Cryptocurrencies Price Prediction: Bitcoin, Ripple, & Stellar – Asian Wrap 23 Dec

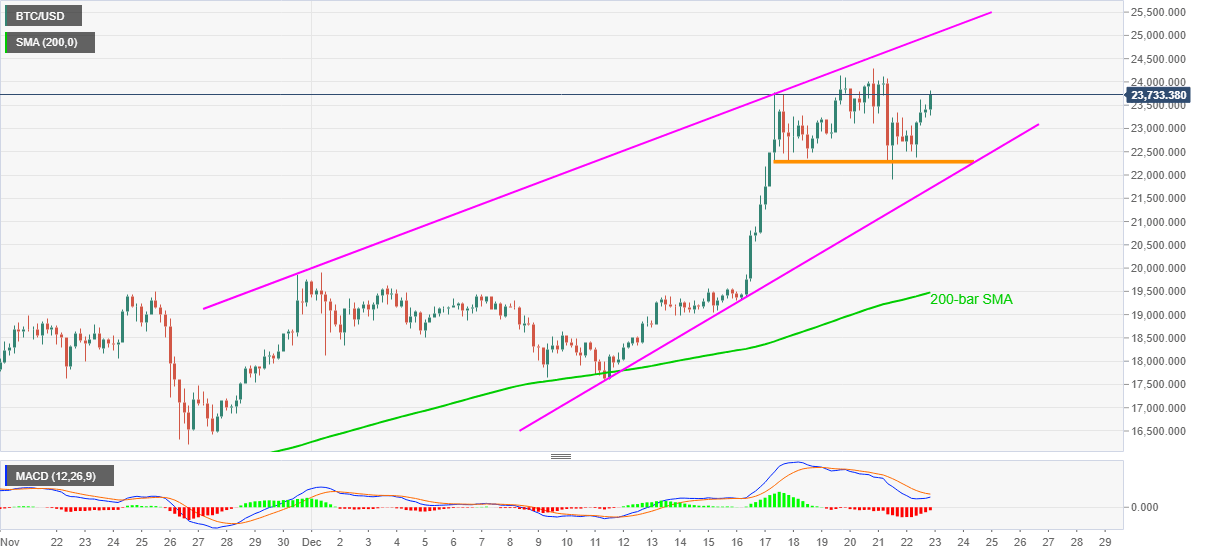

Bitcoin Price Analysis: BTC bulls eye refreshing record top on the way to 24,000

BTC/USD rises to 23,733 during the early Wednesday’s trading. In doing so, the crypto major extends gains from a horizontal area comprising multiple lows since December 07, marked the previous day.

Also supporting the BTC/USD bulls is the MACD histogram that shows the receding strength of the bearish signals.

As a result, the quote is all geared up to challenge the recently refreshed all-time high of 24,299.12. However, the 24,000 round-figure can offer an intermediate halt during the rise.

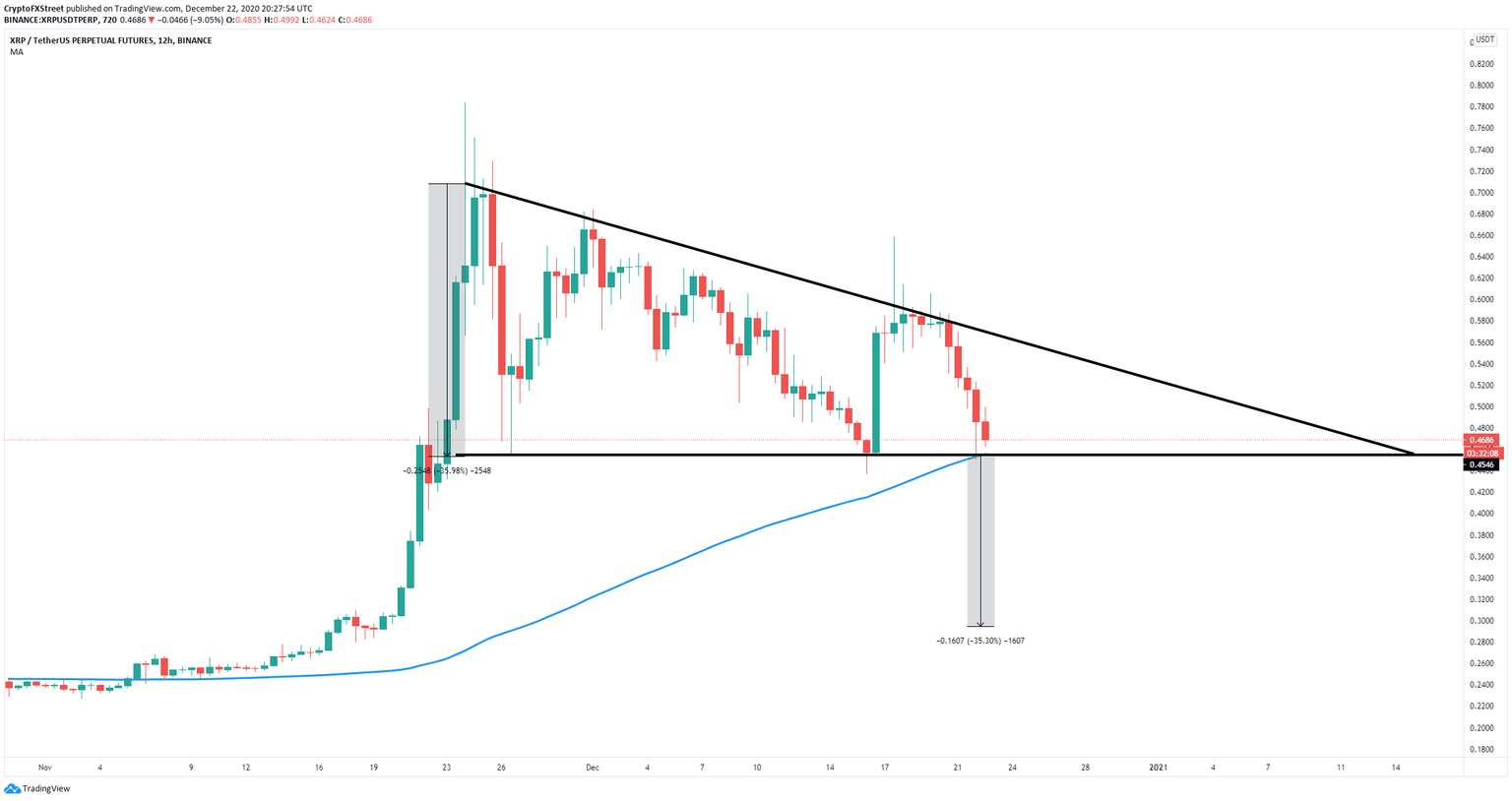

Ripple price must hold $0.45 to avoid a massive 35% dip

XRP suffered a massive blow in the past 24 hours as the U.S. Securities and Exchange Commission (SEC) plans to sue Ripple. Brad Garlinghouse, CEO of Ripple stated that the lawsuit is shocking and an attack on the entire cryptocurrency industry.

On the 12-hour chart, XRP has formed a descending triangle pattern and a robust support level at $0.45. This level also coincides with the 100-SMA, adding even more strength to it. However, a breakdown below this point will most likely drive Ripple price towards a low of $0.30, which is a 35% drop.

Stellar Price Analysis: XLM bears are determined to revisit monthly horizontal support

Having failed to sustain the bounce off of $0.1527 on Tuesday, XLM/USD prints near 3.0% intraday losses, at $0.1576 now, while extending the pullback from key SMAs during early Wednesday.

Although the recent corrective moves eye $0.16, buyers are less likely to enter until the quote stays below 100 and 200-bar SMA, not to forget a descending resistance line from last Thursday.

Even if the XLM bulls manage to cross the 100-bar SMA level of $0.1700, the $0.2000 threshold and the monthly peak surrounding 0.2085 can add filters to the upside.

_23122020-637442920276752943.png&w=1536&q=95)

Author

FXStreet Team

FXStreet