Chainlink to deceive investors as LINK price eyes 30% breakout

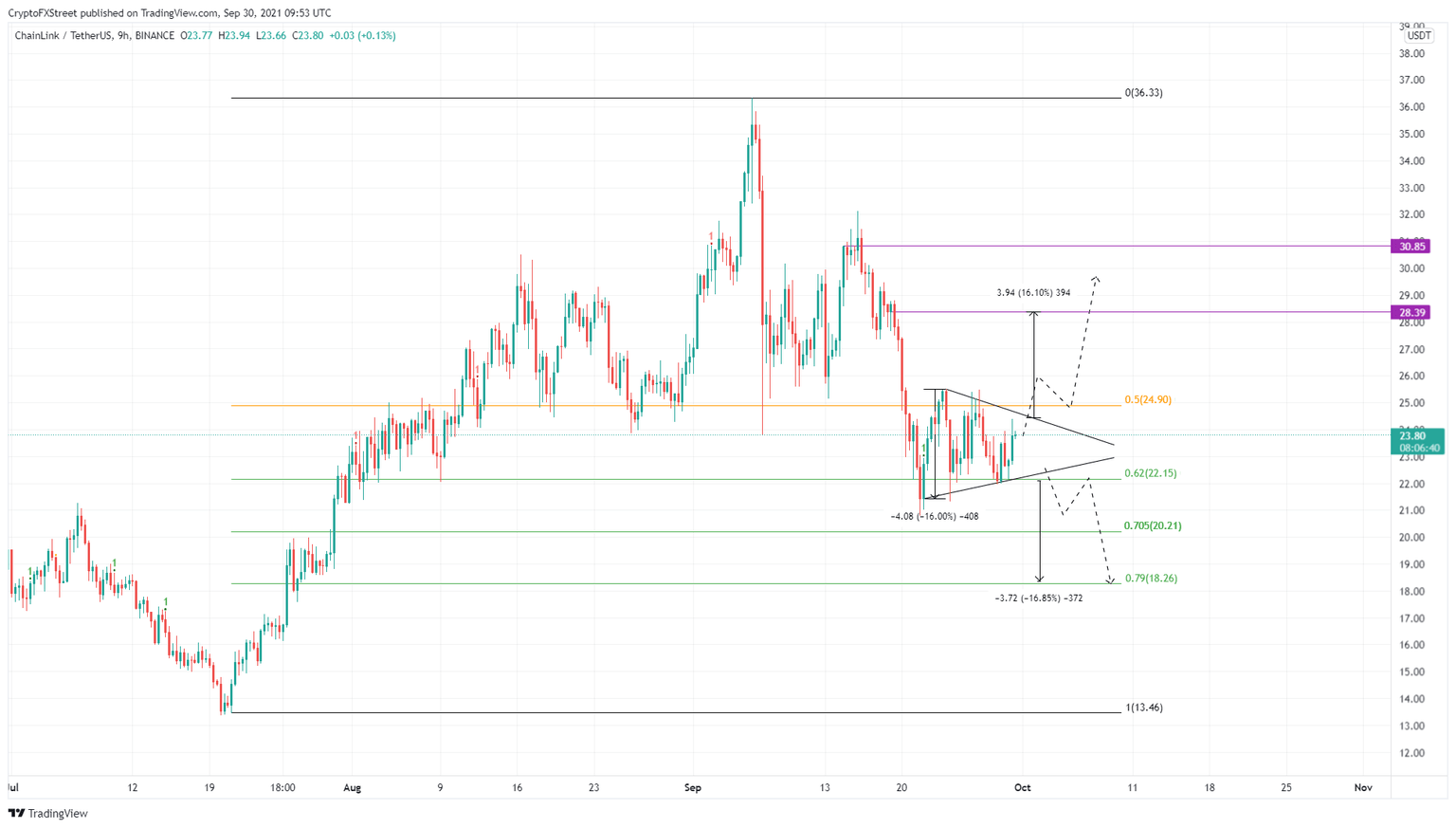

- Chainlink price is consolidating inside a symmetrical triangular, hinting at an explosive move soon.

- A decisive close above the upper trend line will trigger a bullish scenario.

- However, a breakdown of this consolidation might trigger the start of a steep downtrend.

-637336005550289133_XtraLarge.jpg)

Chainlink price began its consolidation after a steep descent that started on September 7. This coiling up could be confusing to investors as LINK could pull a 180.

Chainlink price awaits breakout

Chainlink price dropped roughly 35% since September 16 but began consolidation after forming a swing low at $21.03 on September 22. This move was followed by congestion of LINK price action as swing points started converging.

Connecting trend lines joining these peaks and troughs reveals the formation of a symmetrical triangle. This technical formation has no directional bias and forecasts a 16% breakout, determined by measuring the distance between the highest peak and the trough. Adding this measure to the breakout point reveals a target of $28.38 or $18.26.

Since symmetrical triangles do not have a directional bias for breakouts, investors might expect LINK to break lower due to the bearish trend before the consolidation phase. However, the big crypto and altcoins are booming, suggesting that this symmetrical triangle is a bottom reversal pattern in disguise.

If Chainlink price produces a decisive close above the trading range’s midpoint at $24.90, it will confirm a bullish breakout, triggering a move to $28.39. In some cases, LINK might also tag the subsequent barrier at $30.85, constituting a 30% ascent.

LINK/USDT 9-hour chart

Regardless of optimism in the cryptocurrency markets, if the Chainlink price produces a bearish breakout below $22.15, it will not necessarily invalidate the bullish thesis but only delay it.

In some cases, the buyers might kick-start the uptrend inside the high probability reversal zone, ranging from $18.26 to $22.15.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.