Chainlink Price Prediction: LINK looks to set a new all-time high as there are no barriers ahead

- Chainlink price looks poised to set a new high above $25.78.

- On-chain metrics suggest the digital asset faces very low resistance to the upside.

- Whales have been accumulating a lot of LINK in the past two months.

-637336005550289133_XtraLarge.jpg)

Chainlink price is at $23.55 at the time of writing, on the verge of hitting a new all-time high above $25.78. It seems that large holders have accumulated a lot of Chainlink coins in the past two months and are still not selling.

Chainlink price could hit $30 with no resistance ahead

The In/Out of the Money Around Price (IOMAP) model shows basically no barriers until the area between $24 and $24.2, where 3,600 addresses purchased around 1.68 million LINK. A breakout above this point can quickly send Chainlink price to a new all-time high.

LINK IOMAP chart

Additionally, since November 26, 2020, the number of large holders with 100,000 to 1,000,000 LINK coins has increased from 261 to 271 currently. This indicates that investors still accumulate more Chainlink despite rising prices.

LINK Holders Distribution Chart

Similarly, the number of whales holding between 1,000,000 and 10,000,000 LINK coins increased by four in the same time frame.

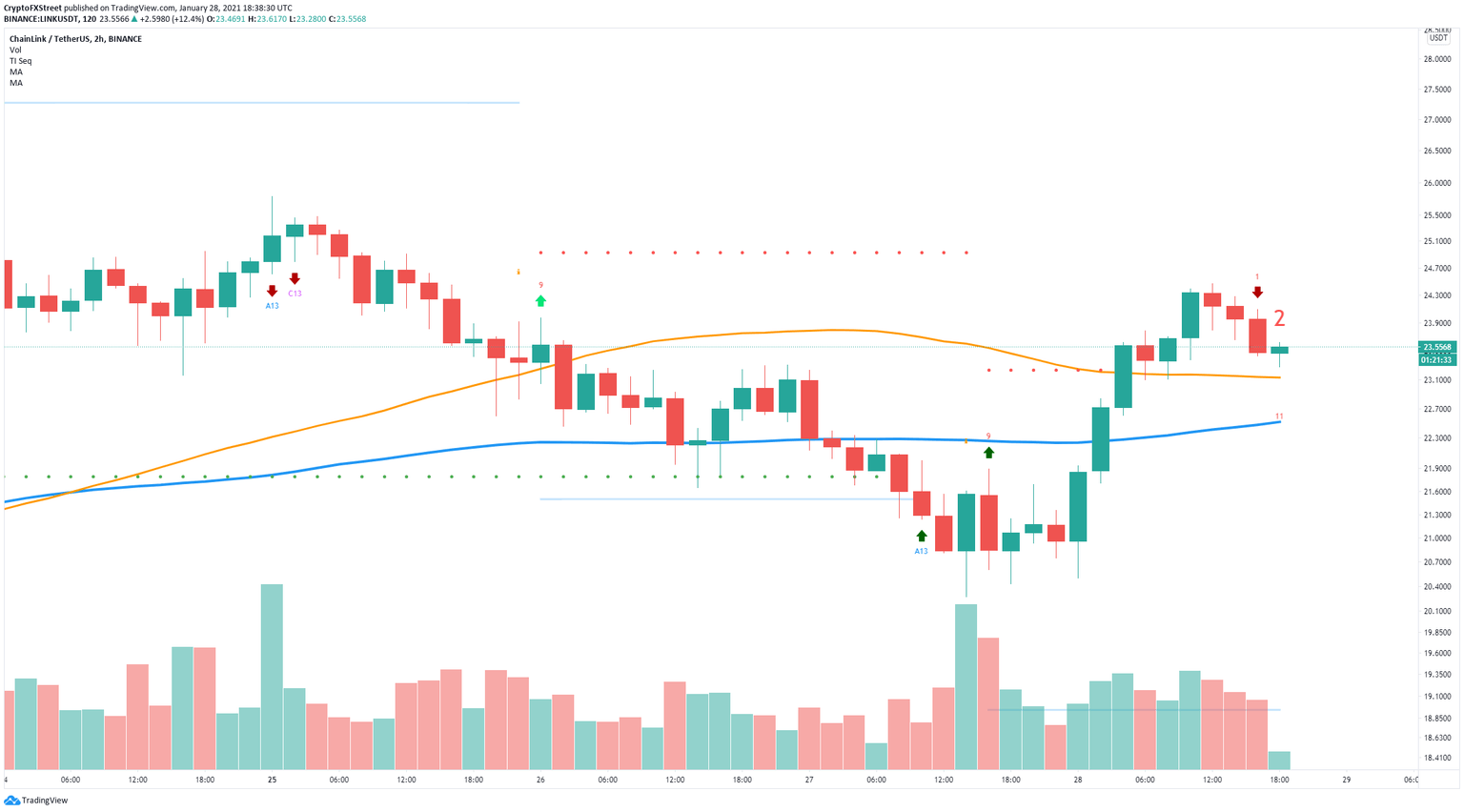

LINK/USD 2-hour chart

However, the TD Sequential indicator has presented a sell signal on the 2-hour chart. Losing the 50-SMA support level at $23 could push Chainlink towards the 100-SMA at $22.5 in the short-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B19.35.20%2C%252028%2520Jan%2C%25202021%5D-637474559436803343.png&w=1536&q=95)