Cardano traps bears as short squeeze begins to rally ADA above $2

- Cardano price action is exceptionally oversold compared to its peers.

- Strong bullish reversal incoming as late-entry short sellers now trapped.

- Excellent long entry opportunity for ADA is incoming.

Cardano price may be at the beginning of a move that could see it lead the broader cryptocurrency market on a fantastic rally over the next six months. Having spent most of the last quarter of 2021 in a downtrend, Cardano is poised for some monumental gains.

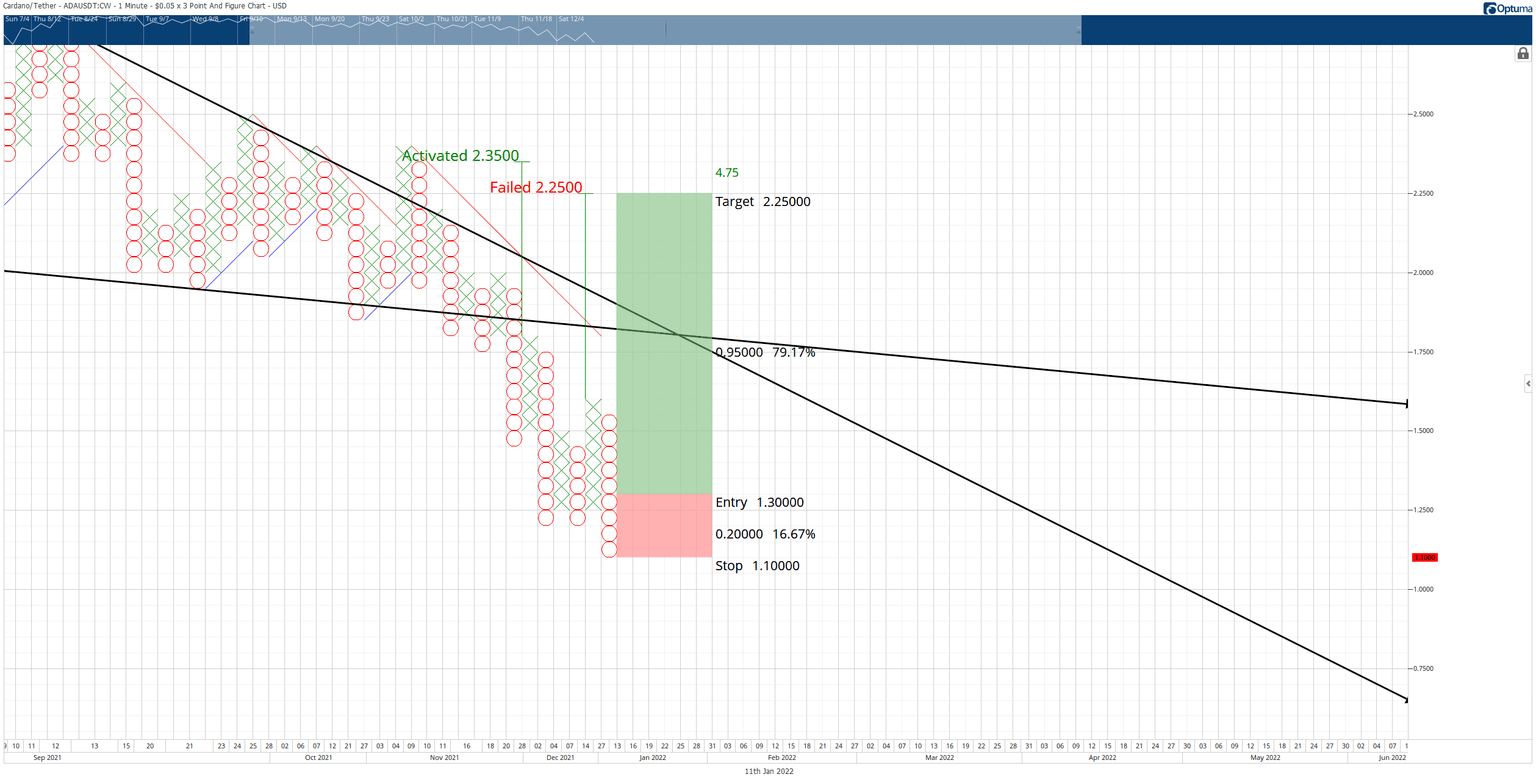

Cardano price develops a powerful bullish trade setup on its Point and Figure chart

One of the most robust and reliable Point and Figure trade patterns is the Fake Out. A Bullish Fake Out pattern develops after a multiple bottom has a breakout that moves at least – but not more than – two Os below the multiple bottom. Next, there must be a reversal column of Xs. Finally, the long entry is at 50% of the range of the previous O column.

For Cardano price, the theoretical long entry is a buy stop order at $1.30, a stop loss at $1.10, and a profit target at $2.25. The profit target is based on the Vertical Profit Target Method in Point and Figure analysis. The possible trade setup is a 4.75 reward/risk trade setup with an implied profit target of 79% from the entry. A three-box trailing stop would help protect any implied profit.

ADA/USDT $0.05/3-box Reversal Point and Figure Chart

Downside risks, however, do remain. For example, any daily or weekly close below the $1.00 value area would probably trigger a flash crash through an extremely thing volume profile to the next high volume node and cluster of support at $0.40. In that scenario, Bitcoin would likely be trading near $30,000 and Ethereum near the $2,250 price range.

The theoretical long setup for Cardano price is invalidated if the current O-column moves lower to $1.00.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.