Cardano price sets up buying opportunity for ADA to rally 35%

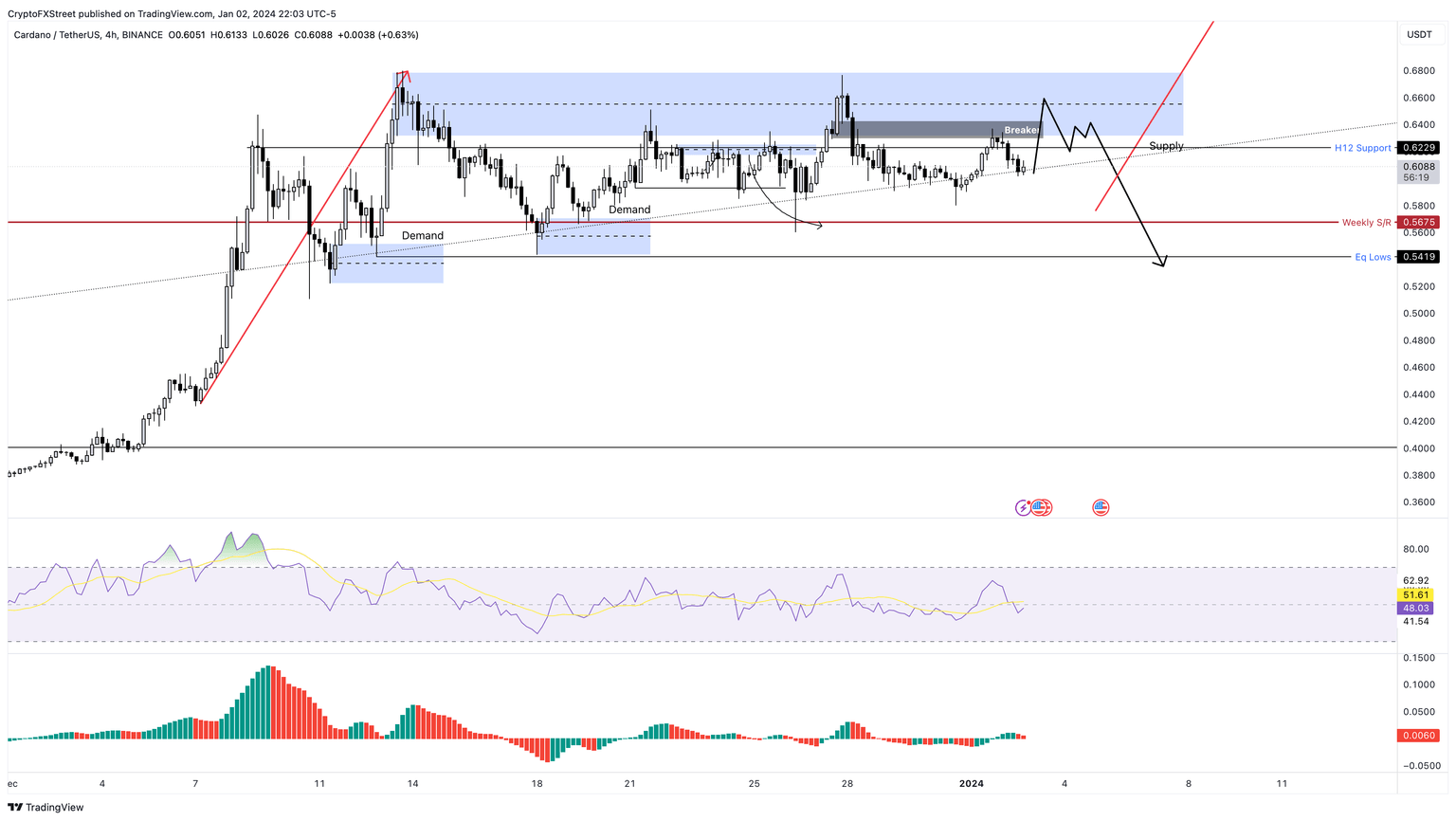

- Cardano price action continues to consolidate in the $0.600 to $0.650 range.

- ADA faces a major supply zone hurdle, extending from $0.631 to $0.678.

- A flip of this barrier could send ADA to retest the $0.800 and $0.823 levels.

Cardano (ADA) price action is currently being held up by an inclining trendline. While a breakdown would give sidelined buyers an opportunity to accumulate, a breakout above a key hurdle could propel ADA higher.

Also read: Spot Bitcoin ETF update: The politics behind approvals according to investment bank TD Cowen

Cardano price is at a crossroad

Cardano price slipped into consolidation after setting up a local top at $0.647. Since then, ADA has attempted to continue the ascent by setting up a higher high at $0.680, but the bullish momentum failed to support this move. As a result, ADA has produced a sideways movement that currently trades at $0.608.

Regardless, ADA has produced a set of higher lows, indicating that the buyers are persistent in buying the dips.

In the short-term, Cardano price could breach the uptrend line connecting the higher lows produced since December 8. This move could briefly pierce the weekly support level at $0.567 and attempt a sweep of the equal lows around $0.541.

This 11% retracement in Cardano price is key for sidelined buyers to accumulate ADA at a discount. Additionally, this move would cause the short-sellers to close their positions. These two events create a massive spike in buying pressure, triggering a recovery rally that leads to the reclaim of the 12-hour support level at $0.622.

In a highly bullish case, if Cardano price can overcome the $0.600 to $0.650 supply zone, it could continue its ascent and attempt to reflect the 55% rally witnessed between December 7 and 13. As a result, ADA could inflate by 35% from the $0.567 weekly support level to tag the $0.800 and $0.823 hurdles.

Read more: Cardano on-chain metrics signal ADA holders should tread with caution

ADA/USDT 4-hour chart

On the other hand, if Cardano price flips the support level of $0.567 level into a resistance barrier on the weekly time frame, it could denote weakness. Additionally, this move would produce a lower low and invalidate the bullish thesis.

In such a case, Cardano price could crash 25% to tag the $0.400 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.