Cryptocurrencies price prediction: Bitcoin, Ethereum & Ripple – European Wrap – 31 January

Bitcoin Price Prediction: BTC/USD stuck between Confluence Detector’s resistance and support

The digital asset market is wallowing in red wavy waters ahead of the weekend session. Unlike the bullish action at the beginning of the week, prices in the crypto market are likely to close the week in the red.

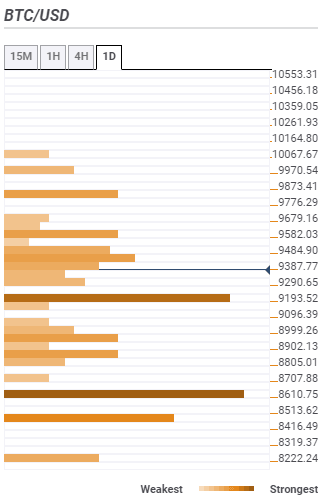

Bitcoin confluence levels

Bitcoin price is facing intense pressure on the key support areas ranging from $9,290 and highlighted by the Bollinger Band 4-hour middle, pivot point one-day support one and the Bollinger Band one-hour lower. If the selling pressure ravages through the support the most significant support is seen at $9,193. If push comes to shove and Bitcoin is mauled through $9,000, the next and most prominent support is holding the ground at $8,610.

Ethereum Price Analysis: ETH/USD settles above SMA200 daily

Ethereum, the second-largest digital asset with the current market capitalization of $19.8 billion, hit $186.72 during early Asian hours and retreated to $180.32 by the time of writing. Despite the retreat, the coin has gained nearly 3% in recent 24 hours, moving in sync with the market.

-637160699869428179.png&w=1536&q=95)

Ripple ecpsystem loses another XRP-based project due to AMLD5

XRP, the third-largest digital asset with the current market value of $10.5 billion, has gained 3.5% in recent 24 hours. The coin has been moving in sync with the cryptocurrency market; however, XRP's gains are less spectacular. Unlike Bitcoin or Ethereum, XRP has not been able to retest the recent high as of yet.

-637160563310552747.png&w=1536&q=95)

Author

FXStreet Team

FXStreet