Crypto.com to undergo bullish correction before CRO explodes to $0.60

- Crypto.com token is currently hovering between the 50-day and 100-day SMAs, indicating a consolidation.

- The coiling up will likely result in a retracement before a massive move higher.

- A breakdown of $0.391 will invalidate this short-term bullish thesis.

Crypto.com token has been in an uptrend for quite some time but the exhaustion of the recent rally has led to a consolidation. A breakout from this coil could be the trigger for further gains for CRO.

Crypto.com token provides opportunity for gains

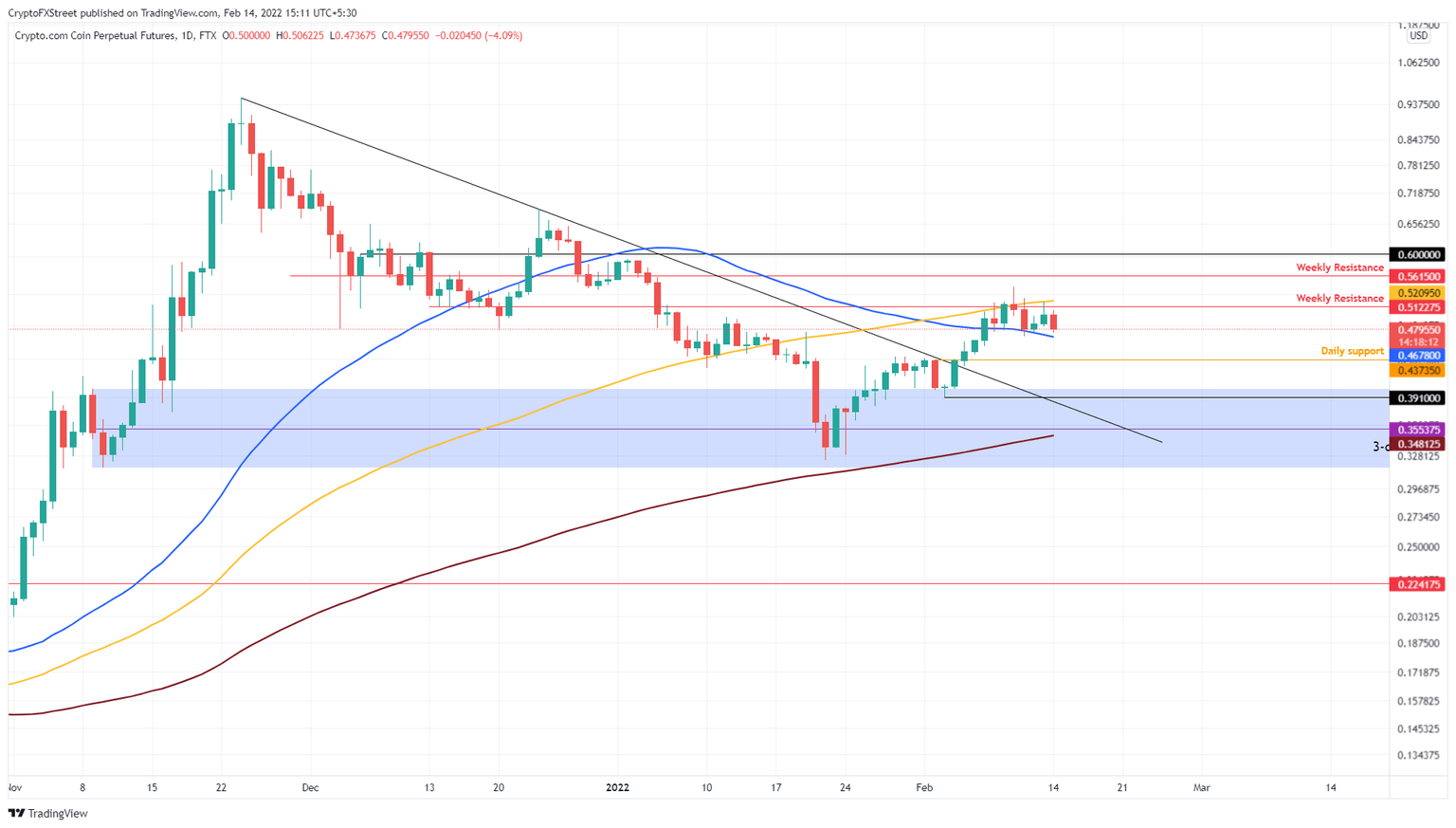

Crypto.com token rallied 67% from January 22 to February 10 and set up a short-term higher high at $0.543. Price action is currently coiling up in a tight range between the 50-day Simple Moving Average (SMA) and the 100-day SMA, suggesting a lack of directional bias.

Considering the overall outlook for the market, there is a good chance CRO will retrace to the $0.437 support level before reversing its trend. Interested individuals can capitalize on this downtrend and open a long position at $0.437.

The resulting uptrend will likely shatter through the aforementioned SMAs and make a run for the $0.562 resistance barrier. While investors can book profits here, there is a chance that the Crypto.com token will extend even further, beyond this hurdle, and retest the $0.60 barrier.

CRO/USDT 1-day chart

Regardless of the bullish correction, if the Crypto.com token produces a lower low below $0.391, it will invalidate the short-term bullish thesis. While this development might sound bearish, the 3-day demand zone, extending from $0.316 to $0.400 will absorb any incoming selling pressure and keep the bullish outlook intact – at least in the long-term.

A daily candlestick close below $0.316, however, will create a lower low, hinting at a continuation of the downtrend to $0.224.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.