Chainlink price lingers near 2024 high with dwindling exchange supply of LINK

- Chainlink supply on exchanges dipped nearly 4% in February to 211.61 million LINK tokens.

- LINK price lingers near its 2024 peak of $20.856 on Wednesday.

- Chainlink network activity and trade volume support recent LINK price gains.

-637336005550289133_XtraLarge.jpg)

Chainlink has observed an increase in address activity in the past week. This paved the way for LINK price to rally towards its 2024 high of $20.856 on Binance.

LINK price is $20.294 on Wednesday, lingering close to its 2024 peak. On-chain metrics paint a bullish picture for Chainlink’s token.

Also read: Ripple unveils plans for crypto custody while XRP price trades sideways

Chainlink on-chain metrics support LINK price gains

Three key on-chain metrics, Active Addresses, Daily Active Addresses and Supply on Exchanges support LINK’s recent price gains. Active Addresses noted several spikes throughout February, as seen in the Santiment chart below. Active Addresses hit a high of 6,493 on February 2.

LINK Active Addresses. Source: Santiment

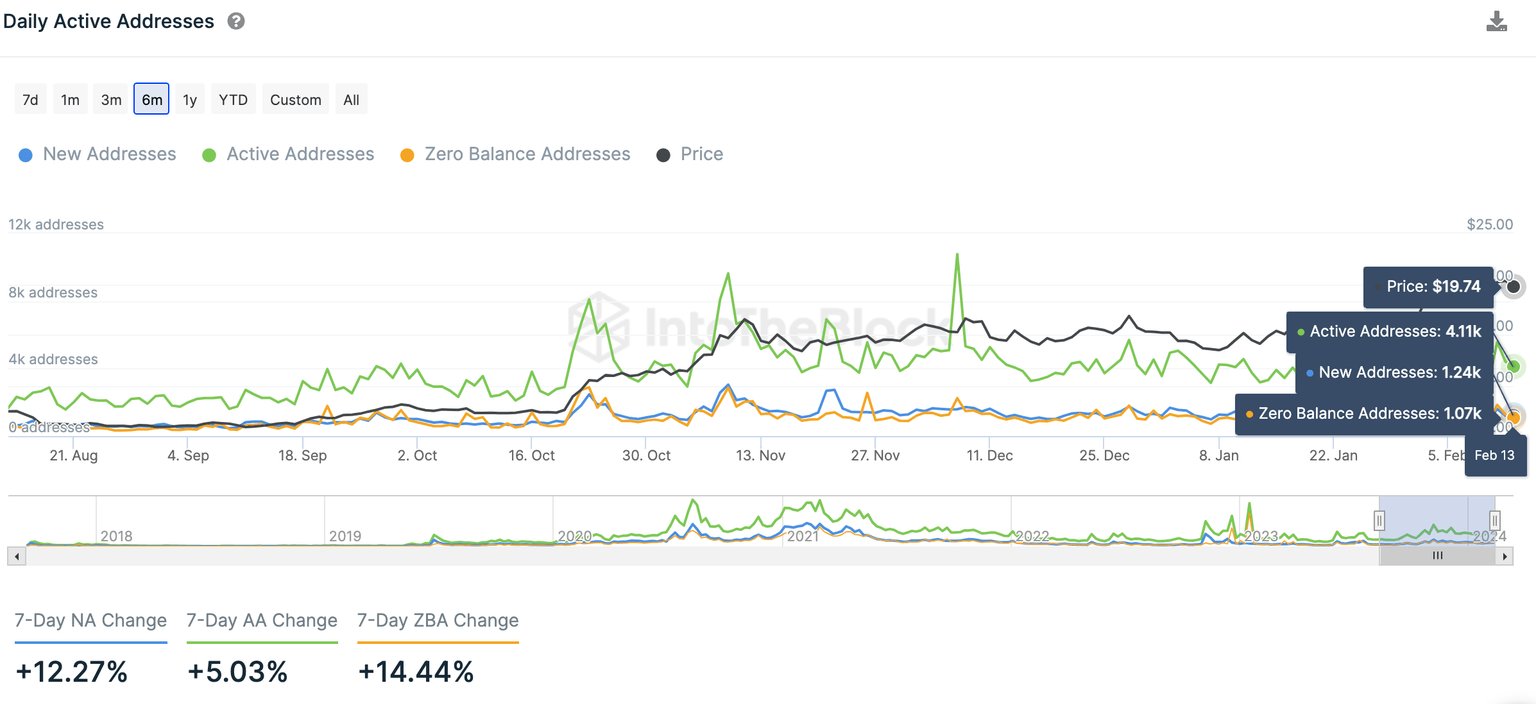

The Daily Active Addresses chart shows a 12.27% increase in new addresses in the past week. The chart from IntoTheBlock shows a 5% increase in Active Addresses in the past seven days. This supports the rising activity on Chainlink.

Daily Active Addresses. Source: IntoTheBlock

LINK Supply on Exchanges dipped in February, dropped from 219.51 million on February 2 to 211.61 million on Wednesday. LINK supply has declined 4% this month, likely reducing the selling pressure on Chainlink’s token. This supports the bullish thesis for Chainlink.

LINK Supply on Exchanges. Source: Santiment

At the time of writing, LINK price is $20.294. If Chainlink’s native token extends its gain, LINK price could revisit its 2024 peak of $20.856.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B16.20.34%2C%252014%2520Feb%2C%25202024%5D-638435059160752377.png&w=1536&q=95)

%2520%5B16.08.27%2C%252014%2520Feb%2C%25202024%5D-638435059853740193.png&w=1536&q=95)