Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin regains ground above $23,000, inspires the bulls

- Buying interest pushes BTC back above $23,000.

- Ethereum in a dangerous position below the critical support level.

- Ripple recovers from the intraday low of $0.44, still depressed.

The cryptocurrency market has started the recovery from the short-lived decline, with most of the coins turning green again on a day-to-day basis. While the low base effect is definitely something to consider, the overall sentiments are improving slowly across the board. UMA is still the hottest altcoin out of top-50 with nearly 40% growth. It is followed by THETA with 18% gains. XRP is an outsider. The coin suffered from the news that SEC was going to sue Ripple for an illegal securities offering.

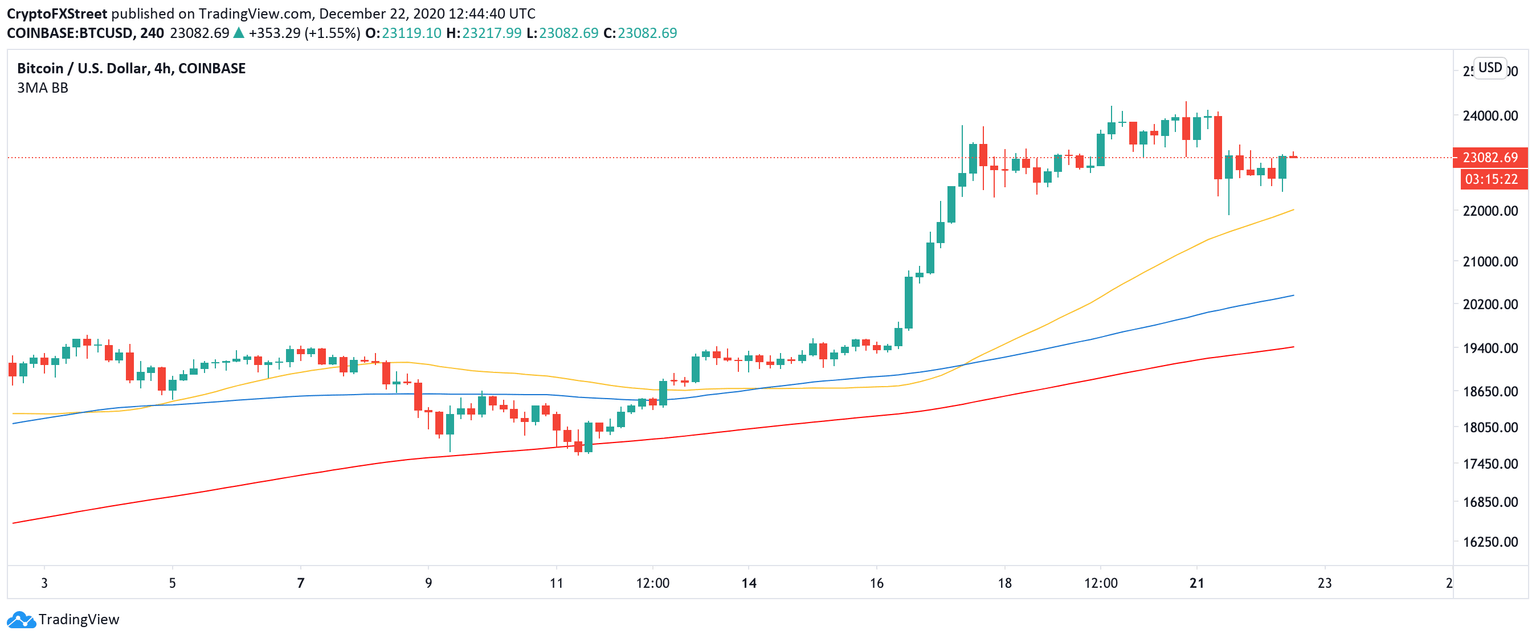

Bitcoin returns above $23,000

Bitcoin retreated to $21,910 for a fraction of time on Monday only to be bought aggressively. As new players entered the market on the sell-off, the price recovered above the psychological level of $23,000. At the time of writing, BTC/USD is changing hands at $23,100.

BTC, In/Out of the Money Around Price (IOMAP)

According to In/Out of the Money Around Price (IOMAP) data, the price reached the critical resistance as about 350,000 addresses purchased over 250,000 BTC on approach to this level. A sustainable move above this level will remove a substantial barrier and allow for a recovery towards $24,000.

On the other hand, BTC should stay above $22,000 to retain positive vibes. This support is reinforced by 4-hour EMA50, and if it is broken, the sell-off may be extended towards $20,000 with 4-hour EMA100 located just above this area.

BTC/USD 4-hour chart

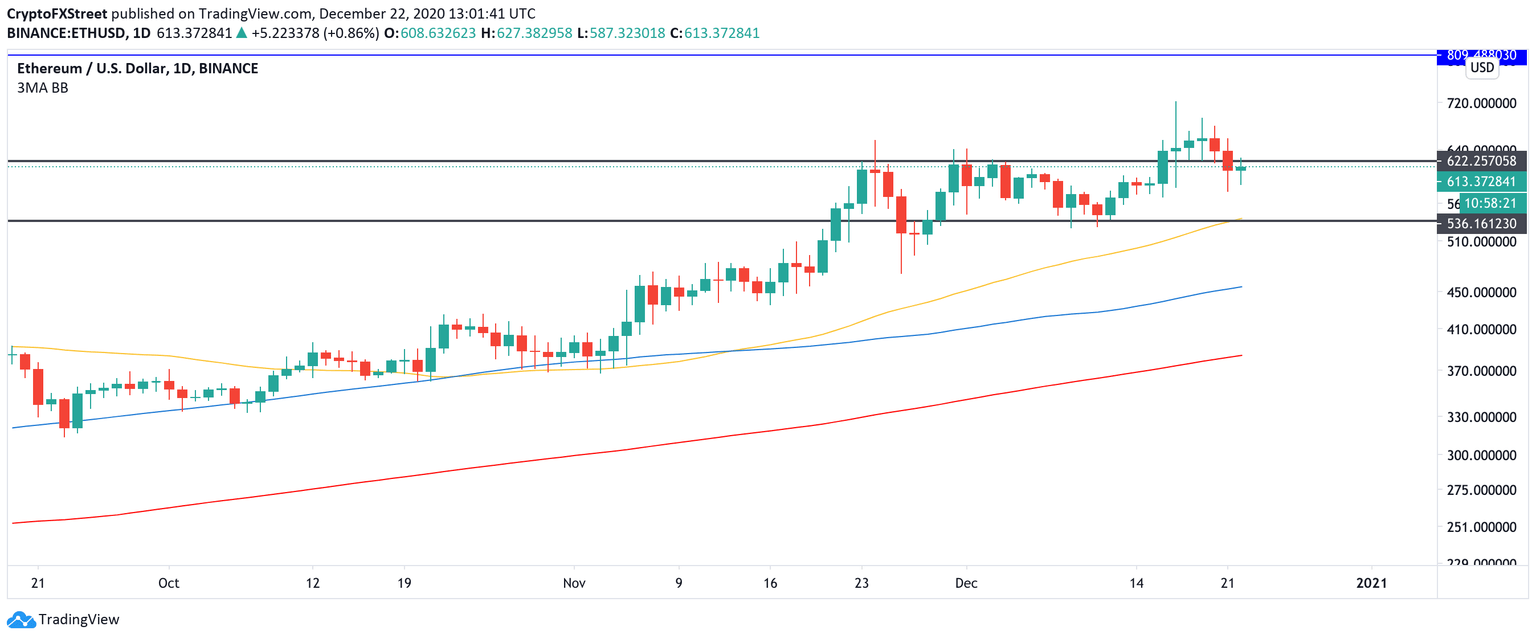

ETH struggles to stay above critical support

ETH is trading at $610, mostly unchanged from this time on Monday. As previously discussed, the price should settle above $620 to retain long term bullish bias as this support is created by the x-axis of an ascending triangle. Otherwise, the price will extend the decline towards $530 (daily EMA50), invalidating the immediate bullish outlook.

ETH, daily chart

On the other hand, if the daily candlestick closes above $620, ETH will re-test the recent high of $631. In the long-run, ETH has the potential to hit %800, which is an estimated target of an ascending triangle.

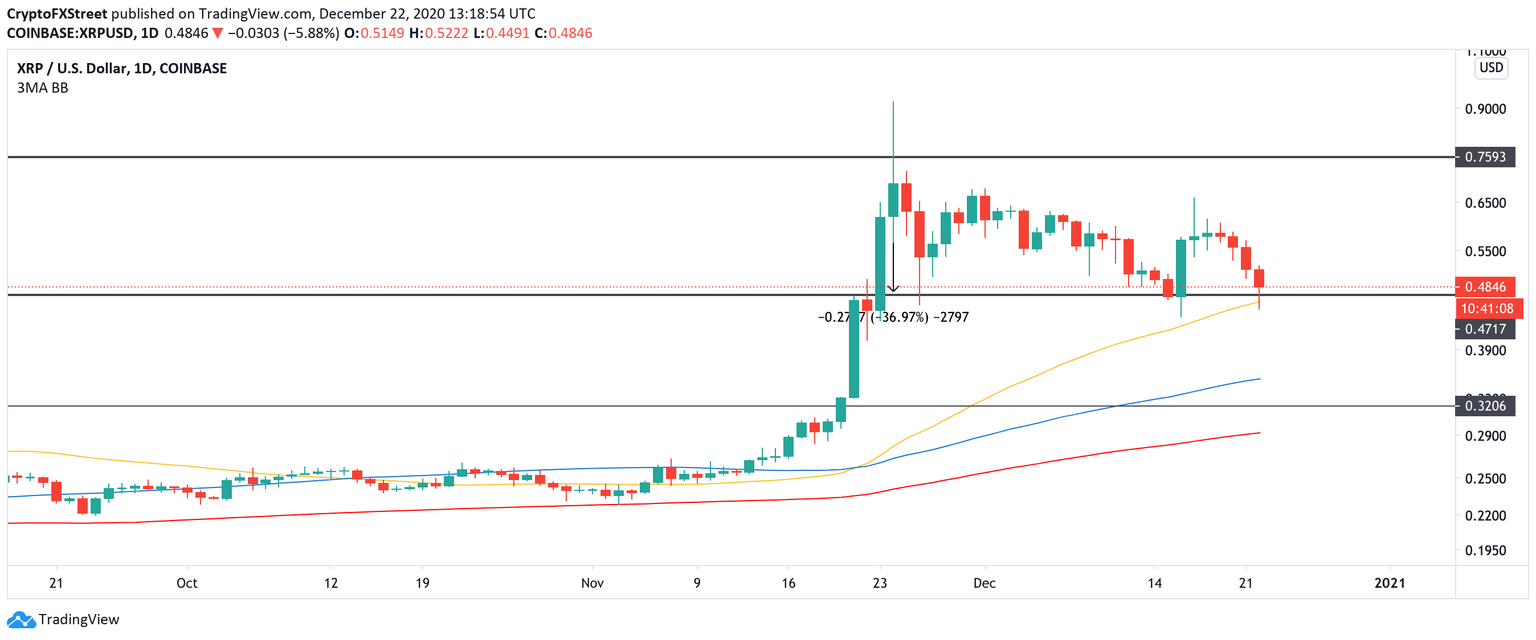

Ripple gets the beating

XRP is out of luck today. The cryptocurrency has lost over 8% of its value in less than 24 hours and touched the low of $0.44 after Ripple's CEO Brad Garlinghouse said that SEC was going to sue the company for selling unregistered securities.

XRP, daily chart

At the time of writing, XRP is changing hands at $0.48, marginally above the critical channel support reinforced by the daily EMA50. A sustainable move below this area will increase the selling pressure and push the price towards $0.35 9daily EMA100).

On the upside, a move above $0.5 is needed to mitigate the bearish pressure and bring the recovery back on track with the next focus on $0.61. This barrier is created by 78.6% Fibonacci retracement level.

Author

Tanya Abrosimova

Independent Analyst

%252022-637442398361780942.png&w=1536&q=95)