Cardano’s DeFi ecosystem ambition might be its biggest roadblock to success

- Cardano has been stepping into every aspect of crypto with DeFi, NFT, and stablecoin instead of being completely focused on just one.

- Even ADA’s deflationary aspect is failing to prop up the demand as investors fail to see it as a lucrative option.

- Ethereum succeeded, where Cardano failed by being focused solely on the one aspect it was developing.

Cardano (ADA) is one of the biggest blockchains in the crypto space, but its valuation more or less has been said to come from its hype rather than its development. Over the last few months, its growth has slowed down despite having a significantly faster network than many of its competitors.

The cause of this arrested development may well be, paradoxically, due to the loftiness of its own ambitions.

What is holding Cardano back?

One of the biggest barriers to Cardano’s development has been its attempt at establishing itself in all sectors of the crypto space. The project has entered the Decentralised Finance (DeFi) market, the NFT space, and launched its own stablecoin Djed, working towards improving scalability and enabling cross-chain without dedicatedly focusing on growing any one front in particular.

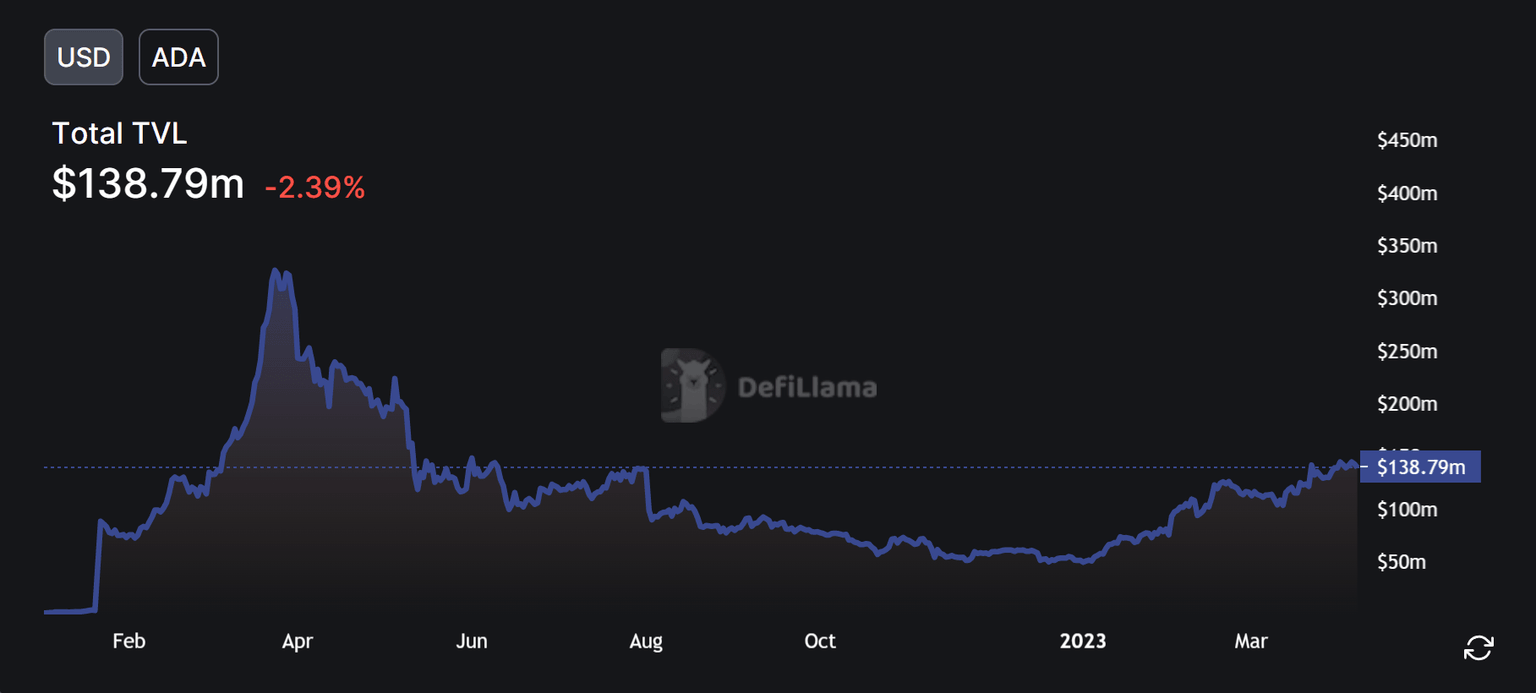

Despite being in the DeFi market for nearly a year and a half now, the chain only has $138 million as total value locked (TVL) at the moment. Even at its highest, the TVL stood at just $320 million.

In contrast, Ethereum layer-2 chain Arbitrum has amassed $2.23 billion in TVL even though it launched only a month before Cardano’s Alonzo hard fork.

Cardano TVL

Although Cardano has been the most hyped-up project, its smart contract launch failed to live up to its hype. This drew criticism towards founder Charles Hoskinson and the project for not being able to deliver. Many notable personalities like Galaxy Investments CEO Mike Novogratz have questioned the project’s valuation, even calling it a “cult”.

Didn’t make our full interview, but Mike Novogratz is also on the list of smart people who remain shocked by Cardano’s valuation:

— Zack Guzmán (@zGuz) June 12, 2021

“They have done something to create this weird cult.”#Cardano $ADA pic.twitter.com/ZHAhL0sgLi

Some even questioned the decentralization that Cardano proposes, which Hoskinson simply dismissed as FUD (Fear, Uncertainty, Doubt)

This is categorically false and a great example of how FUD spreads. https://t.co/GMGkXxRce2

— Charles Hoskinson (@IOHK_Charles) March 4, 2023

In another instance, the Cardano founder criticized the community itself for not being interested in constructive content and focusing on controversy and drama.

Remember CryptoTwitter and the AI generated cryptomedia content somehow completely forgot to report on the 2 hour governance twitter space discussing Cardano. It's almost as if the incentive is to promote division, controversy, and drama instead of constructive stuff?

— Charles Hoskinson (@IOHK_Charles) March 7, 2023

The lack of growth is not only limited to the blockchain but to the price action as well, despite Cardano’s native token ADA being a deflationary asset with a supply of just 45 billion. Deflationary assets are known to induce demand in the market as they have a limited supply which is expected to drive the price action up.

While ADA price did rally throughout 2022, it significantly dropped after the Alonzo upgrade as the smart-contract launch disappointed people, failing to live up to their expectations.

How did Ethereum get it right?

Cardano is hailed as a third-generation cryptocurrency and “Ethereum killer” for having a nearly identical purpose as a blockchain but with a faster processing rate.

But in comparison to Cardano, Ethereum has succeeded due to being focused on one aspect and growing it significantly.

The Ethereum team built DeFi first and became the biggest chain in the world with nearly $30 billion in TVL today. It is now moving on to establishing the Proof-of-Stake consensus method with the Merge in September 2022 and is developing it further by beginning staking withdrawal with the Shanghai upgrade. After that, there is ‘sharding’.

This is why, despite being an inflationary asset, with basically no supply cap, ETH gained prominence. Furthermore, the world’s second-biggest cryptocurrency is eventually transforming into a deflationary asset through its token burn mechanism in August 2021.

This will lead to an increase in the asset’s demand which could result in significantly more growth down the line.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.