Crypto.com outperforms despite broad weakness, CRO targets return to $0.50

- Crypto.com price was down for the day during Thursday’s rout but held up better than its peers.

- Ichimoku support levels held CRO from further losses and helped to confirm a likely bullish reversal zone.

- Downside risks remain, especially with the unknowns of geopolitical war from Russia looming.

Crypto.com price action and the rest of the cryptocurrency market experienced intense selling pressure throughout the trading day on Thursday. Existential threats regarding Russia’s "will they/won’t they" invade Ukraine have rattled risk-on markets across the globe. But Crypto.com, while lower, faired much better than most.

Crypto.com price hits critical support zone, bulls conviction now being tested

Crypto.com price was able to close the day barely under a 5% loss. While that may seem alarming, it’s an overperformance when compared to Bitcoin (down 8%), Ethereum (down 8%), XRP (down 8.5%), Solana (down 8.25%), and a myriad of other major cryptocurrencies, some in double-digit percentage losses.

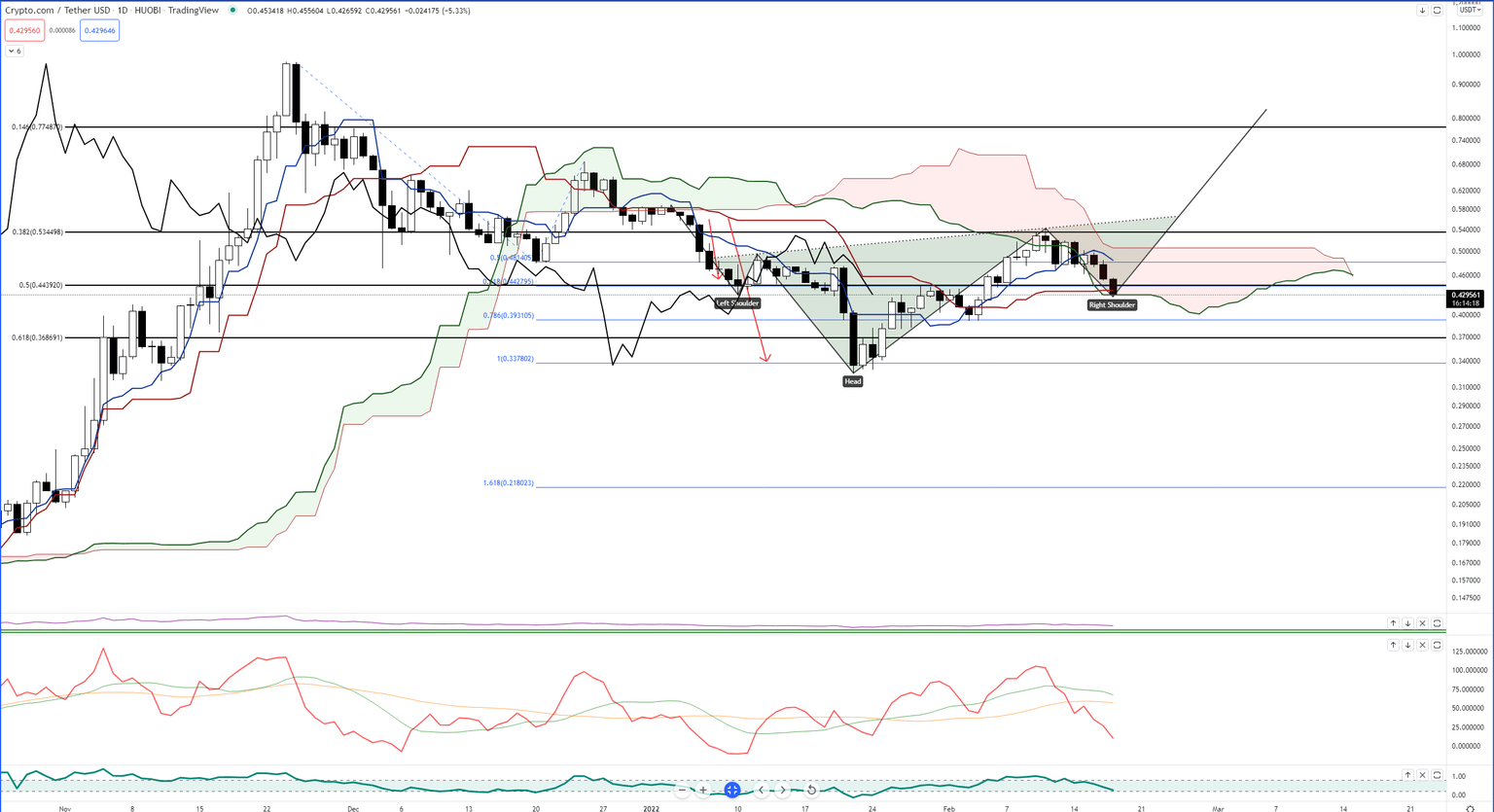

Bears were able to push CRO into a strong support zone in the $0.43 to $0.45 value area. That support zone is made up of the 61.8% Fibonacci extension ($0.44), 50% Fibonacci retracement ($0.45), daily Kijun-Sen ($0.43), and the bottom of the daily Ichimoku Cloud ($0.43). Support is likely to hold in this zone.

A significant factor pointing to $0.43 to $0.45 holding as support is the hidden bullish divergence now present between the candlestick chart and the Composite Index. The appearance of hidden bullish divergence while Crypto.com price is inside a massive support zone gives an extremely high probability that Crypto.com will make another run towards the $0.50 value area.

CRO/USDT Daily Ichimoku Kinko Hyo Chart

Downside risks do remain, however, for Crypto.com price. CRO’s proximity to the bottom of the Cloud sets it up for a possible Ideal Bearish Ichimoku Breakout. While the Chikou Span remains above the candlesticks and in open space, if Crypto.com price has a close on the daily chart at or below $0.425, it would put CRO in the weakest position its been in since January 6, 2022. A return to the $$0.300 value area would be very likely.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.