Here's what you need to know on Wednesday

Markets:

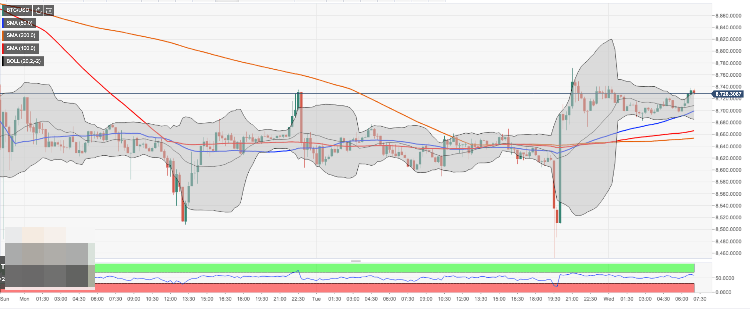

BTC/USD is currently trading at $8,734 (+0.8% on a day-to-day basis). The coin has barely changed since the beginning of the day. The short-term trend is bearish.

The ETH/USD pair is currently trading at $169.6 (+1.0% on a day-to-day basis). The Ethereum's recovery is capped by a psychological $170.00; now the coin is moving within a short-term bearish trend amid low volatility.

XRP/USD settled at $0.2379 after a spike to $0.2255 on Tuesday. The coin is down 0.47% in recent 24 hours.

Among the 100 most important cryptocurrencies, the best of the day are Komodo (KMD) $0.7805 (+27.5%), Golem (GNT) $0.0407 (+23.7%) and SOLVE (SOLVE) $0.1145 (+8.3%), The day's losers are, Centrality (CENNZ) $0.0620 (-8.5%), MCO (MCO) $4.76 (-5.6%) and Bytecoin (BCN) $0.0002 (-5.32%).

Chart of the day:

BTC/USD, 15-min chart

Bitcoin SV has settled above $300 amid strong bullish sentiments. Experts believe that this thome the upside momentum is driven by the upcoming hard fork of Bitcoin's offshoot. The update known as Genesis will take place on February 4. It is expected to reverse some of the changes implemented on Bitcoin protocol, to rake it back to Satoshi's vision. The analysts point out to a high probability of massive sell-off following the event within "buy the rumor, sell the fact pattern".

Industry:

Litecoin network processed transactions worth over $100 billion, according to the data, provided by Bitinfocharts. While this is a solid figure that proves a sustained usage of the network, it is still well below the figures registered in 2018. However, the experts of Litecoin.com noted that the data may be skewed due to high trading volumes in January 2018, when $5 billion a day was transacted on the peak of the massive bull market.

The digital currency branch of Jack Dorsey's payments company Square has announced the development of the Lightning Development Kit. The new feature will help Bitcoin wallet developers integrate the micropayments service with their existing products.

We’ve got the team. We’ve got the mission. We’ve got hit or miss tweets. And now it’s time to talk about what we’re building: Introducing the Lightning Development Kit, or LDK.

Regulation:

A group of global central banks joins forces to assess potential use cases for central bank-issued digital currencies (CBDC) and share their experience in dealing with this type of asset in their respective jurisdictions. According to the announcement published on the website of the Bank of England, the central banks of England, Japan, the Eurozone, Canada. Sweden and Switzerland together with the Bank will International Settlements look into CBDC use cases in such areas as "economic, functional and technical design choices, including cross-border interoperability; and the sharing of knowledge on emerging technologies".

Based in the Netherlands cryptocurrency exchange XRParrot halted operations due to new anti-money laundering regulations adopted by the European countries. The exchange was based on XRP and served as a payment gateway for Ripple's coin.

XRPCommunity: it's been great. However, due to new regulations in The Netherlands (The home of XRParrot) the XRParrot service comes to an end. Accidental or automatic transfers to XRParrot will still be processed for some time (users will be informed). Thank you for everything!

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Fed-led rally could have legs towards $65,000

Bitcoin has risen 7% so far this week, supported by the US Fed interest-rate cut and more than $300 million in ETFs inflows. The recent surge led BTC price to shatter several key technical resistance levels, a sign that the current two-week rally has likely some more way to go towards $65,000.

Ethereum, BNB and POL holders on the watch as BingX faces loss of $26 million in hack

Crypto exchange BingX said on Friday that it suffered a hack, an attack that led to “minimal” losses that researchers at PeckShield estimate at $26.68 million. The attacker swapped the stolen altcoins for Ethereum, Binance Coin and Polygon tokens, according to on-chain data.

Pepe price forecast: Eyes for 30% rally

Pepe extends the upward movement on Friday after breaking above the descending trendline and resistance barrier on Thursday. PEPE’s dormant wallets are in motion, and the long-to-short ratio is above one, further supporting this bullish move and hinting at a rally on the horizon.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin (BTC) has risen 7% so far this week, supported by the US Federal Reserve (Fed) interest-rate cut and more than $300 million in ETFs inflows. The recent surge led BTC price to shatter several key technical resistance levels, a sign that the current two-week rally has likely some more way to go towards $65,000.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.