Cryptocurrency Market Update: Bitcoin’s majestic rally to $400,000 – Max Keiser

- Altcoins wake up as Bitcoin dominance hit a wall, signaling the beginning of the ‘altcoin season.’

- Max Keiser, a prominent Bitcoin investor says $100,000 prediction for BTC is a bit conservative.

Bitcoin has been in a lull for more than two weeks apart from the brief rally that catapulted it to levels above $9,400 on Thursday. On the downside, the largest cryptocurrency has established support at $9,200. Note that in the last week of June, BTC/USD dived to levels close to $8,800 but recovered and reclaimed the ground above $9,000. Consolidation above $9,200 is expected to take place in the coming sessions.

Although Bitcoin has been confined to a drab technical picture, altcoins have performed relatively well starting with Ripple (XRP). The fourth-largest crypto corrected upwards from levels at $0.17 to highs above $0.21. XRP has since retreated and is now pivotal $0.20. The most improved altcoins include Stellar (XLM), Chainlink (LINK), Cardano (ADA) and Tezos (XTZ).

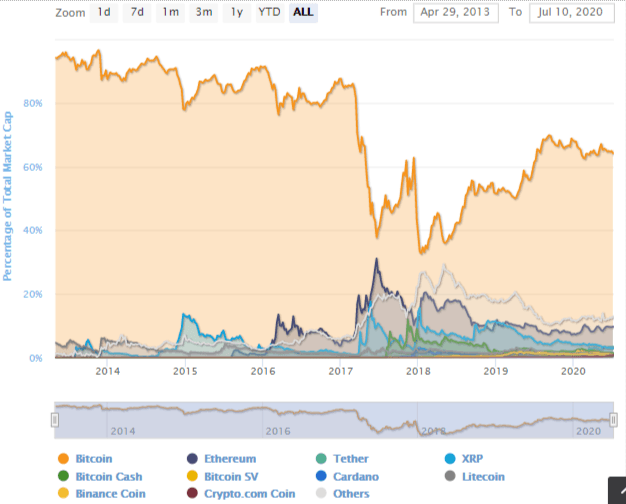

The growth of altcoins has been reflected in market dominance. Bitcoin currently has a market share of 62.8%. The metric was recently rejected at a trendline leading to a drop. On the other hand, altcoins seem to be picking up the pace with analysts predicting the beginning of the altcoin season.

Despite the positive show by the altcoins, Max Keiser believes that there is no way the cryptoassets will rally without Bitcoin. Keiser is a prominent investor in Bitcoin who also hosts the RT’s Keiser Report in collaboration with Stacy Herbert.

According to Keiser, Bitcoin will “eviscerate” all its competitors including “government subsidy-welfare bums.”

So, all these altcoin posers and government subsidy-welfare bums will be eviscerated by the one true bitcoin. It’s about time…,” besides, there is “no coin out there that can do something that BTC doesn’t do already or will be able to do shortly.

In a later comment, Keiser said that Bitcoin dominance in the market would hit 99%. In addition, the investor predicted Bitcoin trading at $100,000, representing a 900% rally from the current price level above $9,200. In another interview with Alex Jones of Inforwars, Keiser said that a $100,000 prediction was rather conservative and that Bitcoin had the potential to hit $400,000.

I am officially raising my target for BTC — and I first made this prediction when it was $1, I said this could go to $100,000 — I’m raising my official target for the first time in eight years, I’m raising it to $400,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren