Crypto.com Price Prediction: Why optimism lingers during CRO's downfall

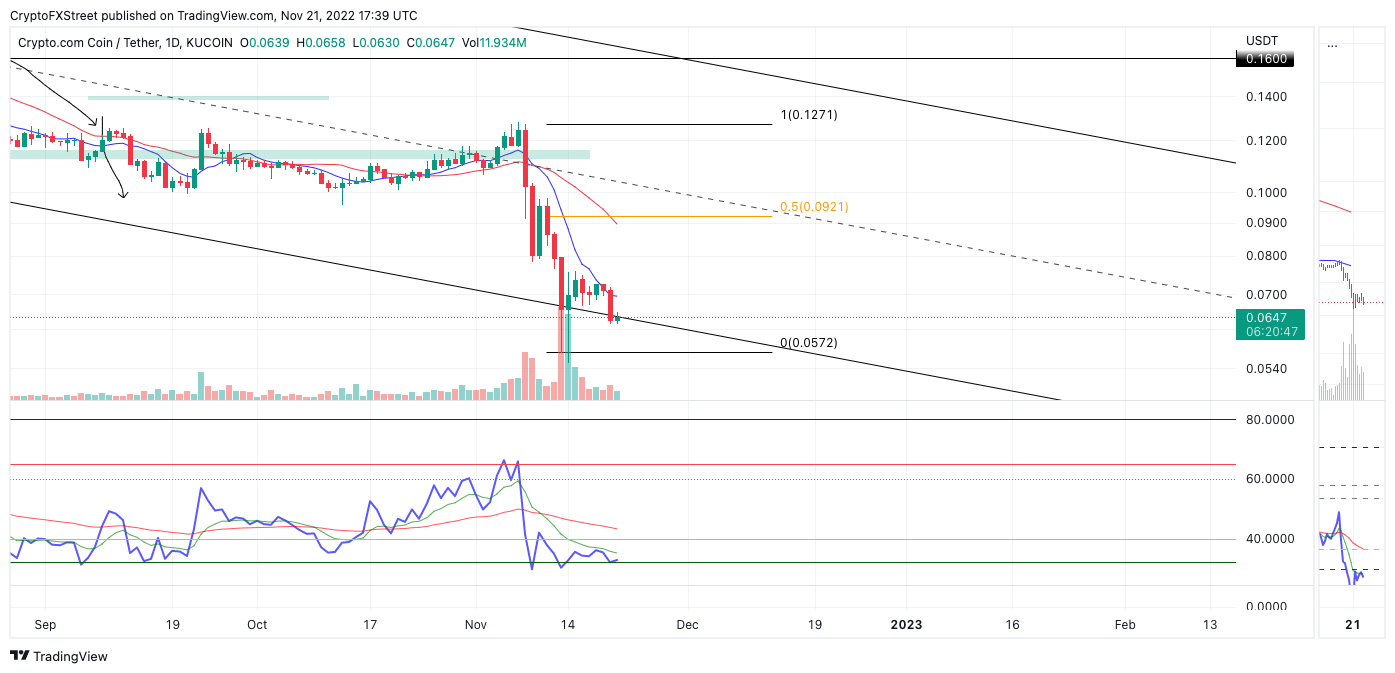

- Crypto.com price retests a descending parallel channel that has acted as support and resistance throughout the year.

- The current sell-off shows a bullish divergence and less volume than the previous decline.

- The bulls will need to hurdle the $0.075 barrier to invalidate the bearish outlook.

Crypto.com's price lost 50% of its market value during November. After a Sunday sell-off and Monday consolidation, traders are forced to ask what side of the trend they want to join. Key levels have been defined to gauge CRO’s next potential move.

Crypto.com price takes a hit

Crypto.com price has taken a blow along with the rest of the crypto market. The 10% decline witnessed on Sunday, November 20, brought the Crypto.com price back to 50% less than CRO auctioned three weeks earlier. Despite the loss, the Ethereum-based cryptocurrency exchange token displays a few optimistic signals that suggest the bulls still need to throw in the towel.

Crypto.com price currently auctions at $0.064. The sell-off has prompted the first retracement of the recently breached descending parallel trend channel. The trend channel has acted as a key barrier of support and resistance throughout the year. The Volume Profile Indicator remains sparse, while the November 20 settlement produced a bullish divergence compared to the previous sell-off earlier in the month.

Based on these factors, the bulls are showing interest, which justifies keeping the CRO price on an immediate watchlist.

CRO/USDT 1-day chart

If the bulls have the strength to produce a turn, the next target would be at the 50% mark of the monthly decline. This places a level of interest at $0.09, which would result in a 35% increase in price from the current market value. Still, the bulls need to hurdle the 8-day exponential moving average near the $0.075 barrier for confirmation. If the breach occurs, invalidation of the uptrend move could be placed below the November 13 lows at $0.057.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.