Here is what you need to know on Thursday, September 3, 2020.

Markets:

The cryptocurrency market is bleeding on a wide scale, led by Bitcoin's price drop to the support at $11,100. Data by CoinMarketCap highlights a significant drop in the total market capitalization from $389 billion on Wednesday to $372 billion at the time of writing. An increase in the trading volume from $80 billion to $106 billion also reflects the intense selloff.

BTC/USD is trading at $11,305 at the time of writing. The largest cryptocurrency has corrected lower by 0.82% on the day. Following the drop to $11,155, a reversal ensued pulling Bitcoin above $11,400. Bulls could not continue with the upward action as the seller congestion at $11,500 remained intact.

Read more: Bitcoin Technical Analysis: BTC/USD return to $12,000 won’t come easy – Confluence Detector

Ethereum is also bleeding after diving from the recent high at $489 to the support established at $420. Attempts have been made to resume the uptrend but selling activities at $450 are putting pressure onto the crypto. Ether is trading at $434 at the time of writing amid a growing bearish grip and high volatility. The path of least resistance is towards the support at $420.

Ripple has lost almost 2% of its value on the day. There was an impressive price action earlier in the week which catapulted the crypto above $0.30. Unfortunately, XRP failed to attract enough volume to sustain gains to the next key level at $0.3250. The bearish wave across the market carried XRP along with it, leading to losses that tested the main support at $0.26. For now, XRP is trading at $0.0.2706 while nurturing a bullish momentum towards $0.30.

A majority of cryptocurrencies have posted losses in the last 24 hours. However, some selected altcoins are still holding onto some gains. They include UMA (11.16%), Kusama (6.72%), Loopring (11.50%) and JUST (8.12%).

Chart Of The Day: BTC/USD hourly

Market:

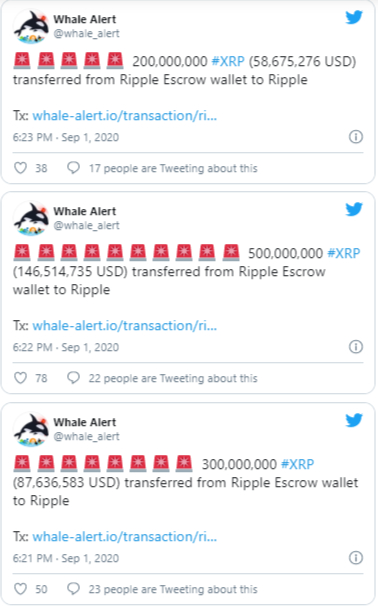

Ripple as expected at the beginning every month transferred 1 billion XRP tokens worth approximately $270 million from the company’s escrow wallet. The funds have been sent to three separate wallets (all belonging to Ripple). The colossal transaction was captured by Whale Alert, a bot that is used to highlighted huge amounts of cryptocurrency transactions. This money is mainly used by Ripple to run the operations of the company. Another transaction amounting to 133,152,655 was made by Ripple to its former CTO Jed McCaleb.

On the other hand, there has been a report of whales transferring huge amounts of Bitcoin and Ethereum in the last 24 hours. A transfer totaling $510 million in BTC and ETH took place amid the losses described above.

Industry:

Although Ethereum has rallied significantly this year, the launch of ETH 2.0 upgrade remains unlikely. Despite the mishaps and delays the protocol’s upgrade has been facing in development, Vitalik Buterin, the co-founder of Ethereum remains confident that the launch will take place as scheduled.

The launch of Yearn.finance’s yETH vault has raised concerns regarding the danger of ETH 2.0 suffering a 51% attack. On the first day of its launch, yETH vault amassed over 137,000 ETH. It is believed that if the growth continues, yETH could hold over 67% of the entire Ethereum supply. Highlighting the 51% attack issue, Eric Wall, the chief intelligence office at Arcane Assets said:

ITT: We come up with fun ways yETH vault strategists can take advantage of the fact that yETH is probably going to control more than enough stake to 67%-attack ETH 2.0 PoS.

Vitalik Buterin in response to the above concern said that the propagator of such an attack “could attack *once* and then they either get slashed or soft-forked away and inactivity-leaked, and they lose their coins so can’t attack again.”

Regulation:

Twitter accounts belonging to prominent individuals have become a soft target for hackers. Not long ago Barack Obama alongside other influential individuals’ accounts was hacked. The hackers lured unsuspecting individuals to send Bitcoin to wallet addresses that were provided.

The Prime Minister of India, Narendra Modi is the latest victim of a hacking attack similar to the one above. His Twitter account was hacked by people operating under the alias ‘John Wick.’ Followers of the prime minister were told to “generously donate to PM National Relief Fund for COVID-19.” Two wallet addresses were provided; a BTC wallet address and an ETH wallet address. Blockchain data shows that no funds had been sent to the address before they were pulled down.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin is showing rising correlation with the S&P 500

Bitcoin and the crypto market have been in an uptrend since Wednesday following the Federal Reserve's decision to cut interest rates by 50 basis points. Bitcoin is up nearly 3% in the past 24 hours, rising briefly above the $63,000 level for the first time in three weeks.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Consensys case against SEC over Ethereum dismissed by Texas court

Consensys announced dismissal of a case it filed against the SEC in April about the agency's alleged actions against Ethereum. Judge Reed O'Connor of the Northern District of Texas dismissed the case on Thursday. Consensys claims that the court failed to examine the "merits" of its claim against the SEC.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Bitcoin: On the road to $60,000

Bitcoin price retested and bounced off from the daily support level of $56,000 this week. US spot Bitcoin ETFs posted $140.7 million in inflows until Thursday and on-chain data supports a bullish outlook.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.

(31)-637347131424984058.png)