Celestia price at pivotal point, TIA could rally nearly 40% if these conditions are met

- Celestia price sits atop the $12.93 support level, hinting at a 15% rally to $15.

- The gains could extend to 38% as TIA could tag $17.37 as it flips the $15 level.

- A daily candlestick close below $10.94 will invalidate the bullish thesis.

Celestia (TIA) price currently sits at a key barrier of $12.93. Hence, the next move could make or break the altcoin. Investors should note that a breakdown of this support structure could trigger a steep correction.

Read more: Grayscale BTC ETF filing keeps important details unrevealed a week before approval

Celestia price needs a push to the upside

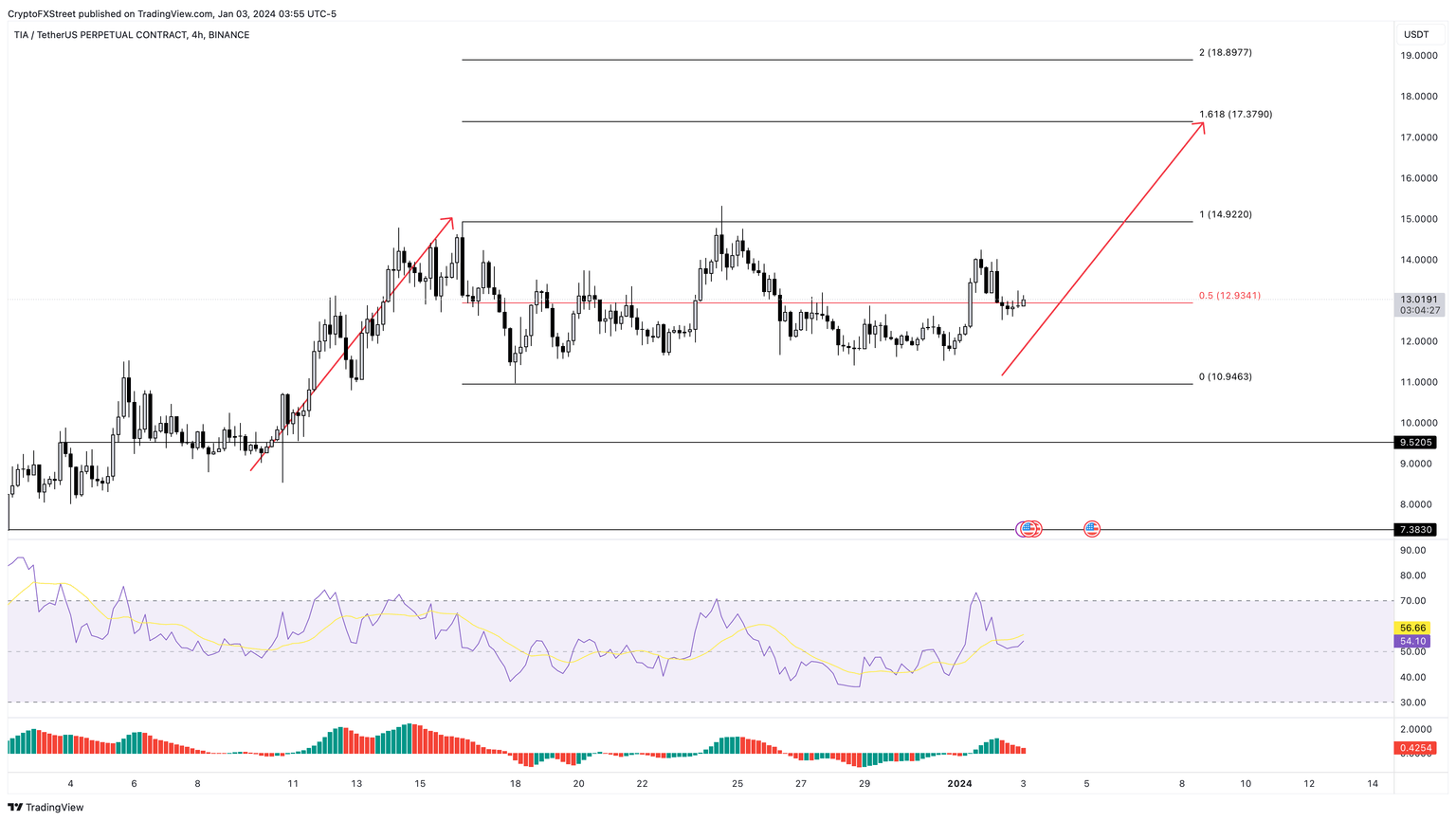

Celestia price has been trading inside the $10.94 to $14.92 range for more than two weeks. As TIA trades around this range’s midpoint of $12.93, one of two scenarios will occur – a bounce that leads to an exponential rally or a pullback that leads to steep correction.

Currently, the Relative Strength Index (RSI) sits at the midpoint, which shows that there is a possibility of a bounce. The Awesome Oscillator (AO) also slides down toward the zero mean level.

A bounce here could send Celestia price to tag the range high of $14.92 or roughly $15.00. A flip of this barrier into a support level could send TIA to the 161.8% Fibonacci Retracement level of $17.37.

This move would constitute a 38% gain from the current level of $13.00.

TIA/USDT 4-hour chart

On the other hand, if Celestia price gets rejected at $12.93, it could trigger a correction to the range low of $10.94. A daily candlestick close below $10.94 will produce a lower low and invalidate the bullish thesis.

In such a case, Celestia price could crash 13% and tag the key support level of $9.52.

Also read: Cardano price sets up buying opportunity for ADA to rally 35%

(This story was corrected on January 3 at 15:48 GMT to say that a daily close below $10.94 will invalidate the bullish thesis, not below $19.94.)

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.