Chiliz price greets European Cup with 30% rally, but CHZ meets trifecta of resistance

- Chiliz price launches 70% in the run-up to the European Cup.

- Convergence of three technical levels puts CHZ rally continuation in doubt.

- 200-day simple moving average (SMA) has contained downside risk on a closing basis.

Chiliz price has climbed over 70% from the June 9 low to today’s high in the run-up to the European Cup, one of the premier soccer events in the world. The noteworthy rally has captured the attention of the cryptocurrency markets and has been applauded by the CHZ faithful. Still, a trifecta of resistance has cooled the rally and puts forecasts of a continuation on hold.

Euro 2020 tournament set CHZ up for the big kick-off

Chiliz is a tokenized platform that permits sports fans, particularly in soccer, to become team influencers and participate in some decision-making. The tokenization deepens the relationship between the fans and the team that was not possible only a few years ago, taking the fan from just a spectator to an active participant in the teams’ evolution.

To begin, fans need to onboard the Socios.com platform to participate in the clubs’ Fan Token Offering (FTO). The fans must purchase CHZ via a cryptocurrency exchange to acquire Fan Tokens specific to a team. The number of tokens is fixed.

Fans use the tokens to vote in polls regarding the club, such as new jerseys, special events, and gain access to exclusive offering unavailable to anyone else. The more tokens a fan holds, the higher the influencer rating and the opportunity to climb through different reward tiers until they have access to the club’s biggest VIP benefits.

Juventus, an Italian soccer club, was the first team to develop a token offering and has been followed by other soccer giants such as Barcelona, Paris Saint-Germain, Atlético de Madrid and Roma. Hence, the boost in CHZ over the last three days as the teams get ready for the European Cup.

The European Cup is about to open. In the past 24 hours, sports concept tokens have risen sharply, CHZ rose by more than 34.88%, the turnover rate reached 37.27%, and the transaction volume was $646 million, surpassing UNI, BCH, SOL, etc. pic.twitter.com/t1OaWf6bZ0

— Wu Blockchain (@WuBlockchain) June 11, 2021

Chiliz price overcome with sports enthusiasm

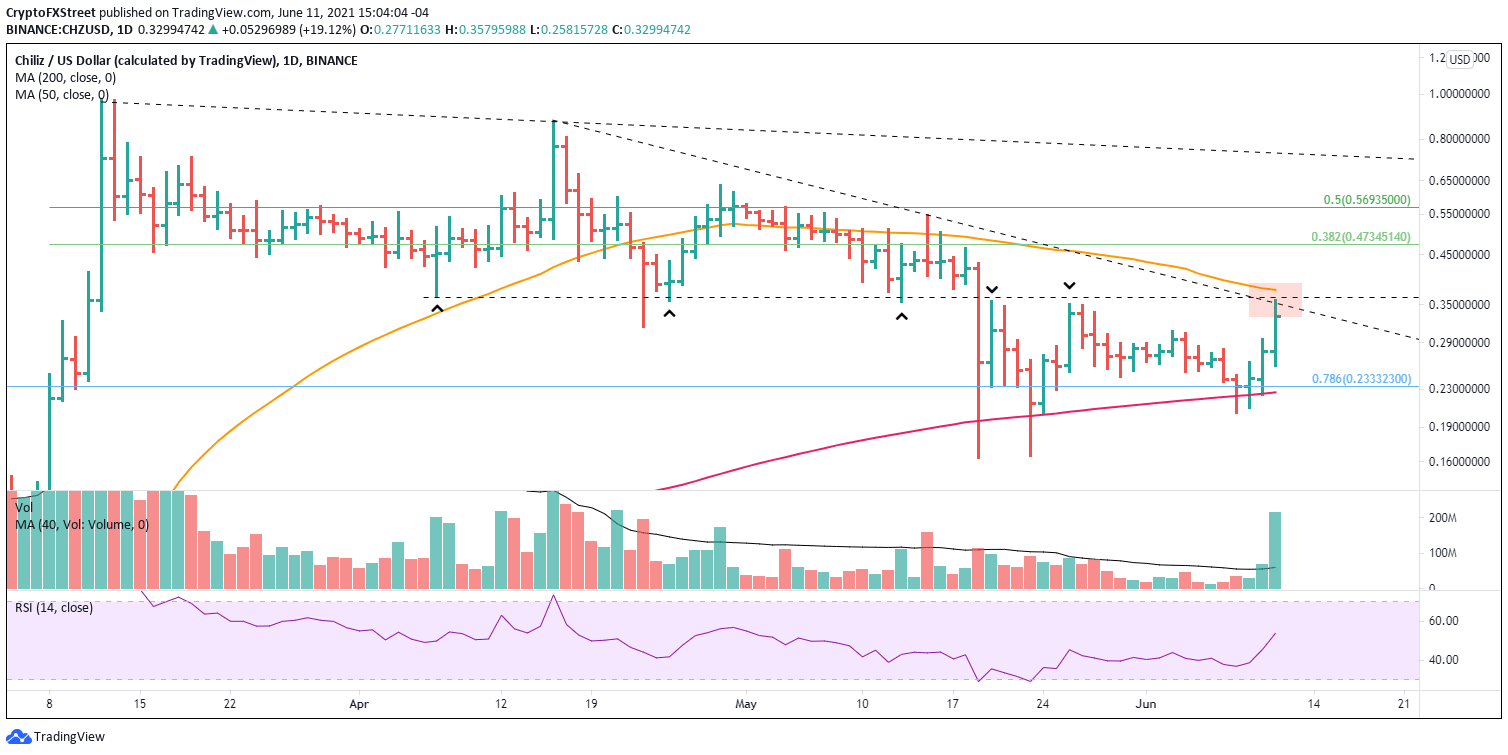

To review, Chiliz price crashed over 80% from the March 12 high of $0.975 to the May 19 low of $0.163, and it was highlighted by a 60% drop on May 19. However, CHZ rebounded over 100% from the May 19 low to May 20 high but remained below the key resistance level originating with the April 7 low at $0.364.

Since the May 19 low, Chiliz price has been unable to rally above the $0.364 level, preferring to move between the level and the 200-day SMA. Today, CHZ attempted to conquer the distinguished resistance but fell short, constrained by the April declining trend line at $0.351 and intimidated by the declining 50-day SMA at $0.377.

Chiliz price now encounters a trifecta of technical resistance covering the price range of $0.351 to $0.377, and it could prevent the European Cup hype from driving CHZ higher moving forward.

It would take a close above the 50-day SMA at $0.377 to void the cautious outlook for the sports and entertainment token.

Downside support is formalized by the near intersection of the 78.6% retracement of the February-March rally at $0.233 with the 200-day SMA at $0.226. Any weakness beyond that support raises the probability that Chiliz price will test the May 19 and 23 lows at $0.163 and $0.164, respectively.

CH/USD daily chart

If Chiliz price does close above the 50-day SMA, it will be quickly met with resistance at the 38.2% Fibonacci retracement at $0.473 reinforced with heavy price congestion from mid-May.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.