Crypto enthusiasts grow “extremely greedy” suggesting a major correction is underway

- The Crypto Fear and Greed Index currently shows significant greed in the crypto market.

- The indicator has been an accurate indicator of bullish and bearish reversal scenarios in the past.

According to the official description of the Fear and Greed Index, the cryptocurrency market is highly emotional. Investors tend to get greedy when the market is rising rapidly and fearful when it's going down.

Although it might not seem logical, periods of extreme fear can be great buying opportunities. Conversely, when investors are greedy, the market could potentially be facing a correction.

How accurate is this indicator?

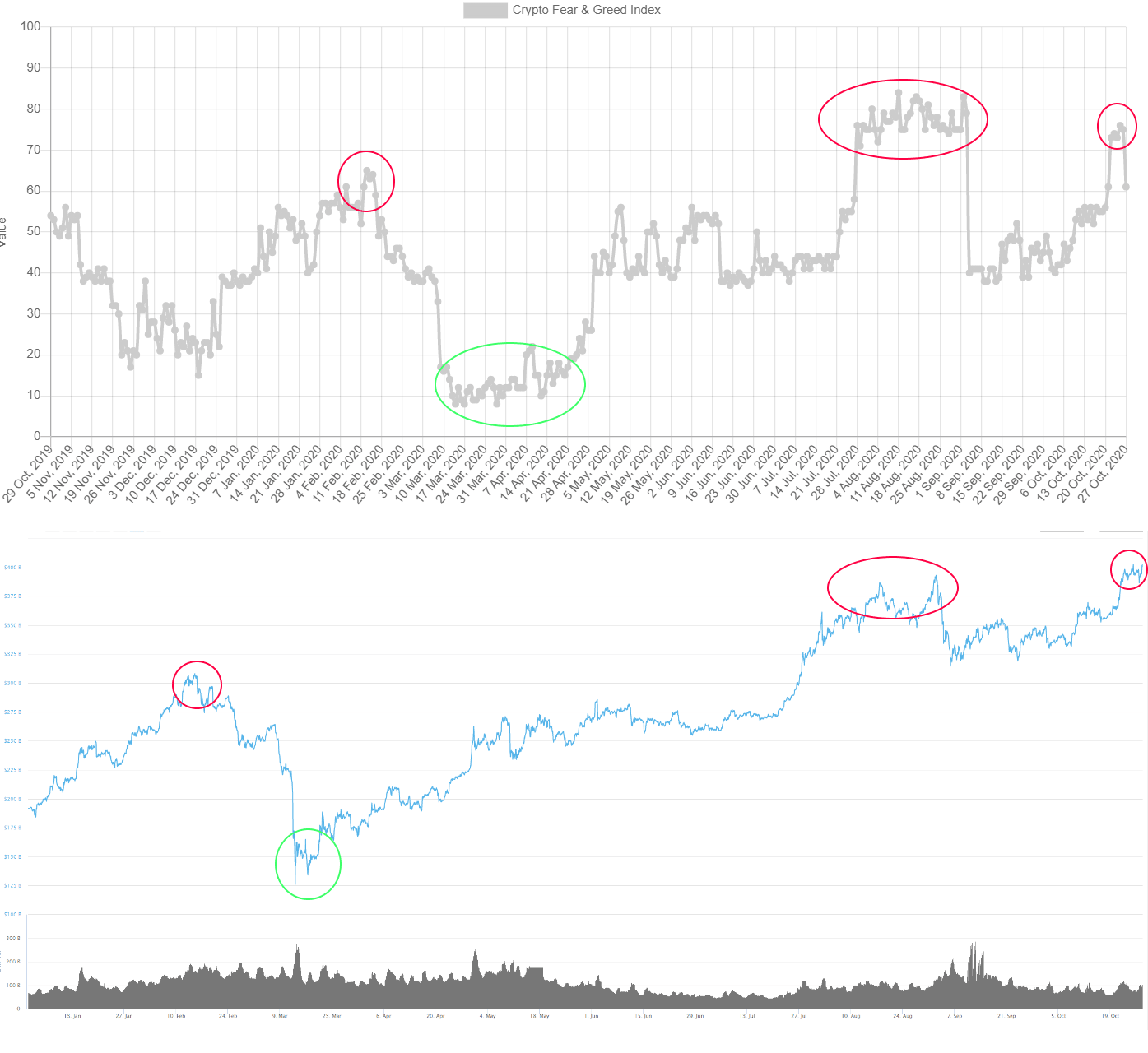

The last period of high greed happened throughout the month of August. The index reached 83 points on September 2, right before a massive $76 billion market capitalization correction. Another peak in greed was hit at 61 points on February 12, which accurately predicted the following colossal $160 billion correction of the entire crypto market.

Crypto Fear and Greed Index Compared to Market Capitalization

Similarly, right after that correction took place in March, the fear index touched 8, and the market started to rebound. Considering the greed index is reaching highs again, it would seem that Bitcoin and the crypto market are poised for a correction.

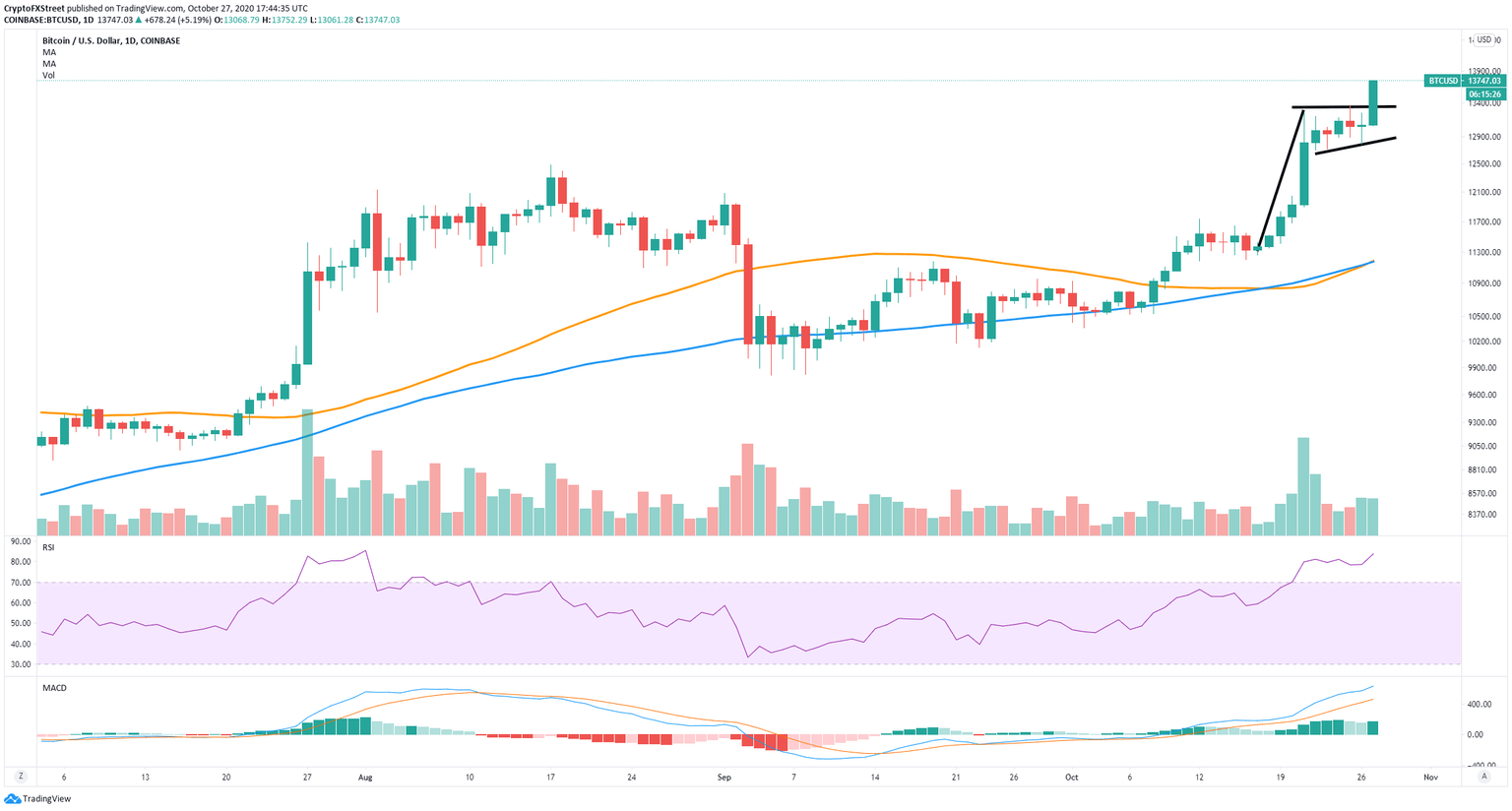

BTC/USD daily chart

However, despite the greed of crypto investors, Bitcoin has continued surging past the high at $13,350, established on October 25, breaking out of what seems to be a daily bull flag. Many technical indicators and on-chain metrics show very little resistance to the upside for Bitcoin.

In previous articles, we have seen that the IOMAP chart provided by IntoTheBlock shows very little opposition to the upside well until $15,000. However, the greed index could limit Bitcoin's potential gains and the entire market in the short-term.

In the event of a sudden liquidation period of long positions on Bitcoin, the digital asset could fall towards $13,000 to re-test the psychological level. On September 2, when the greed index was high, BTC fell by more than 18%, a similar drop would take the flagship cryptocurrency towards $11,000.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.