Chiliz Price Forecast: CHZ could crash by 44% in the near term

- Chiliz price is contained inside a head-and-shoulders pattern on the 4-hour chart.

- CHZ faces a significant resistance point which stops it from advancing further.

- The digital asset needs to hold a crucial support level to avoid a massive fall.

Chiliz price is down by 44% since its all-time high of $0.84 on April 16. The digital asset has experienced massive volatility in the past several weeks after several positive announcements.

Chiliz price must hold crucial support level

On the 4-hour chart, it seems that CHZ has formed a head-and-shoulders pattern with its neckline located at $0.47. A 4-hour candlestick close below this key point would confirm a breakdown of the pattern.

CHZ/USD 4-hour chart

The height of the pattern from the top to the neckline is 44% which would also be the long-term price target of the breakdown.

There are other price targets on the way, first at $0.435 and the second at $0.366 which are previous lows of CHZ.

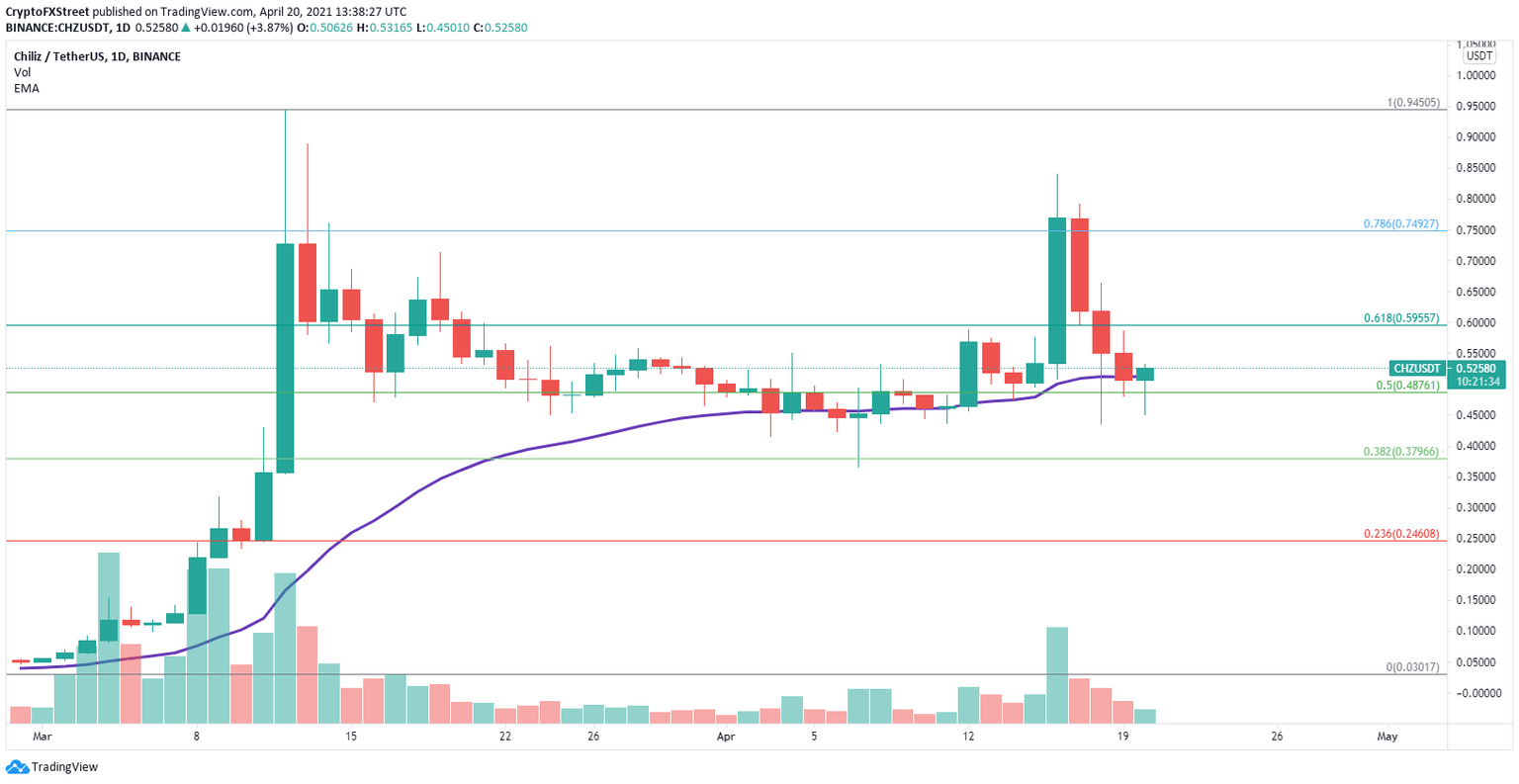

The biggest asset of the bulls is the 26 EMA on the daily chart which has held the price for several months.

CHZ/USD daily chart

If Chiliz can stay above this key support level, it can quickly shoot up toward $0.60 at the 61.8% Fibonacci retracement level as there isn’t a lot of resistance ahead.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.