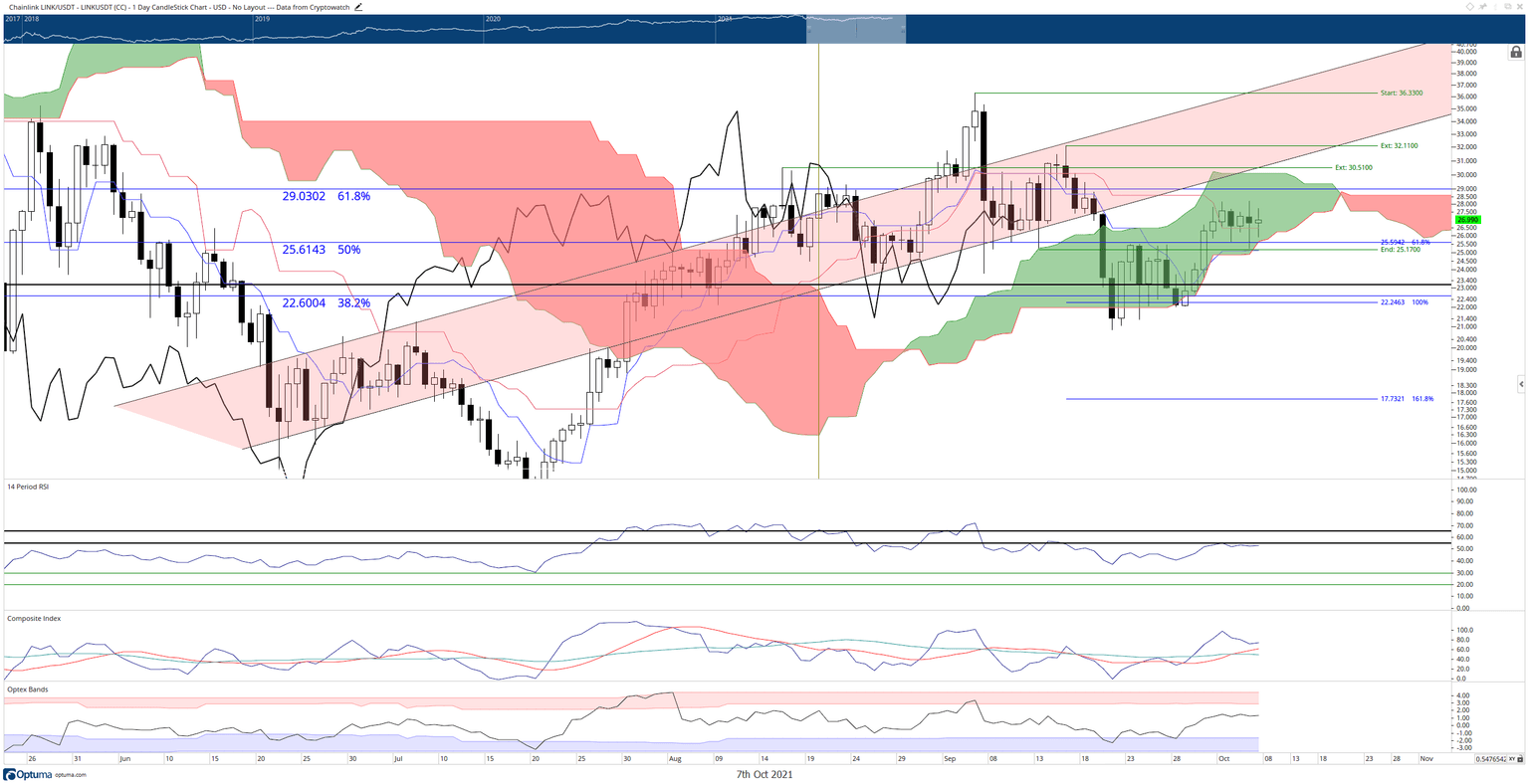

Chainlink to present buy opportunity at $22 before LINK enters new uptrend

- Chainlink price continues to experience indecision, volatility, and whipsaws inside the Cloud.

- Senkou Span B remains the primary support level; if it fails, a free fall to sub-$20 value areas is likely.

- The oscillators show strong bearish continuation patterns.

-637336005550289133_XtraLarge.jpg)

Chainlink price action has drifted lower against Bitcoin’s broader rise. There is strong support at Senkou Span B and the 50% Fibonacci retracement near the $26 value area. If $26 fails, then opportunities for short sellers to take over open up.

Chainlink price slides south, creating anxiety for bulls

Chainlink price remains inside the Cloud and currently represents a textbook example of the frustration and difficulty traders face when an instrument is inside the Cloud. Multiple cases can be made for buyers and sellers alike to take control of any future trend. The side of the market experiencing the most frustration at present are longs.

A look at the Chikou Span shows how many attempts have been made to position it in a close above the candlesticks. However, five consecutive trade sessions of higher rejections have generated significant angst for the bulls.

Final support for Chainlink price is currently at $26. If bulls fail to support Chainlink at this level, then bears have an easy path to push Chainlink down to the 161.8% Fibonacci expansion level near $18. In addition, the hidden bearish divergence in the Composite Index and the rejection against the overbought level in the Relative Strength Index lend weight to the bearish scenario ahead.

LINK/USDT Daily Ichimoku Chart

To invalidate the near-term bearish sentiment, buyers need to propel Chainlink to a close above $31. A close at $31 would put Chainlink price above the Cloud and the Chikou Span above the candlesticks, creating a condition that would confirm a new bullish expansion phase.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.