Chainlink price aims for $26 as it hits a new all-time high in trading dominance

- Chainlink price has established its new all-time high at $25.78 on January 25.

- The digital asset has hit another all-time high in trading dominance at 4.7%.

- LINK bulls are ready to push the digital asset above $26 facing very little resistance above.

-637336005550289133_XtraLarge.jpg)

Chainlink has been one of the best performing coins in 2020 and is trying to do the same in 2021. The digital asset has reached a market capitalization of $10 billion positioning itself rank seven.

Chainlink price faces no resistance to a new all-time high

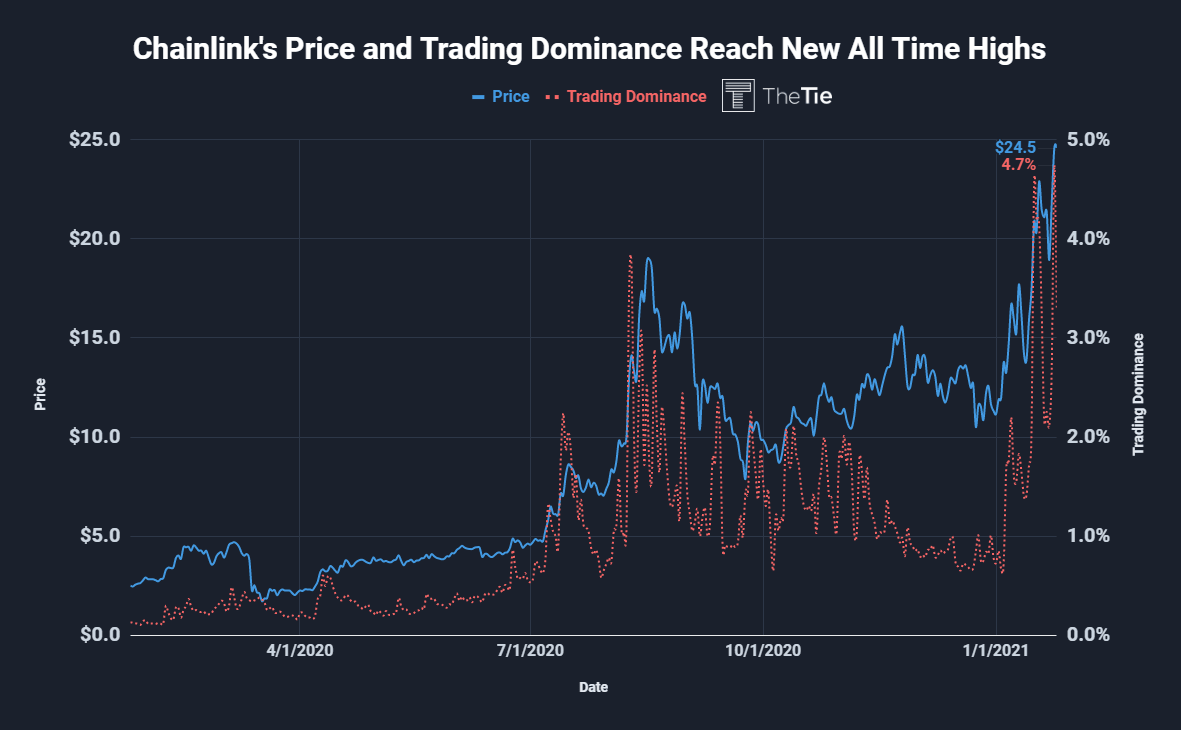

According to statistics from TheTie, Chainlink has just hit a new all-time high in trading dominance volume over the market hitting 4.7%. This rise coincides with the digital asset hitting a new all-time high at $25.78.

LINK Trading Dominance

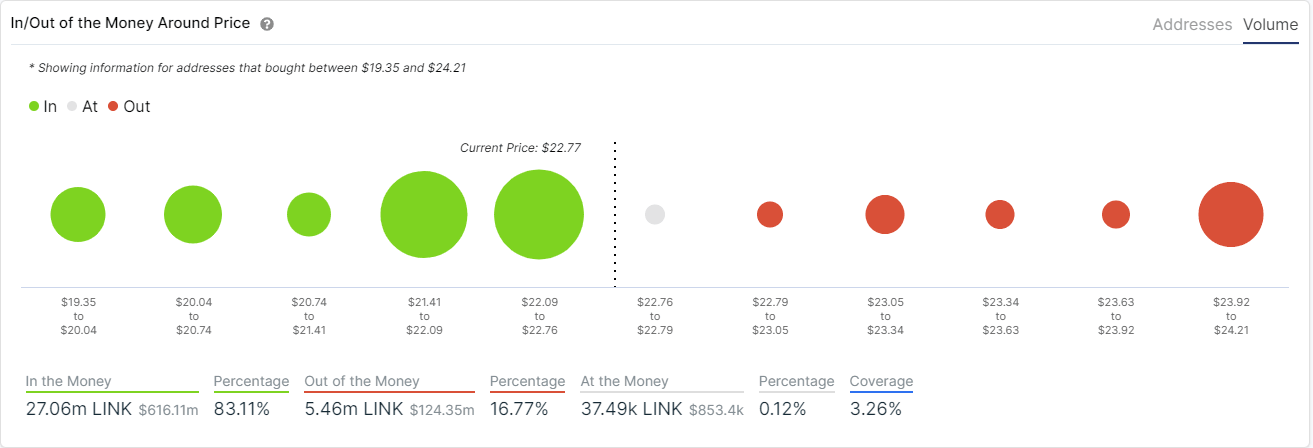

According to the In/Out of the Money Around Price (IOMAP) chart, LINK faces almost no barriers on the way up. The most significant resistance area is located between $23.92 and $24.21 where 4,040 addresses reached 4.24 million total volume. A breakout above this point would easily drive Chainlink price towards $26.

LINK IOMAP chart

It’s also worth noting that the IOMAP model indicates that between $22.7 and $21.4, there is a robust support area where 20 million LINKs were purchased by over 11,000 different addresses, adding a lot of credence to the bullish outlook.

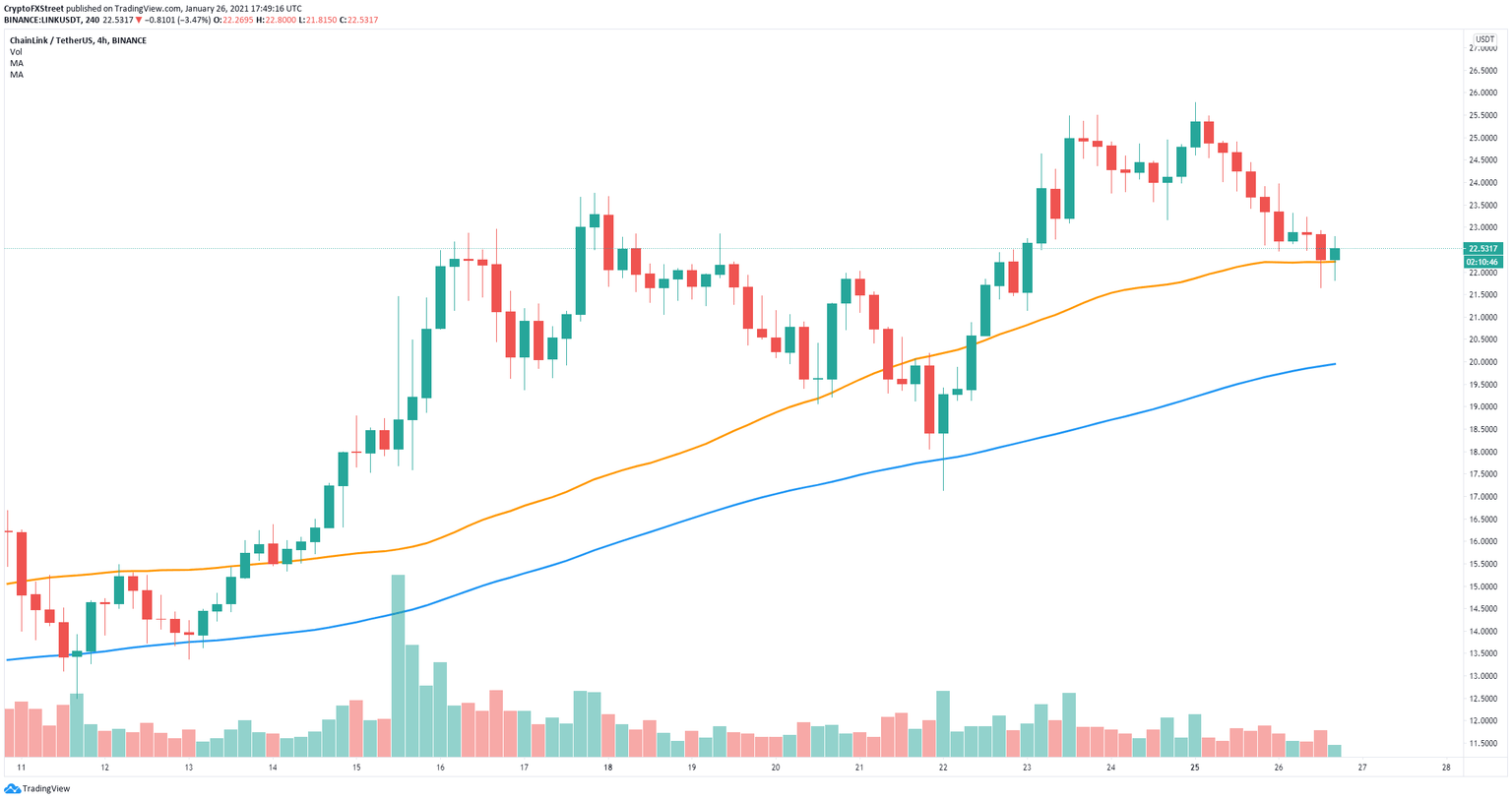

LINK/USD 4-hour chart

However, on the 4-hour chart, Chainlink has established a downtrend and is on the verge of losing a crucial support level at $22.2, the 50-SMA. If the bears can push Chainlink price below this point, it could dive towards the 100-SMA at $20.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.