Cryptocurrencies Price Prediction: Ethereum, Tezos & Ontology – Asian Wrap 23 Mar

Ethereum Price Prediction: ETH remains vulnerable to downside below $1,725-15 key hurdle

Ethereum portrays a corrective pullback from $1,657, to currently around $1,680, during early Tuesday. In doing so, the quote bounces off 50% Fibonacci retracement of the late February’s fall. However, the ETH/USD pair keeps the previous day’s break of the key support, now resistance, comprising 200-SMA and multiple levels marked from February 24.

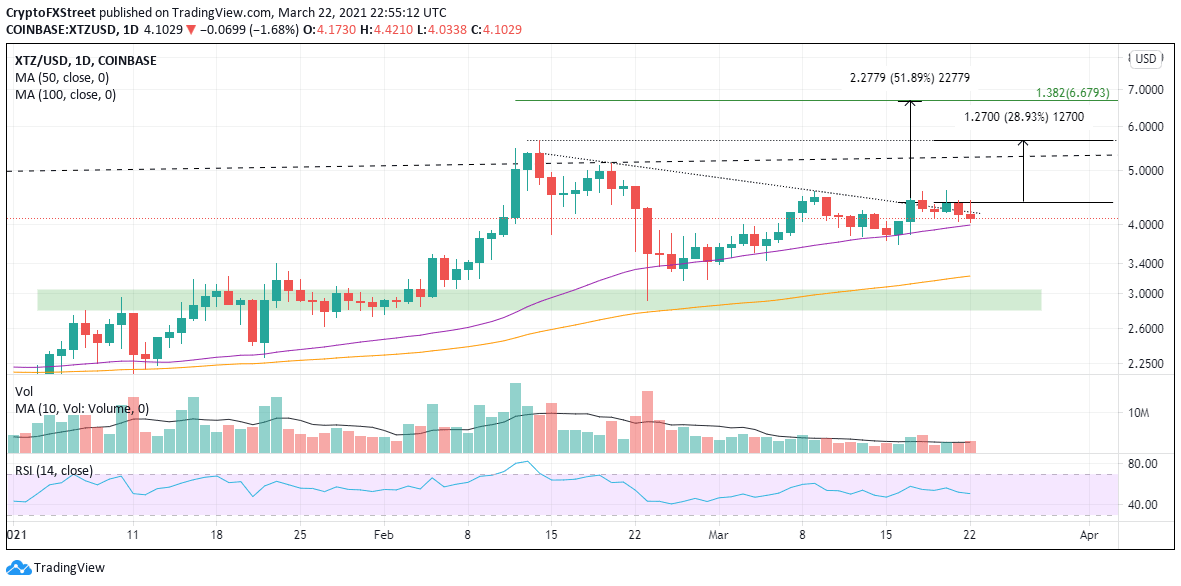

Tezos price breakout now in doubt as the crypto market bleeds

Tezos (XTZ) price broke out on March 17 with a 9% gain on a 50% increase in average daily volume. It was the type of price action that bulls wanted after the long consolidation along the 50-day SMA. However, over the last five days, XTZ has been drifting lower and is currently trading below the downtrend line.

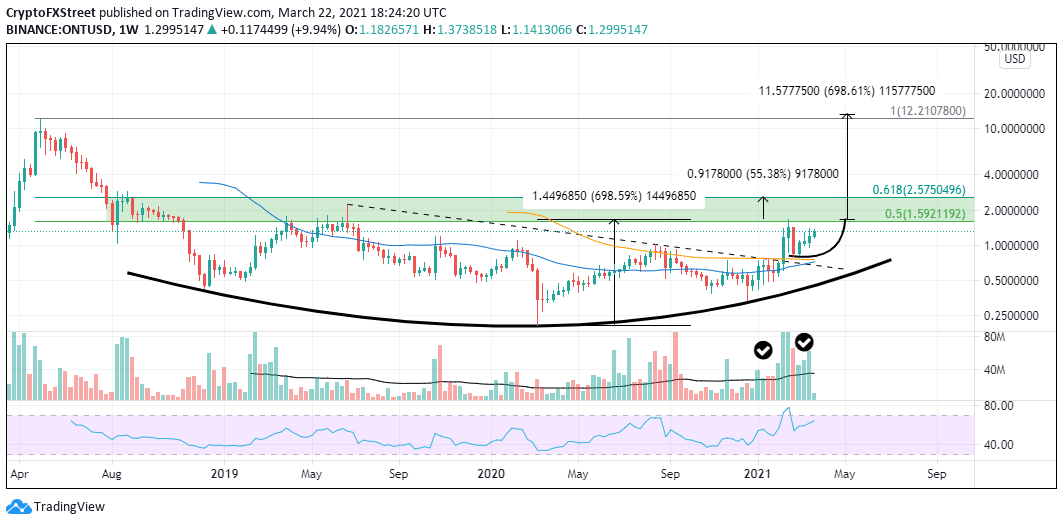

Ontology Price Forecast: ONT breaks out, projecting a 55% upswing

Ontology price, over the last two years, has carved out a cup-with-handle base with significant upside potential in the short and long-term. Strong volume and an extreme overbought condition demonstrate the upward momentum off the December lows.

Author

FXStreet Team

FXStreet