Pepe price is up 121%, will PEPE bulls continue their stampede?

- Pepe price trades at $0.00266 after a 121% rally in the last two days.

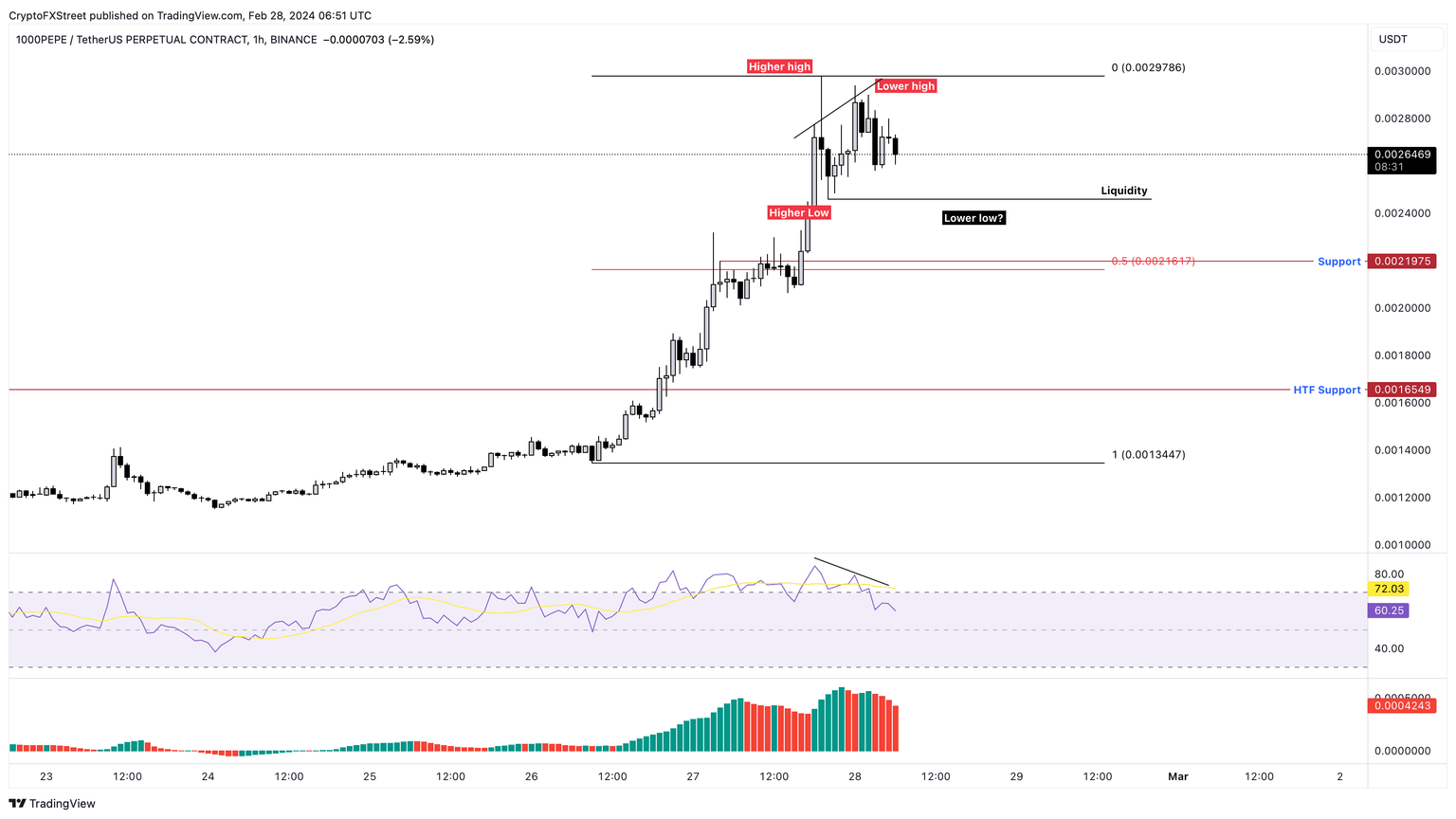

- If the altcoin sets up a lower low along with the already established lower high, it could mean correction.

- But a liquidity sweep below $0.00245 followed by a recovery could send PEPE flying.

Pepe (PEPE) price has been extremely volatile in the last two days after a 121% rally. This uptrend could see a small breather in the mid-week before PEPE bulls kickstart another run. However the extension of the bull move depends on the market structure it is yet to produce.

Read more: Pepe Price Prediction: PEPE is an outlier with over 15% gains as meme coins post single-digit surges

Pepe price showcases impressive rally

Pepe price shot up 121% from $0.00134 on February 26 to $0.00297 on February 27. This impressive rally can be attributed to the ongoing frenzy with Ethereum’s recent move beyond the $3,000 psychological level. As a result, ETH-related altcoins are exploding.

Since PEPE happens to be the Ethereum chain’s very own meme coin, investors are showing this token some love, especially after the Solana-based meme coin hype.

Regardless, will Pepe price continue its ascent?

So far, Pepe price has produced a lower high after setting up a local top at $0.00297. As PEPE retraces, investors need to pay attention to the $0.00245 level due to the sell-side liquidity resting below it.

A sweep below this level – if followed by a recovery – could be key to extending the rally. This bullish outlook depends on whether PEPE can produce a subsequent higher high. In which case, Pepe price could eye a retest of the round number at $0.00300.

Read more: PEPE price inches closer to 2024 peak with top crypto exchanges teasing PEPE memes on X

1000PEPE/USDT 1-hour chart

On the other hand, if Pepe price fails to recover above $0.00245 after a sweep of the sell-side liquidity, it would set up a lower low and flip the market structure bearish. It also indicates that the uptrend could be short-lived, and that a correction could ensue soon.

In this situation, investors need to look for a potential pullback to short PEPE. The target would be the midpoint of the 121% rally at $0.00216, which closely coincides with the $0.00219 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.