- Decentraland price at an inflection point.

- MANA completed a 50% logarithmic retracement, fulfilling conditions for a new floor to target new highs.

- $2.50 is the critical resistance zone to break above to initiate a new bull run.

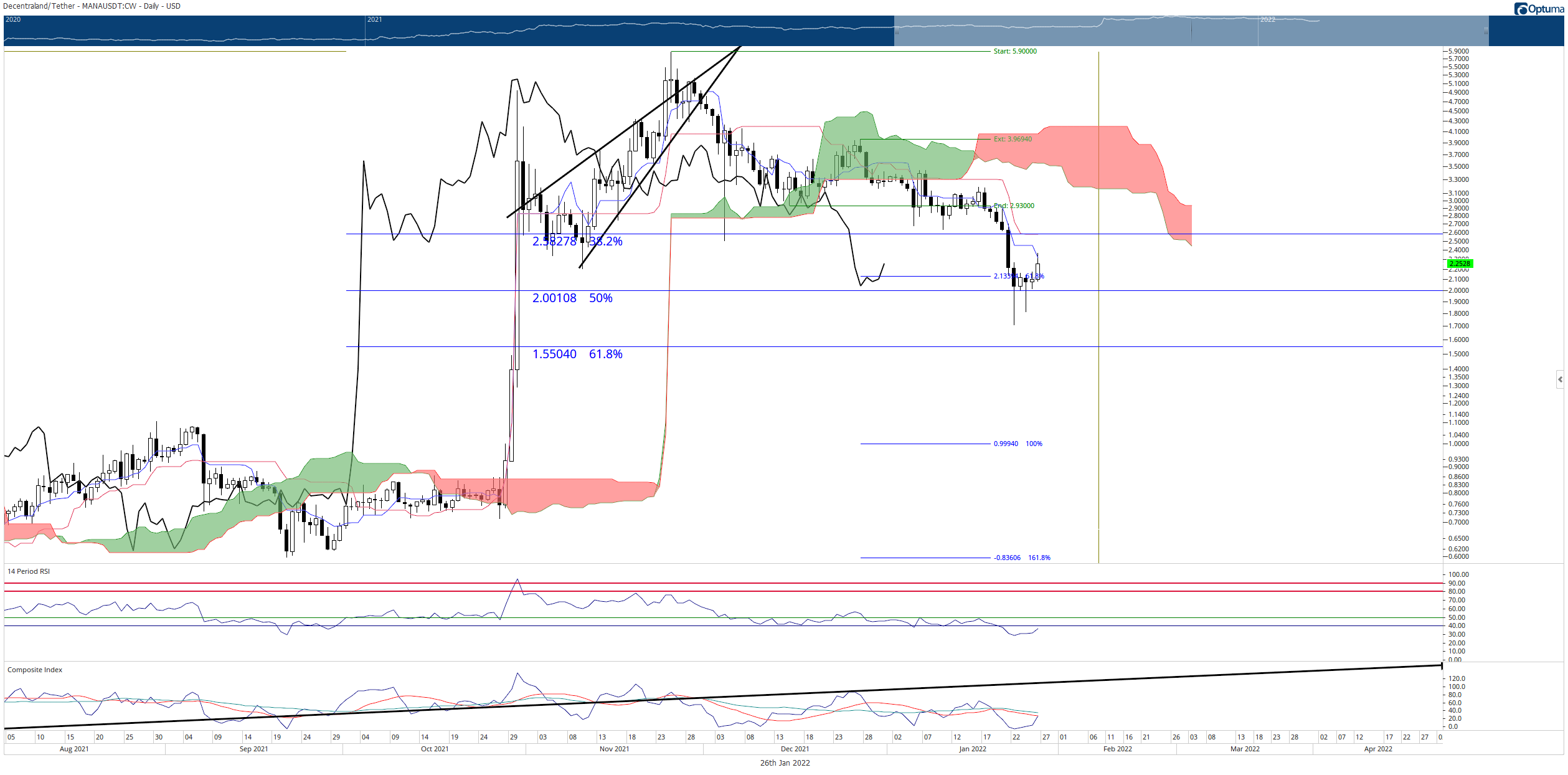

Decentraland price has rallied strongly since it hit three-month lows at $1.70. Since then, MANA has spiked nearly 39% off the lows to hit $2.25.

Decentraland faced strong Ichimoku and Fibonacci resistance at $2.50

Decentraland bulls have been thirsty to repeat the rally it experienced in October 2021. There is no reason why MANA can’t repeat that success, especially given the growth in interest and investment into the metaverse and gaming-token space. However, significant hurdles exist and will be tested before Decentraland can return to its highs.

The first hurdle that Decentraland price must defeat is a confluence zone of resistance between the Tenkan-Sen at $2.50 and the shared $2.58 price level with the 38.2% Fibonacci retracement and Kijun-Sen. The likelihood of MANA pushing through the $2.58 zone decreases significantly if the Composite Index oscillator creates a high above the January 16 high (in the oscillator) – hidden bearish divergence. But if MANA can create a close above the January 16 close, then the hidden bearish divergence will be avoided.

MANA/USDT Daily Ichimoku Kinko Hyo Chart

Downside risks remain strong but should be limited to the 50% Fibonacci retracement at $2.00. Any further bullish outlook is invalidated if a daily or weekly close is below $2.00. MANA would likely push towards the 61.8% Fibonacci retracement in that scenario at $1.55.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Avalanche set to gain wider reach with its Stripe integration

Stripe makes another move by integrating AVAX and Core into its platform. Users can purchase AVAX directly on Stripe, along with dapps and NFTs. The partnership may stir traffic into the Avalanche ecosystem and cause more interest in web3.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin (BNB) price, like most altcoins, is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price.

EigenLayer to launch airdrop in May following the introduction of the Eigen Foundation

EigenLayer announced it would launch season one of its airdrop on May 10. EIGEN tokens would play a key role in the recently introduced "intersubjective forking." Some crypto community members have expressed dissatisfaction with the airdrop vesting schedule.

Ethereum erases weekend gains as yearlong SEC investigation comes to light

Ethereum (ETH) began the week by posting losses of 4.2% on Monday after recent filings from Consensys revealed that the Securities & Exchange Commission (SEC) began formal investigations into ETH's security status since March 2023.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.