Chiliz Price Prediction: CHZ looks to retrace 12% after recent run-up

- Chiliz price has been on a tear as it rallied 40% between June 15 and June 16.

- Like the initial run-up, the current rally has peaked, as indicated by the MRI.

- A 12% correction to the demand zone, ranging from $0.280 to $0.291, seems likely.

Chiliz price saw two massive rallies over the past week due to the European Cup. However, the current upswing appears to have hit a local top and shows signs of exhaustion and potential reversal.

Chiliz price eyes a higher low

Chiliz price rose roughly 55% due to the start of the Euro 2020 tournament. However, this rally faded as CHZ went from $0.357 to $0.263, a 26% retracement.

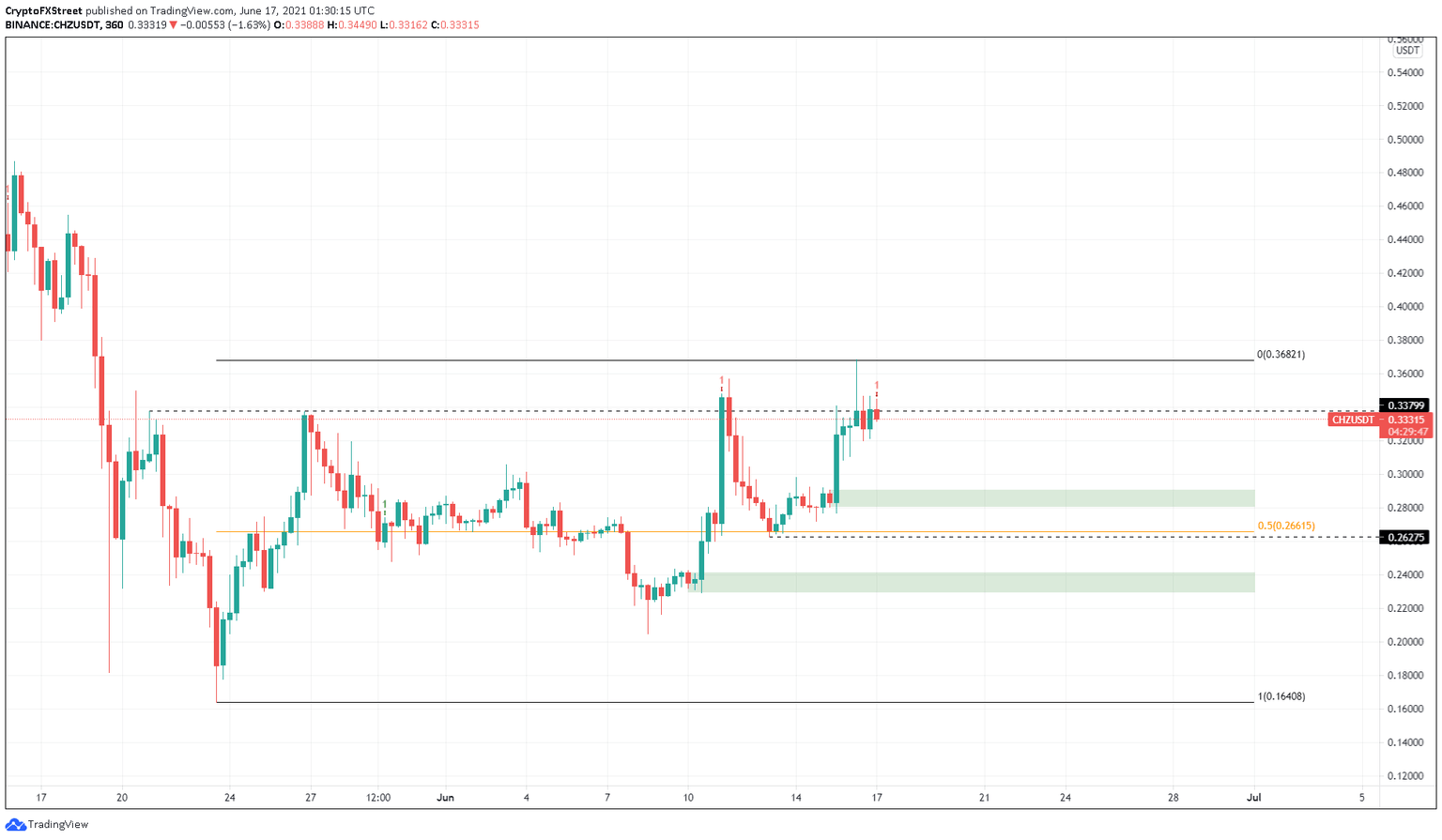

Interestingly, this move found support at the 50% Fibonacci retracement level at $0.266, which is the midway point of the range that stretches from $0.164 to $0.368. Chiliz price market structure looks strong when looking at this range and how the altcoin has never stayed below $0.266 for too long.

Therefore, the 26% pullback was bound to restart the upswing for Chiliz price. From June 13 to June 16, CHZ rose roughly 40% due to the Coinbase Pro listing. This uptick formed a peak at $0.368.

Now, the Momentum Reversal Indicator (MRI) has formed a sell signal in the form of a red ‘one’ candlestick on the 6-hour chart, indicating that the run-up has reached its pinnacle and that a reversal is likely. This technical formation forecasts a one-to-four candlestick correction.

Investors can expect a 12% retracement to the demand zone that extends from $0.280 to $0.291.

In certain conditions, CHZ might head to the 50% Fibonacci retracement level at $0.266. While a decisive close below the recent swing low at $0.263 will indicate the creation of an equal low, a 6-hour candlestick close below it will indicate a continuation of the downswing. This move would also indicate the shift in trend from bullish to bearish due to the creation of a lower low.

CHZ/USDT 6-hour chart

If Chiliz price produces a 6-hour candlestick close above the range high at $0.368 before retracing 12%, it would invalidate the bearish thesis. In such a case, CHZ could rise 12% to the swing low at $0.391, created on May 17.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.