Dogecoin and Shiba Inu lead the wave of meme coin price rallies, here’s what to expect

- Dogecoin and Shiba Inu are leading a recovery rally in meme coins, alongside Baby Doge Coin, FLOKI and Dogelon Mars.

- DOGE, SHIB and rival meme coins yielded gains for holders since February 15, in response to Dogefather Elon Musk’s recent tweet.

- The billionaire appointed his dog as Twitter CEO and the crypto community is asking whether it is Dogecoin, Shiba Inu or FLOKI.

Shiba-Inu-themed meme coins are leading a recovery rally in crypto. The two largest meme coins Dogecoin and Shiba Inu recovered from their recent price drops. This is not the first time Musk’s comments have triggered price rallies in meme coins.

Also read: Binance becomes SEC’s latest target after Kraken, Coinbase and Paxos, but markets remain strong

Dogecoin and Shiba Inu are leading a price rally in meme coins

Dogecoin and Shiba Inu are leading a rally in meme coins after recent commentary from Tesla CEO Elon Musk. Musk tweeted a picture of his Shiba Inu dog Floki and appointed him the new CEO of Twitter.

The billionaire’s tweets garnered attention in the crypto community as it sparked an intense debate on which meme coin is represented in Musk’s tweet. Three Shiba-Inu-themed meme coins Dogecoin (DOGE), Shiba Inu (SHIB) and FLOKI are the top contenders.

Musk’s tweet triggered a price rally in meme coin, adding as much as $500 million to DOGE’s market capitalization within a 15-minute period. This explains the impact of Musk’s comments on Shiba-Inu-themed cryptocurrencies.

FLOKI yielded massive gains for holders overnight

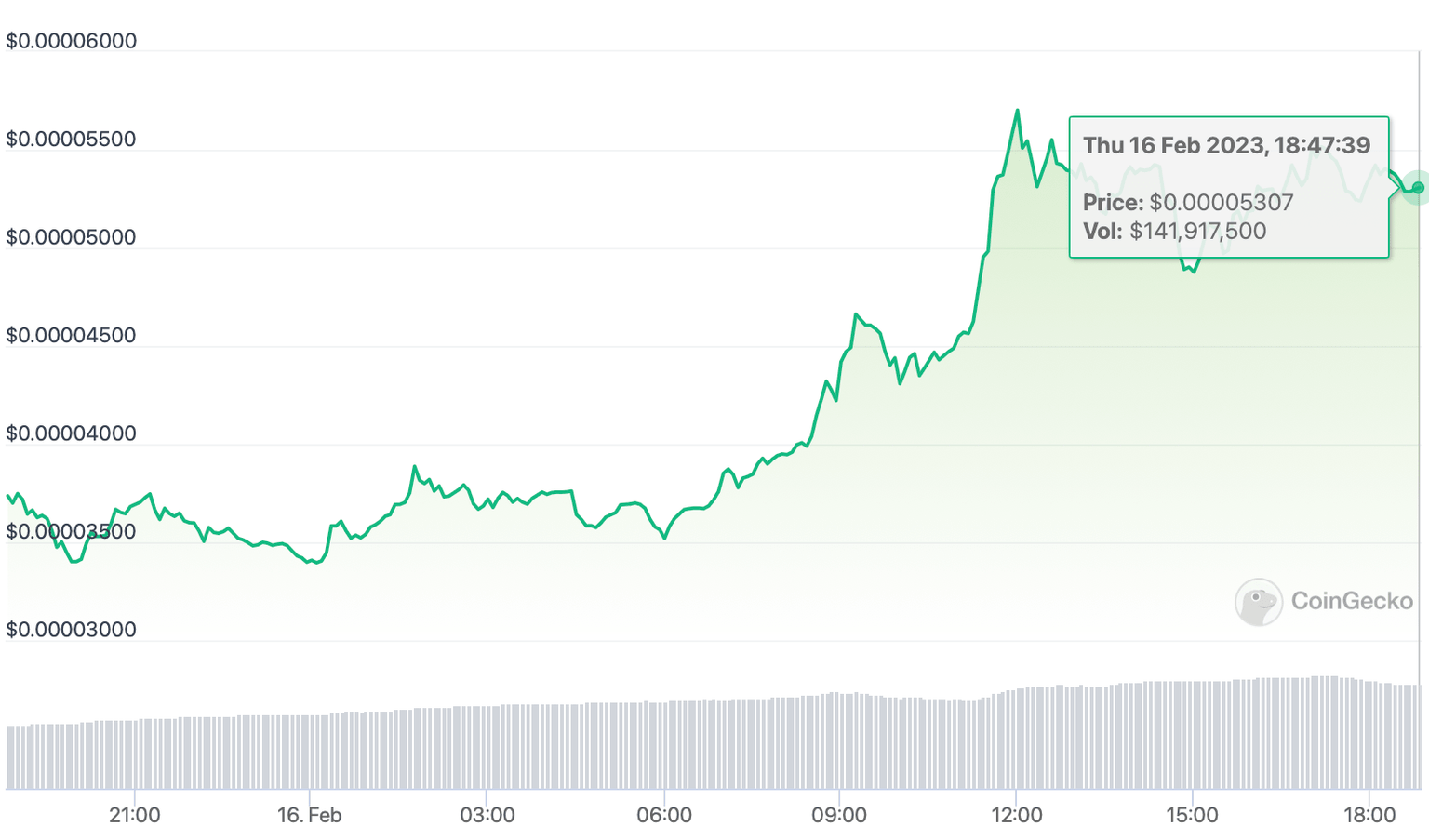

FLOKI, the meme coin that derives its name from Elon Musk’s dog Floki, has yielded the highest single-day return to traders, compared to Shiba Inu and Dogecoin. FLOKI offered 42% gains to holders overnight, leading among the top three meme coin contenders.

FLOKI price chart

FLOKI ranks among the top 100 cryptocurrencies by market capitalization, based on data from CoinGecko. FLOKI is on the watchlist of 94,276 traders, with its rising popularity among meme coin traders.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.