Decentraland price to retest $2.50 before MANA advances further

- Decentraland price action has experienced a significant rally, moving nearly 70% from the January 22 low.

- MANA is coming off a consecutive eight-day winning streak.

- Bearish divergence may want a pullback from the recent rally.

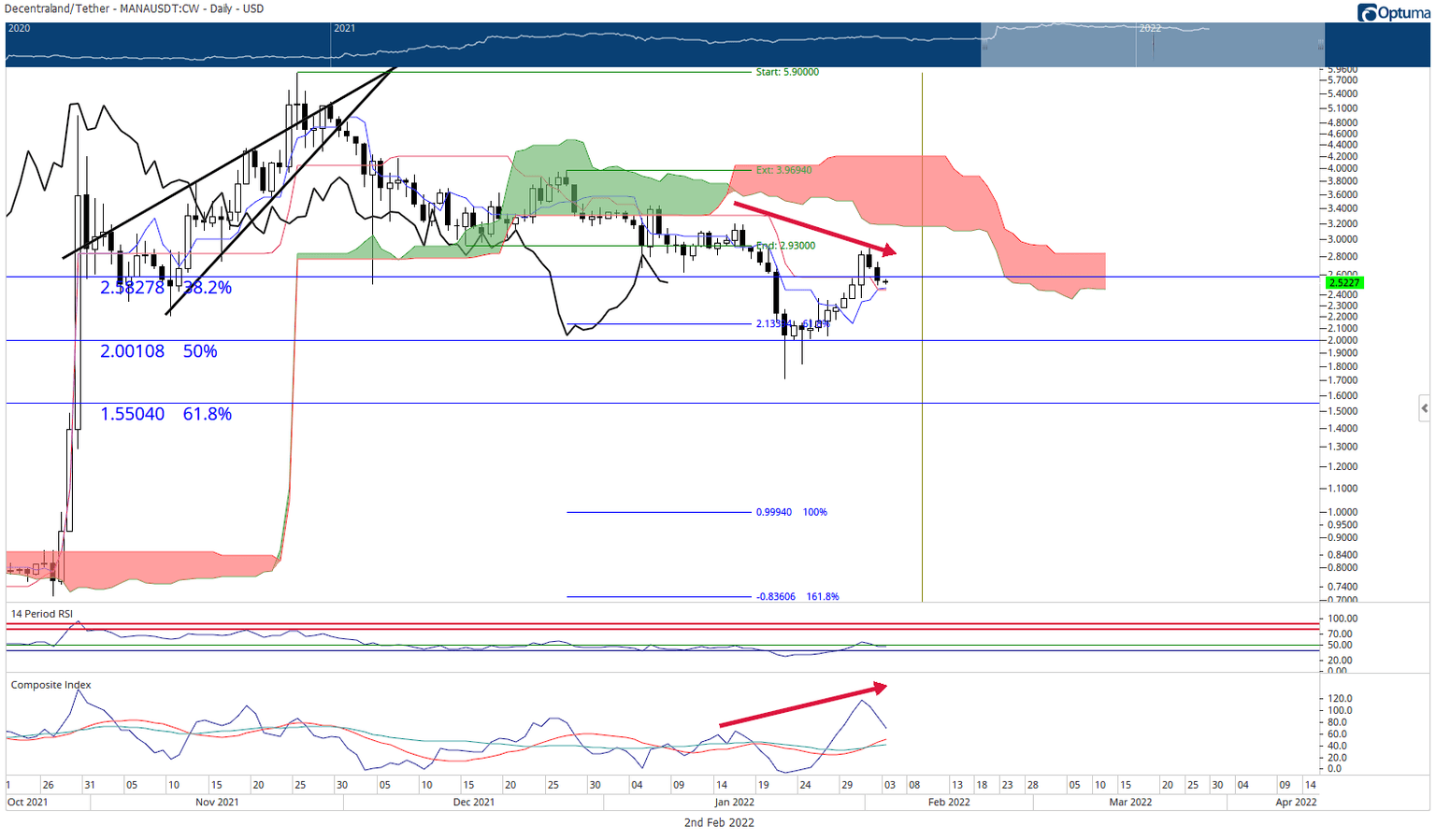

Decentraland price action continues to be very bullish in the near term, with bulls completing a spectacular rally off the 50% Fibonacci retracement at $2.00. Bulls continued this momentum, pushing past $2.25 and $2.50, but halted shy of the $3.00 value area.

Decentraland price facing a retest of $2.50

Decentraland price action faces some selling pressure after failing to hold a close above the 38.2% Fibonacci retracement at $2.54. The following primary support zone for Decentraland is now the confluence zone of the Tenkan-Sen and Kijun-Sen at $2.50.

The drop over the past three trading days is likely due to the hidden bearish divergence between the candlestick chart and the Composite Index. This type of divergence occurs when the price chart prints lower highs/closes and the oscillator prints higher highs. It is a bearish continuation warning that is only valid if the prior trend was a downtrend – which Decentraland price was in.

Failure to hold $2.50 would likely mean a strong drive to retest the 50% Fibonacci retracement at the $2.00 value area. This could generate further weakness that would threaten to drop MANA lower, possibly below the 2022 low.

If the $2.50 level holds as support, then there is a high probability of Decentraland price moving up to test the bottom of the Ichimoku Cloud (Senkou Span A) at $3.20

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.