Binance becomes SEC’s latest target after Kraken, Coinbase and Paxos, but markets remain strong

- The US SEC continues its crackdown on cryptocurrency firms, latest target Binance could resort to a monetary settlement.

- Binance could settle the regulators investigations in its business in the US, exploring remediations and paying fines.

- Bitcoin price rallied as sentiment turned bullish among market participants, yielding 11.6% gains for holders overnight.

Binance, the world’s largest cryptocurrency exchange, is under investigation by US financial regulator, the Securities and Exchange Commision (SEC). The exchange could pay monetary penalties and settle existing investigations on its US business.

US financial regulators recently tightened their grip on the crypto market, slapping firms like Kraken and Paxos with investigations.

Also read: Binance CEO CZ addresses stablecoin FUD as BNB gears up for 46% upside

SEC conducts investigation in Binance US arms

The US Securities and Exchange Commission (SEC) is closely investigating the relationship between the US arms of Binance and two trading firms with ties to founder Changpeng Zhao. Sigma Chain AG and Merit Peak Ltd. are the two market makers on Binance’s US exchange and the regulator is examining the exchange’s disclosures to customers about its relationship with trading firms.

Binance.US website says that affiliated market makers may trade on its platform, however it doesn’t name the firms. The SEC requested the exchange for more information on the two market makers, considered affiliates of the exchange’s US business.

CZ was listed as the chairman of the board of directors of Sigma in a Swiss incorporation document from January 2019. Further, CZ signed a document on behalf of market maker Merit, approving an infusion of capital into Binance.US in exchange for shares in the company.

In its 2020 investigations into Binance, the SEC refers to Merit as a “Binance entity” in its subpoena.

Will Binance pay and settle the investigations on its business?

Binance, meanwhile, expects to pay monetary penalties to effectively settle and put to an end existing US regulatory and law-enforcement investigations into its businesses. The firm’s Chief Strategy Officer Patrick Hillman said that the exchange is working with regulators to reach a settlement figure.

The trading giant expects the outcome to be a fine most likely, or perhaps more, and that remains for regulators to decide.

US regulators tighten the noose around crypto’s neck

The New York State Department of Financial Services ordered the Paxos Trust Company to stop issuing the US Dollar-pegged BUSD stablecoin. The development came a day after reports that the SEC is likely prepared to sue the firm for alleged violations of the investor protection laws.

After its crackdown on Kraken for its “staking-as-a-service” the US SEC continued its regulation by enforcement on trading platforms like Binance.

Also read: Breaking: SEC to sue stablecoin issuer Paxos over Binance USD

Coinbase battles the US SEC’s actions on staking as a service

Coinbase, one of the largest cryptocurrency exchanges, voiced its opinion on the issue of the SEC treating “staking” as an unregistered security. The exchange offers staking through “Coinbase Earn.” The exchange published a blog on February 10, stating that:

Staking is not a security under the US Securities Act, nor under the Howey test.

Trying to superimpose securities law onto a process like staking doesn’t help consumers at all and instead imposes unnecessarily aggressive mandates that will prevent US consumers from accessing basic crypto services and push users to offshore, unregulated platforms.

Crypto markets remain resilient despite FUD

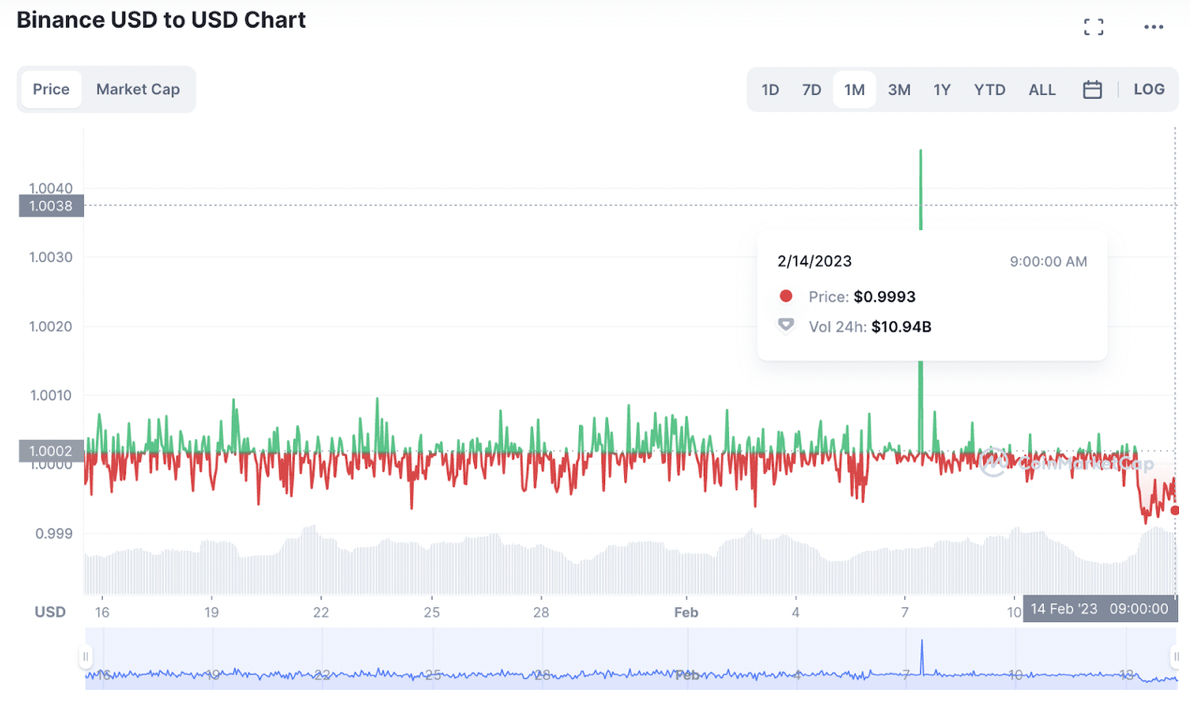

Despite the regulatory uncertainty in the crypto space, the markets seem to be resilient. The Fear, Uncertainty and Doubt (FUD) has failed to negatively impact the 2023 rally. Binance USD (BUSD) temporarily depegged, trading at $0.9993 on February 14, but seems to be recovering.

BUSD price chart

The same can be said for the exchange’s native token Binance Coin (BNB), which shed 11% after the news of SEC suing Paxos for BUSD. However, the recovery seems to be going well for the altcoin, which has recouped the losses and currently trades at $320.

This bullish outlook can be attributed to the general market outlook which has remained optimistic since the start of 2023. Bitcoin price continues to add more gains to its 48% upswing so far. As a result, altcoins, including BNB, are showing strength.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.