CYBER price jumps nearly 17% ahead of $10 million token unlock

- CYBER price is capitalizing on the bullishness from the past week as well as the upcoming token unlock.

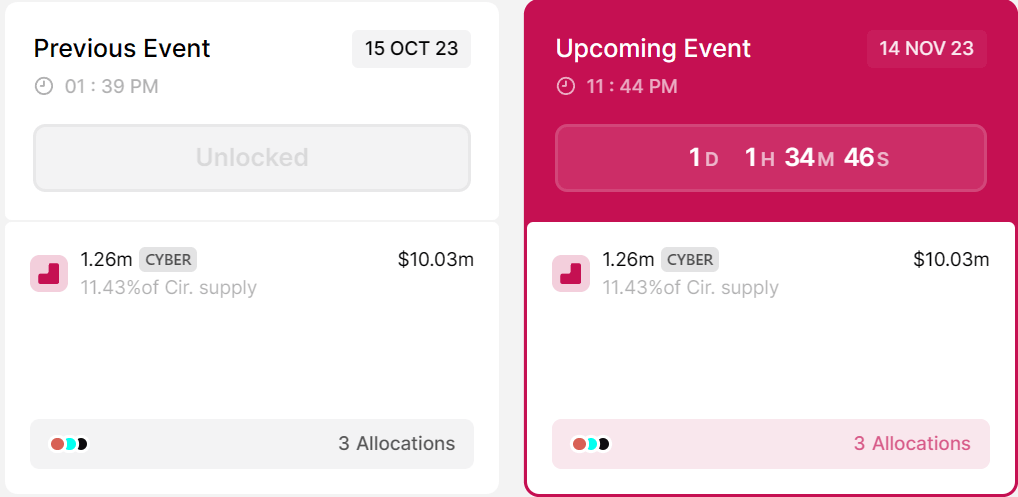

- 1.26 million CYBER tokens worth $10.03 million will be unlocked in the next 24 hours, which may result in a price decline.

- CYBER price was complacent during the previous event in October when a similar amount of CYBER was unlocked.

CYBER price’s rally emerged as a surprise for investors on Monday as the small-cap altcoin advanced against broader market cues. Apart from the rally in the past few days, a major catalyst for this increase is the upcoming token unlock, which would flush the market with more tokens, hence why investors are boosting the price.

CyberConnect token unlock is almost here

CYBER token is native to the web3 social networking platform and has noted a sudden increase in price in the past 24 hours ahead of the token unlock event set to take place in the next 24 hours. This event would see 1.23 million CYBER tokens worth over $10 million entering the market.

Token unlocks generally tend to be a bearish event, which results in a price fall. The reason behind this is the chunk of tokens that are flushed into the market, which causes a crash in the price as the demand reduces owing to increased supply.

However, the rally is likely CYBER holders boosting the price before the unlock in order to book profits before the price goes down. A similar occurrence was observed in the past when, on October 15, exactly 1.23 million CYBER tokens worth $10.03 million were unlocked.

CYBER token unlocks

The price on October 15 did not see any increase, and the following day it only rose by 2%. While the cryptocurrency falls among the small-cap category with a market capitalization of $85 million, today’s rally made it a token to watch.

CYBER price to likely decline

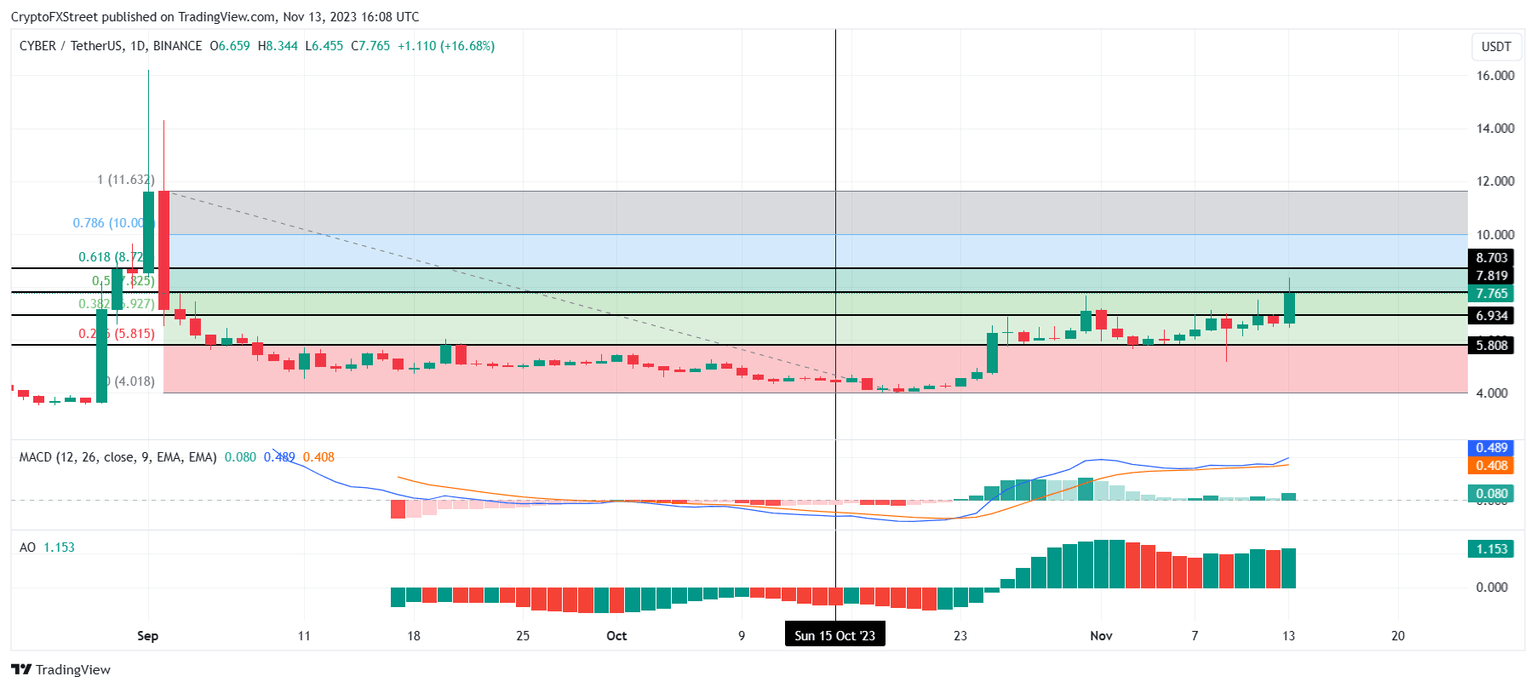

CYBER price trading at $7.76 is up by nearly 17% in the last 24 hours, with the intra-day trading high reaching $8.34. At the time of writing, the altcoin is close to breaching the crucial 61.8% Fibonacci Retracement of $11.63 to $4.01, marked at $7.81.

Given the upcoming token unlock, there is a possibility that not only will CYBER price fail to breach the $7.81 barrier but also will decline to test the support line marked at $6.93. Losing this support line would result in a decline to November lows of $5.80.

CYBER/USDT 1-day chart

However, if the altcoin closes above the $7.81 resistance and manages to test it as a support level, it would be able to invalidate the bearish thesis, which is generally the case when the 61.8% Fibonacci line is tested as support. This would also enable CYBER price to potentially breach the $8.00 psychological mark and reach a two-month high.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.