Chainlink VRF receives new integration as LINK price ponders 60% climb

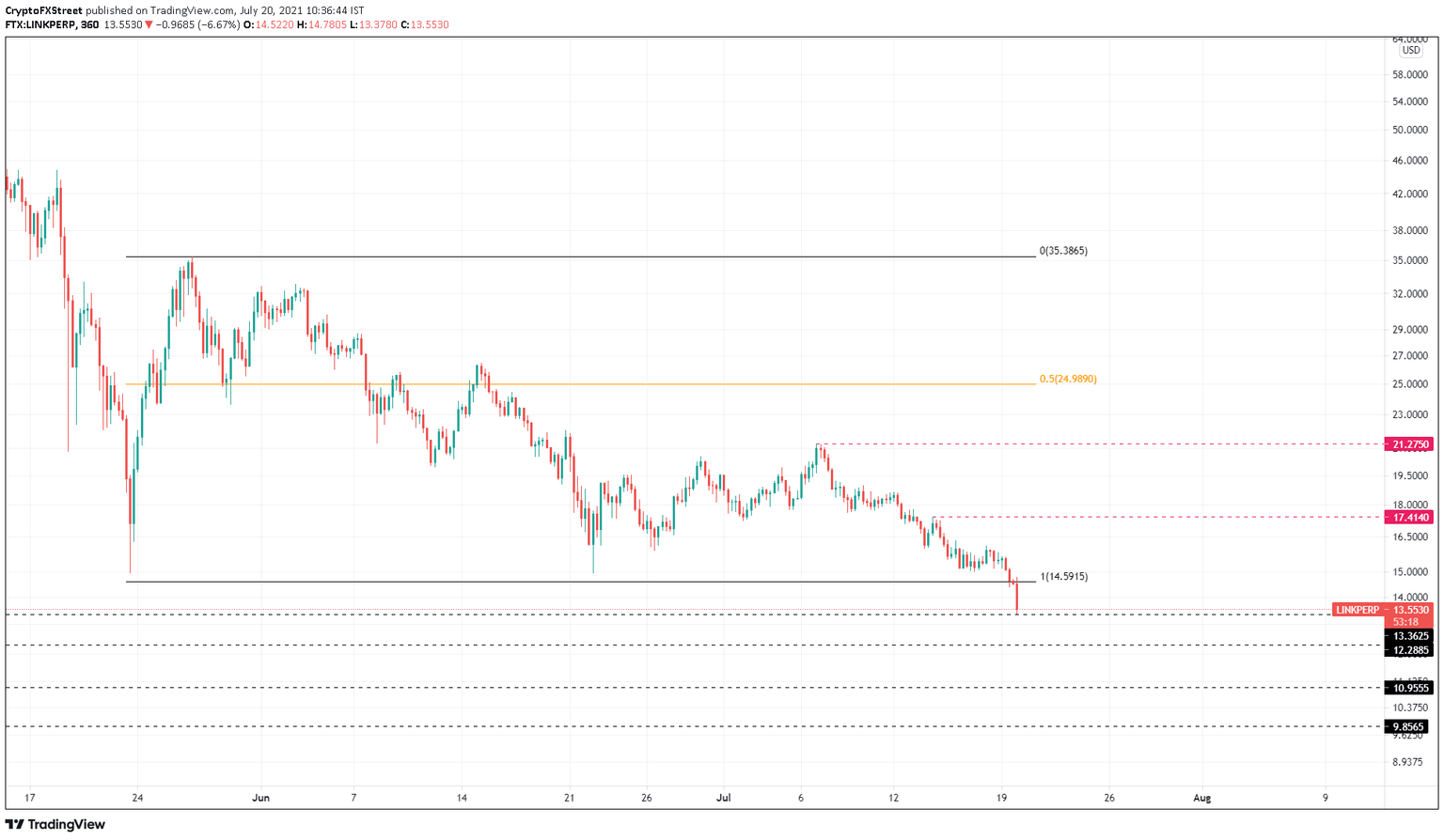

- Chainlink price is currently close to reversing its downtrend as it approaches $13.36.

- Infinity Skies is the latest project to integrate Chainlink VRF.

- A breakdown of the $10.96 support level will invalidate the bullish thesis.

-637336005550289133_XtraLarge.jpg)

Chainlink price has dropped considerably over the past two weeks as it retests a crucial support level. A bounce from this barrier seems likely, but investors need to be aware of a breakdown that could entail further downswings.

Chainlink VRF adoption continues to rise

Chainlink Verifiable Random Function (VRF) is an important functionality used to automate randomness that helps projects in many ways. Chainlink has purposely built the VRF to be a secure, on-chain randomness solution for smart contracts. The upside of this functionality is that it is tamper-proof and unbiased.

For example, Infinity Skies is using VRFs to distribute rare in-game loot to its users randomly. In games such as this, randomness is pivotal in ensuring the players get a leveled playing field and the excitement of unpredictability.

The announcement reads,

Since loot is probabilistic and NFTs hold real value to players, it is imperative that the minting of loot cannot be ‘gamed’. Chainlink VRF provides the Infinity Skies’ smart-contract responsible for chest opening with direct access to a tamper-proof and auditable random number to determine outcomes when opening chests.

While the adoption of Chainlink products like price feeds, keeper network or VRF is soaring, the price action so far has been lackluster. However, technicals are indicating that this gloomy phase might be coming to an end as LINK hints at a bullish outlook.

LINK price prepares to make u-turn

Chainlink price has witnessed a 37% descent over the past two weeks, pushing it down to $13.55. LINK is currently testing a support level at $13.36, a bounce from which seems likely.

The primary reason for this bullishness comes from Bitcoin price, teetering off a vital demand barrier and showing signs of a reversal.

Assuming a bullish scenario for Chainlink price, a bounce from $13.36 will allow the token to reclaim the range low at $14.59. This development will open the path for the oracle token to climb 19% to tag the resistance level at $17.41.

If LINK price produces a decisive 6-hour candlestick close above $17.41, it will signal the presence of buyers, pushing it up by 22% to $21.28.

This run-up constitutes a 60% ascent from the $13.36 foothold.

LINK/USDT 6-hour chart

On the other hand, a breakdown of the $13.36 support level will reveal the weak bulls. Such a move might trigger a 10% downswing to $12.29. If the selling pressure slices through this floor, it will invalidate the bullish thesis.

In this case, Chainlink price might slide 9% to tag the demand barrier at $9.86.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.