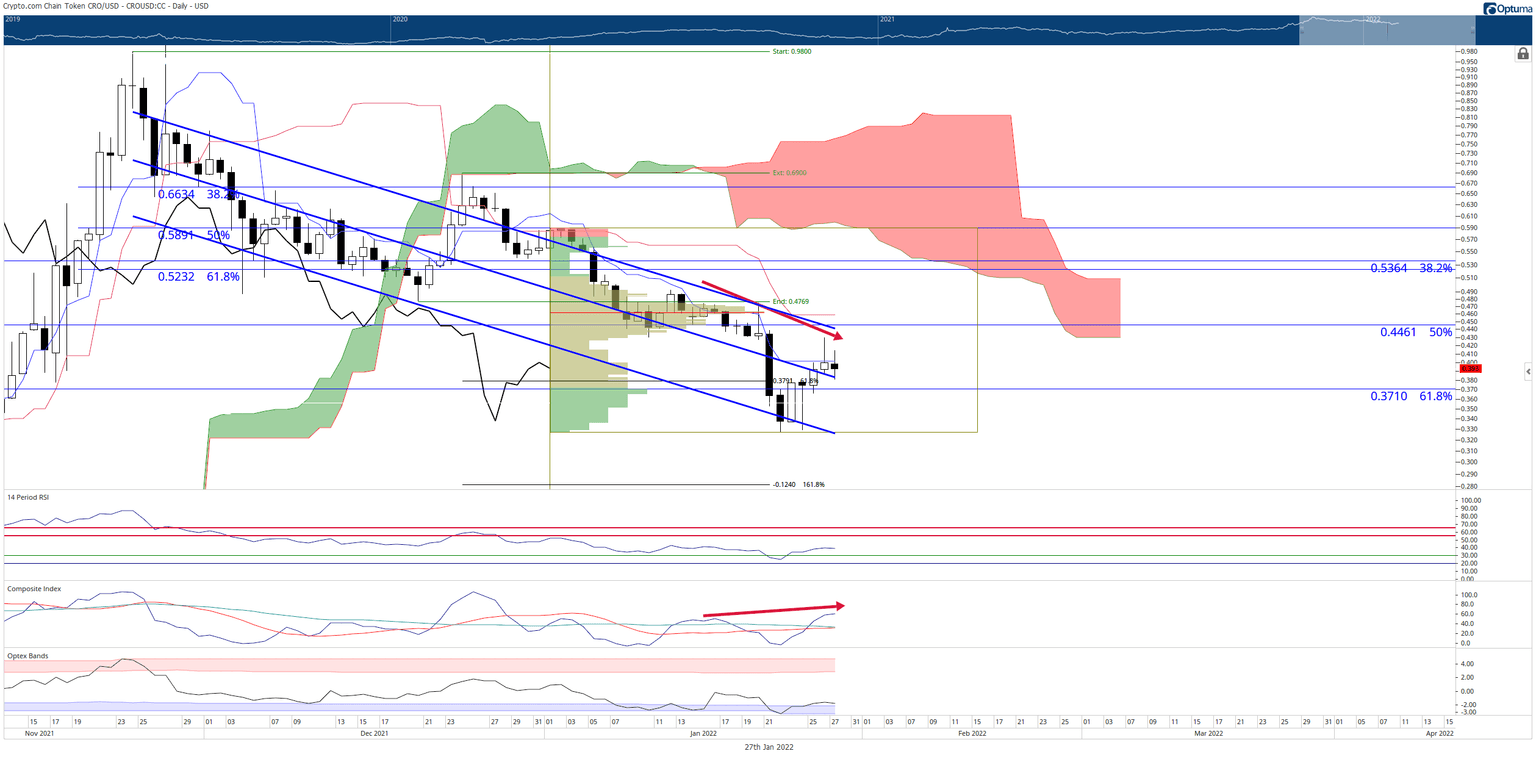

Crypto.com bulls maintain tentative support zone as CRO bulls target $0.50

- Crpyto.com price has maintained a steady support zone in the $0.40 area, but bulls appear to be weakening.

- Bearish continuation between the price chart and oscillators warns of a return lower.

- Buyers need to step in and support CRO, or a return to $0.35 is coming.

Crypto.com price continues to face challenges above the $0.40 price level. Strong selling against the Tenkan-Sen at $0.40 tests buyers' conviction – failure to break above the Tenkan-Sen signals continued weakness.

Crypto.com price faces continued selling pressure unless bulls rally CRO

Crypto.com price action has a difficult road ahead if it wants to return to an uptrend that targets new all-time highs. During the intraday session, buyers face the third consecutive day of pushing above the Tenkan-Sen but fail to close above it. The oscillators provide little help in determining an anticipated move, but selling pressure towards a move lower is the most likely scenario.

The strongest case for another downswing, or a least a return to test the 2022 low at $0.32, is the divergence between the candlestick chart and the Composite Index. The arrow pointing down on the candlestick chart shows lower highs, while the arrow on the Composite Index shows higher highs. This divergence is known as hidden bearish divergence. Hidden bearish divergence is only valid if something is already in a downtrend – Crypto.com is definitely in a downtrend –acts as a warning that the current move up is likely to terminate and resume the prior downtrend.

CRO/USDT Daily Ichimoku Kinko Hyo Chart

However, bulls can invalidate a downtrend continuation setup by removing the hidden bearish divergence. To do this, Crypto.com price needs a close above the January 16 close of $0.46. This would also generate a breakout above the current bull flag (blue diagonal linear regression channel) and the Kijun-Sen. From there, a move toward $0.50 is likely.

However, failure to breakout above the Tenkan-Sen would likely see CRO price test the bottom of the bull flag and the 2022 low.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.