Cardano could rally 14% to $0.70 as TVL holds above $425 million

- Cardano’s Total Value Locked held above the $425 million mark early on Tuesday, easing slightly from the all-time high from December 14 .

- The asset, considered Ethereum killer, yielded 11% weekly gains for holders.

- ADA price could climb towards the $0.70 target if the uptrend remains intact amidst profit-taking.

Cardano (ADA) has registered an 11% price gain during the last week, supported by Bitcoin’s (BTC) uptrend, and on-chain metrics suggest a bullish outlook for the altcoin. Cardano’s correlation with Bitcoin in the last three months stands at 0.89 – rallying alongside the largest crypto asset by market capitalization – while Cardano chain’s total value of assets locked holds up close to its recent record high of $444 million.

ADA price sustained above the $0.61 level this week.

Also read: Solana, XRP and Cardano receive $16 million weekly inflows as Bitcoin sees outflows

Cardano TVL climbs, ADA gains likely sustainable

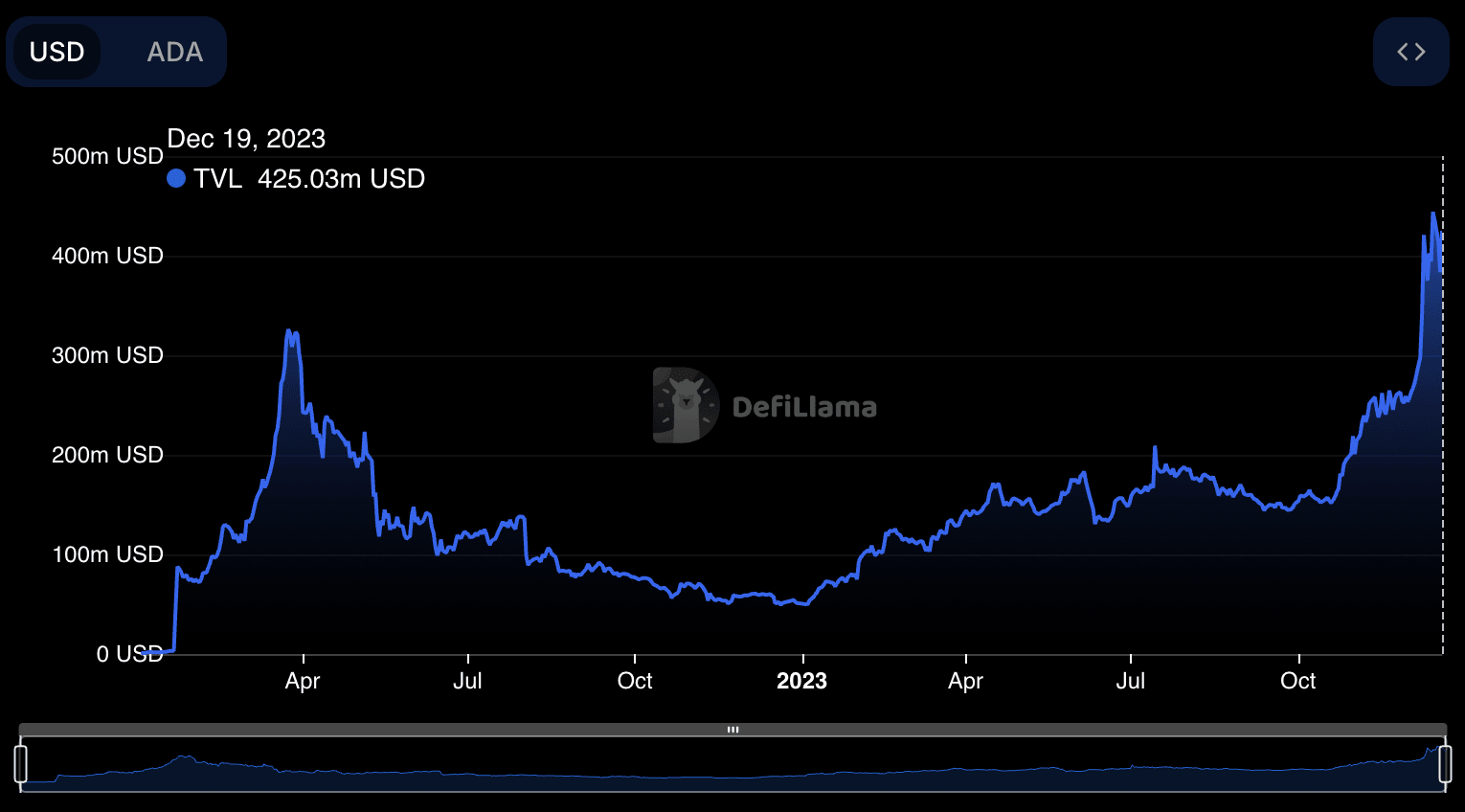

- The Total Value of assets Locked (TVL) in a blockchain is indicative of the relevance and demand for a chain among market participants. Cardano’s TVL surpassed $425 million on Tuesday, supporting a bullish thesis for the asset’s relevance in the ecosystem.

- As seen in the DeFiLlama chart below, Cardano’s TVL hit a peak of $444 million on December 14 last week, before its pullback to $425 million.

Cardano TVL. Source: DeFiLlama

- Network Realized Profit/Loss (NPL), an on-chain metric used to identify whether Cardano transactions on a given day were profitable or realized losses, shows that ADA holders have engaged in profit-taking between December 4 and 19. When combined with the whale transactions of $100,000 or more, large wallet-addresses holding ADA tokens are realizing gains in the asset.

Cardano NPL and Whale Transaction Count (>$100,000). Source: Santiment

- Cardano price resumed its upward trend on December 17, despite the profit-taking activities. This is indicative of the strength in Cardano’s upward trend. Another key catalyst that is likely driving these gains is ADA correlation with Bitcoin.

- Data from Macroaxis shows that Cardano’s three-month correlation with Bitcoin is 0.89. Therefore, a rally in the latter is reflected in ADA as well. The Ethereum killer is in lockstep with Bitcoin’s climb.

ADA could climb to $0.70 target

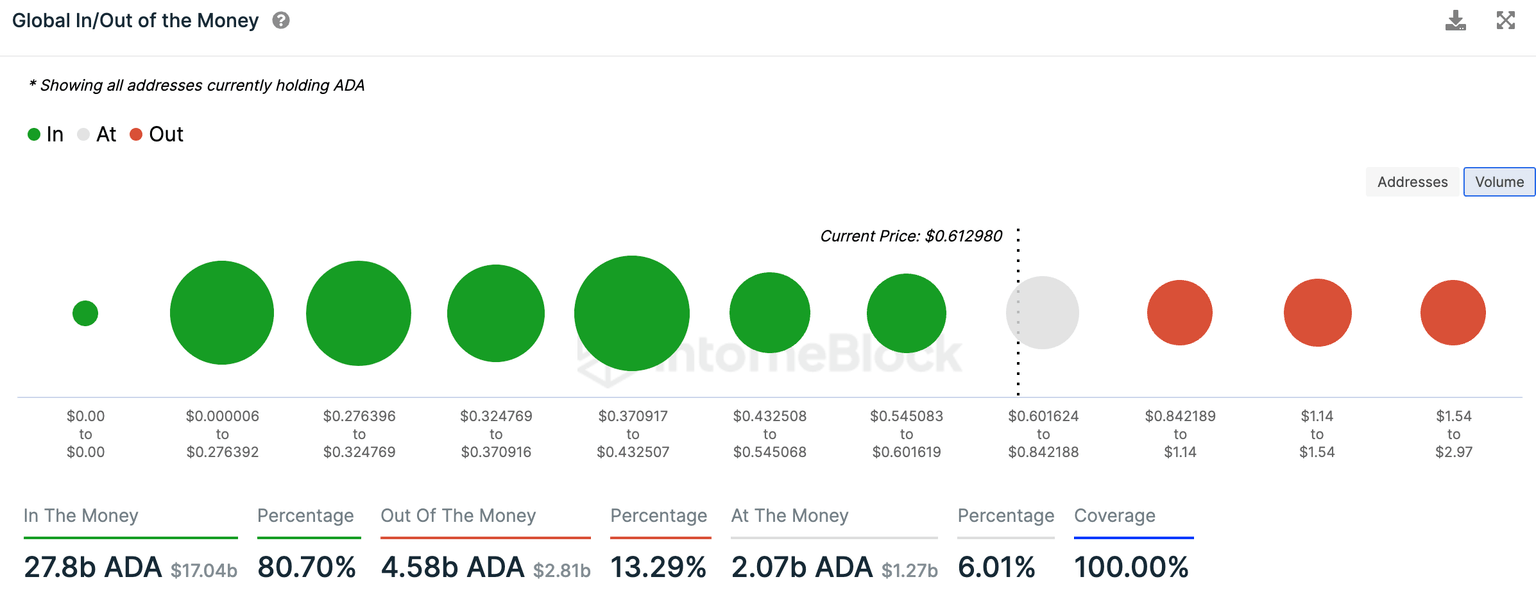

- IntoTheBlock data gives insight into Cardano’s support and resistance levels. At the time of writing, ADA price is $0.61. The altcoin is in a crucial demand zone that ranges from $0.6016 to $0.8421, where 208,690 addresses bought 2.07 billion ADA tokens.

- Below this range, Cardano’s price is likely to find support in the range between $0.5450 to $0.6016. However, if ADA price sustains its gains and continues rallying, Cardano could breach the resistance at $0.8421 to climb towards the $1 psychological barrier.

Global In/Out of the Money. Source: IntoTheBlock

- Cardano’s price is in an uptrend that started on October 19. Since then, ADA price formed higher highs and higher lows, hitting a local peak of $0.6802 on December 14. As seen in the ADA/USDT 1-day chart below, Cardano price is likely to climb towards the Fair Value Gap, which is placed between $0.7021 and $0.7258.

- If Cardano price successfully pushes past resistance at the 38.2% Fibonacci retracement level of the decline from its April 4, 2022 peak of $1.2436 to December 29, 2022 low of $0.2369, which is located at $0.6214, the path to $0.70 is relatively free of roadblocks.

ADA/USDT 1-day chart

- However, a daily candlestick close below the 10-day Exponential Moving Average (EMA) at $0.5854 could invalidate the bullish thesis for Cardano. In the event of a decline, ADA price could find support at $0.5854 and the 23.6% Fibonacci level at $0.4745.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B13.09.14%2C%252019%2520Dec%2C%25202023%5D-638385717533136668.png&w=1536&q=95)