- The holiday mood seems to have taken a toll on the market as it is painted red everywhere.

- Bitcoin defends $5,200 support following rejection at $5,300.

- Ripple and Ethereum hold tight to key support levels as bears take advantage of Easter Holiday.

The crypto market is strongly bearish in the morning of Good Friday. The holiday mood seems to have taken a toll on the market as traders take a minute to relax after four months of trading in 2019. The total market capitalization is currently sliding lower from the weekly high at $180 billion recorded on Thursday 18. The market cap stands at $178 billion with Bitcoin taking up the bigger chunk at $92 billion. Bitcoin dominance on the market is rising, besides it stands at $52% at press time.

Bitcoin price update

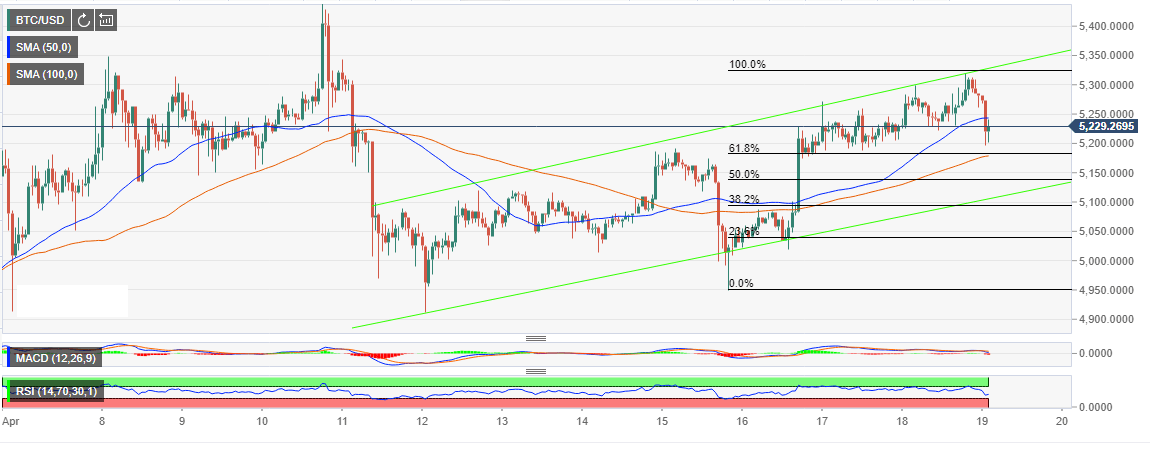

Bitcoin has throughout this week, been trending upwards within a rising channel. The bulls keep pushing the limits on the upside, although it has been capped slightly past $5,300. An attempt to make headway above this level was futile moments before the end of Thursday’s session. A lower correction tanked below 50 SMA but the support at $5,200 is still in place. BTC/USD is trading at $5,231 while facing resistance at the 50 SMA.

Ethereum and Ripple price update

Both Ripple and Ethereum are in the red at press time. Ethereum is down 1.85% to trade at $171.40 while Ripple is in the red with losses of 2.18% and changing hands at $0.3306. Both the assets are hanging in the balance slightly above key support areas. Ethereum, for example is right in the middle of the bullish zone we explored in the price prediction on Thursday. Ripple, on the other hand, is barely holding on to the resistance turned support at $0.3300. The rest of the top twenty cryptocurrencies are in the red with losses between 0.5% and 3%.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin is showing rising correlation with the S&P 500

Bitcoin and the crypto market have been in an uptrend since Wednesday following the Federal Reserve's decision to cut interest rates by 50 basis points. Bitcoin is up nearly 3% in the past 24 hours, rising briefly above the $63,000 level for the first time in three weeks.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Consensys case against SEC over Ethereum dismissed by Texas court

Consensys announced dismissal of a case it filed against the SEC in April about the agency's alleged actions against Ethereum. Judge Reed O'Connor of the Northern District of Texas dismissed the case on Thursday. Consensys claims that the court failed to examine the "merits" of its claim against the SEC.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Bitcoin: On the road to $60,000

Bitcoin price retested and bounced off from the daily support level of $56,000 this week. US spot Bitcoin ETFs posted $140.7 million in inflows until Thursday and on-chain data supports a bullish outlook.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.