Ripple Price Analysis: XRP/USD stays in a range, fails to follow Bitcoin's recovery

- XRP/USD is locked in a tight range limited by $0.2200.

- Critical support is created by 38.2% Fibo retracement.

XRP/USD has retreated from Thursday’s high of $0.2223 to trade at $0.2152 by press time. The coin has stayed mostly unchanged since this time on Thursday and lost about 1.5% since the beginning of Friday. Ripple’s XRP has been locked in a tight range since the start of the week, despite sharp Bitcoin’s recovery. Now it is the third-largest digital coin with a current market value of $9.5 billion and an average daily trading volume of $2.6 billion.

XRP/USD: Technical picture

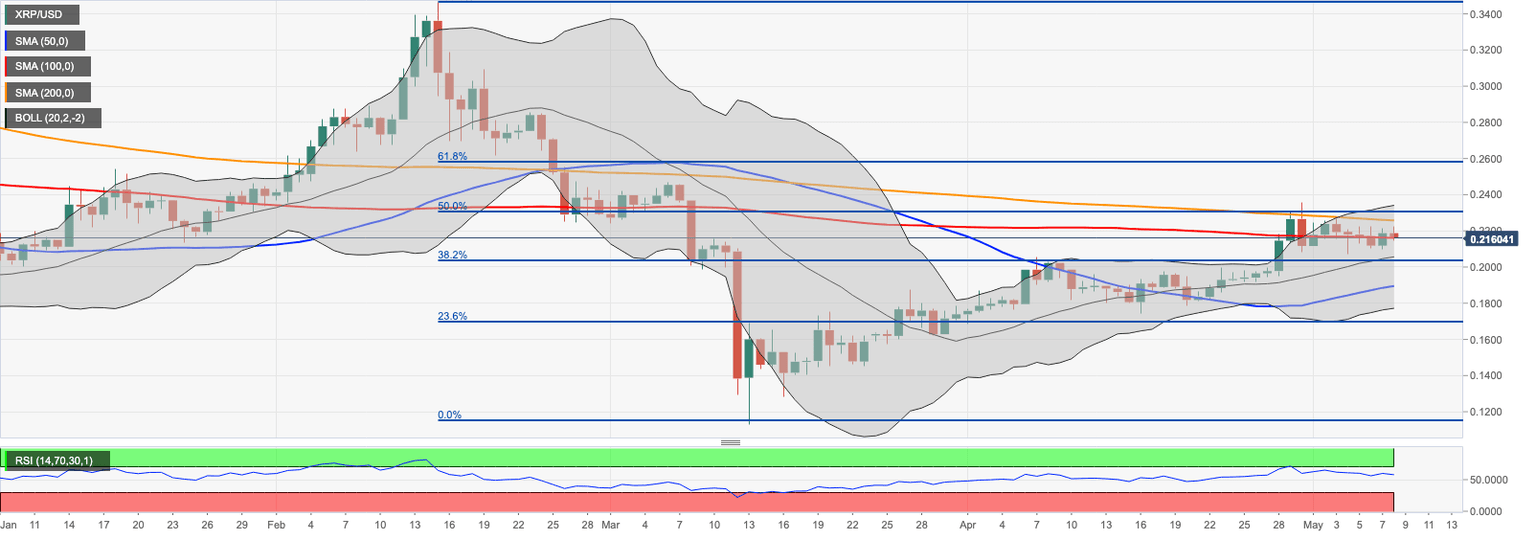

On the daily chart, XRP is hovering around the pivotal level of SMA100 currently at $0.2160. If it is cleared, the sell-off may be extended towards psychological $0.2100, with Thursday’s low located right below this level. Once it is out of the way, bears will be ready to push XRP towards the critical support area of $0.2030-$0.2000 reinforced by 38.2% Fibo retracement of the downside move from February 2020 high and the lower line of the daily Bollinger Band. This zone is likely to slow down the bears; however, if it is broken, daily SMA50 on approach to $0.1900 will come into focus.

XRP/USD daily chart

On the upside, a sustainable move above $0.2200 is needed for the recovery to gain traction and take the price towards daily SMA200 at $0.2250. This MA has limited XRP upside momentum since the end of April. If it is broken, psychological $0.2300 will come into view, followed by $0.2357, which is April monthly high. The daily RSI shows signs of reversal, which means that the upside momentum is fading away.

XRP/USD 1-hour chart

On the intraday charts, the recovery is limited by a combination of 1-hour SMA50 and SMA100 at $0.2170. It is closely followed by 1-hour SMA200 at $0.2180. These levels may slow down the move towards the above-said critical resistance zone.

Author

Tanya Abrosimova

Independent Analyst

-637245277117918601.png&w=1536&q=95)