Grayscale BTC ETF filing keeps important details unrevealed a week before approval

- Bitcoin price rallied by more than 6% over the weekend to hit a 21-month high, breaching the crucial resistance of $45,000.

- Bloomberg ETF analyst James Seyffart states that the January 9-10 approval window remains intact.

- Most of the applicants have yet to name their Authorized Participant, including Grayscale, which did not name anyone in its recent amendment.

Bitcoin price made headlines over the past few days for reclaiming a crucial resistance as support after nearly two years. The bullishness ahead of the anticipated spot BTC ETF approval is showing its effect on the cryptocurrency even as top applicants, including the likes of Grayscale, leave their applications partially incomplete.

Daily Digest Market Movers: Bitcoin spot ETF race sees missing jockeys

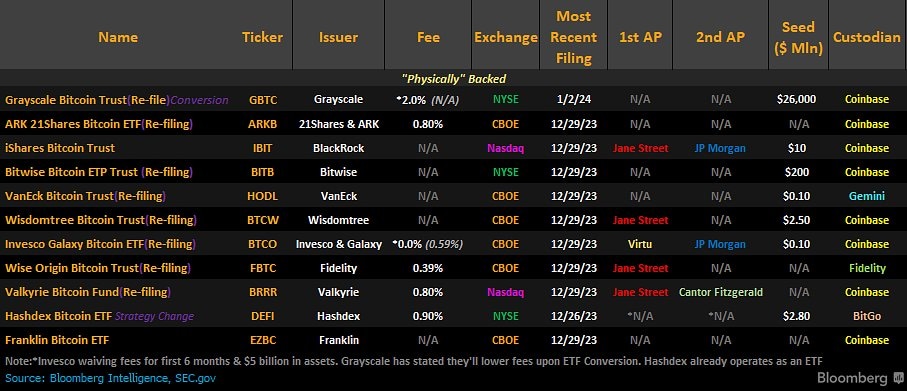

Bitcoin spot ETF filings have three important aspects that need to be addressed by an applicant before they can launch their investment products. These are Authorized Pariticpant (AP), fees and seed capital. While these factors are irrelevant to an average investor, being part of the process, they must be addressed soon.

As of this moment, about half of the applicants are yet to submit most of these details, which include names like Grayscale, Bitwise, VanEck, and Hashdex. Some of these have even launched their marketing campaign before the aforementioned factors are addressed.

According to Bloomberg ETF analysts, most of the spaces (N/As) in the table below are expected to be filled by next week, which is the deadline for approval from the Securities and Exchange Commission (SEC). The window for the green light from the regulatory authority is January 8 - 10, and the applicants must have the nitty-gritty of the filing down.

Bitcoin ETF filing updates

The reiteration is due to the recent filing from Grayscale, which amended its application, mentioning clear cash-only creation/redemption but has yet to name an AP. Furthermore, no details regarding the fees have been provided by the asset manager either on its Grayscale Bitcoin Trust (GBTC) to spot BTC ETF conversion filing.

Technical Analysis: Bitcoin price is still treading upward, regardless

Bitcoin price has seen an increase of more than 6% over the New Year weekend as Bitcoin hit $45,000 entering 2024. This is a crucial milestone for the altcoin since it is the highest the cryptocurrency has traded at in the past 21 months. The last time BTC was at this level was back in April 2022 post, when the bear market peaked and came to a halt after bringing the digital asset to $18,200.

However, despite the rally, Bitcoin price is yet to breach the resistance of $45,259. This line has acted as a crucial support and resistance level throughout February, March and April 2022 and is acting as a barrier at the moment as well. BTC did cross it during the intra-day trading hours but fell back down to close below it.

The Relative Strength Index (RSI) is well above the neutral line in the bullish zone, which is an indicator that there is still enough steam in the cryptocurrency to continue its rise. This falls in line with the expected approval of the spot BTC ETFs over the next week, which would act as a catalyst anyway.

BTC/USD 1- day chart

A flip of $45,259 into support would definitely act as the first step in the direction of reclaiming $50,000 for Bitcoin.

However, a failed breach might see the Bitcoin price struggle a bit before reaching the intended target. A retest of the $44,000 point cannot be ruled out either, but a fall through it would invalidate the bullish thesis and delay the recovery rally.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

-638398763359554773.png&w=1536&q=95)