Cryptocurrencies Price Prediction: Bitcoin Cash, Litecoin & Ripple – European Wrap 8 May

Bitcoin Cash reclaims $250 as a BCH-based DeFi startup raises $1 million in seed fund

Bitcoin Cash price advanced higher above $250 as BTC/USD surged above $10,000. The price action extended above towards $260 but hit a wall at $258 (intraday high). In the meantime, BCH/USD has adjusted lower to $250 as selling pressure makes a comeback. Generally, the entire cryptocurrency market is bearish during the European session.

%2520(5)-637245180142094312.png&w=1536&q=95)

Litecoin Price Analysis: LTC/USD falling within a descending channel

Litecoin price action continues to follow the confines of a descending channel after the recovery in the last week of April stalled under $50. The channel support remains instrumental in slowing down the selling pressure. Also vital to the buyers is the short-term support range; $44 - $45.

%2520(2)-637245216046880182.png&w=1536&q=95)

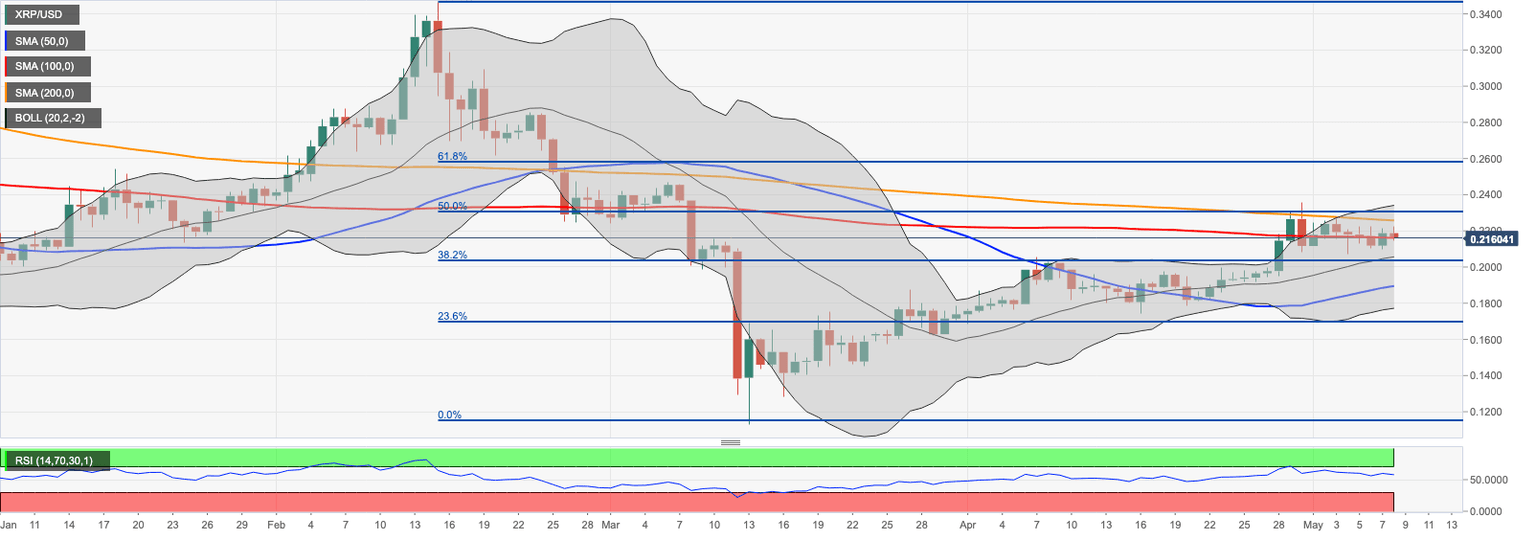

Ripple Price Analysis: XRP/USD stays in a range, fails to follow Bitcoin's recovery

XRP/USD has retreated from Thursday’s high of $0.2223 to trade at $0.2152 by press time. The coin has stayed mostly unchanged since this time on Thursday and lost about 1.5% since the beginning of Friday. Ripple’s XRP has been locked in a tight range since the start of the week, despite sharp Bitcoin’s recovery. Now it is the third-largest digital coin with a current market value of $9.5 billion and an average daily trading volume of $2.6 billion.

Author

FXStreet Team

FXStreet