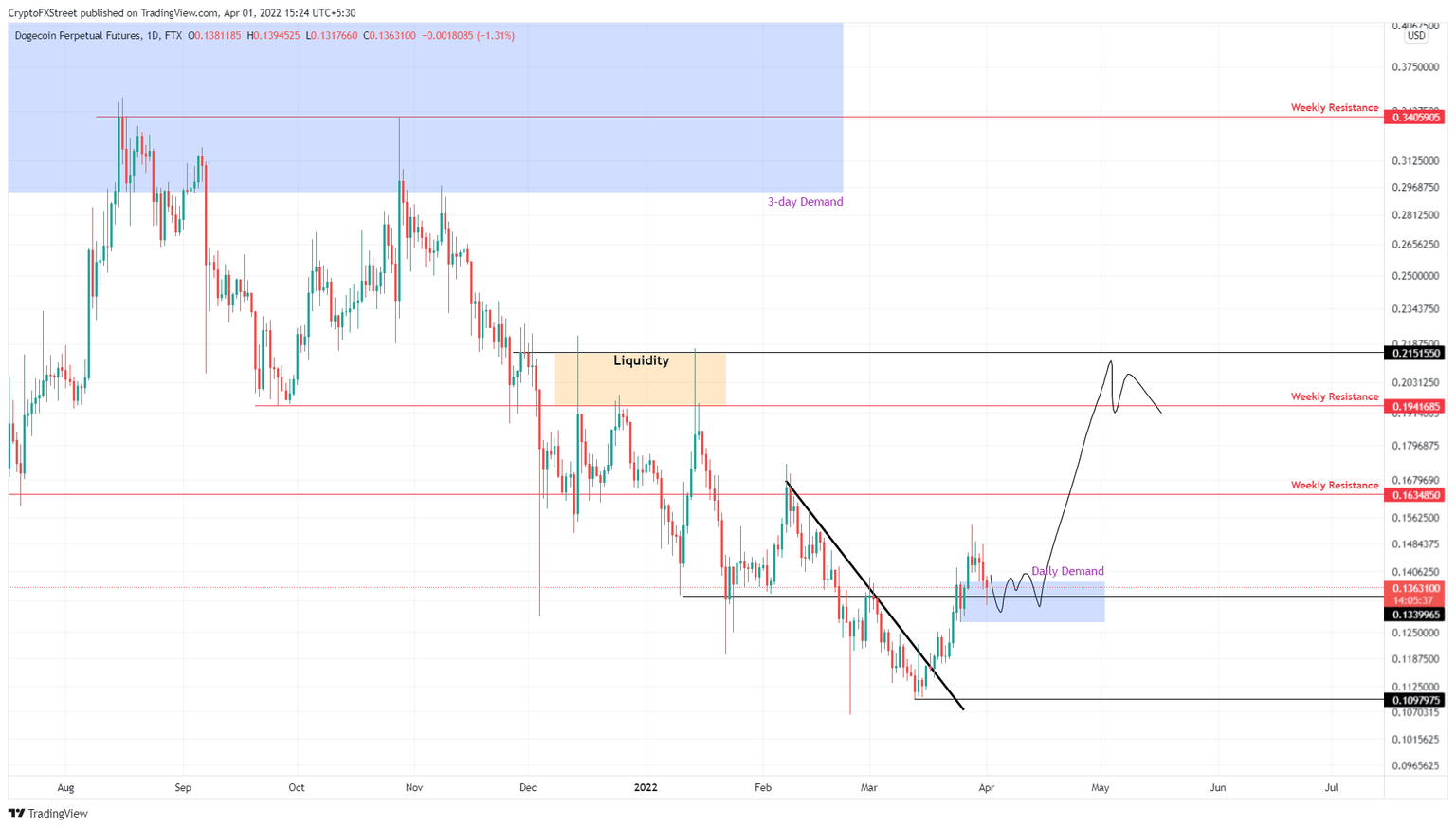

- Dogecoin price is currently bouncing off the $0.127 to $0.137 demand zone.

- A spike in buying is likely to propel DOGE by 60% to $0.215.

- A daily candlestick close below $0.127 will invalidate the bullish thesis.

Dogecoin price faces exhaustion after its recent gains, causing a minor retracement. This pullback has pushed DOGE into a demand zone, suggesting the possibility of a quick run-up.

Dogecoin price to kick-start another run-up

Dogecoin price retraced 14% after a 40% upswing that began on March 14. While the pullback will allow Dogecoin buyers to recuperate, it was caused by Bitcoin’s sudden downtrend. Regardless, the retracement has caused DOGE to retest the $0.127 to $0.137 demand zone, which will provide bulls with the extra oomph to kick-start another leg-up.

The resulting rally will propel DOGE to retest the $0.163 and $0.194 weekly resistance barriers. Clearing these hurdles is crucial for market makers to collect the buy-stop liquidity resting above the $0.194 barrier.

This ascent, therefore, would constitute a 60% gain for investors that are willing to seize the opportunity, and the time is now ripe as the Dogecoin price retests the daily demand zone.

DOGE/USDT 4-hour chart

While things are looking up for Dogecoin price, the breakdown out of the demand zone will put a final nail in the bulls’ coffin.

A daily candlestick close below $0.127 will invalidate the bullish thesis for Dogecoin price by creating a lower low. This move will also lead to the breakdown of the demand zone, indicating a surge in selling pressure.

In this situation, market participants can expect DOGE to retrace to the $0.109 support level, allowing buyers to regroup and give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.