Cardano price primed to rebound as institutional interest for ADA surges

- Cardano price continues to be influenced by the 2018 high of $1.39.

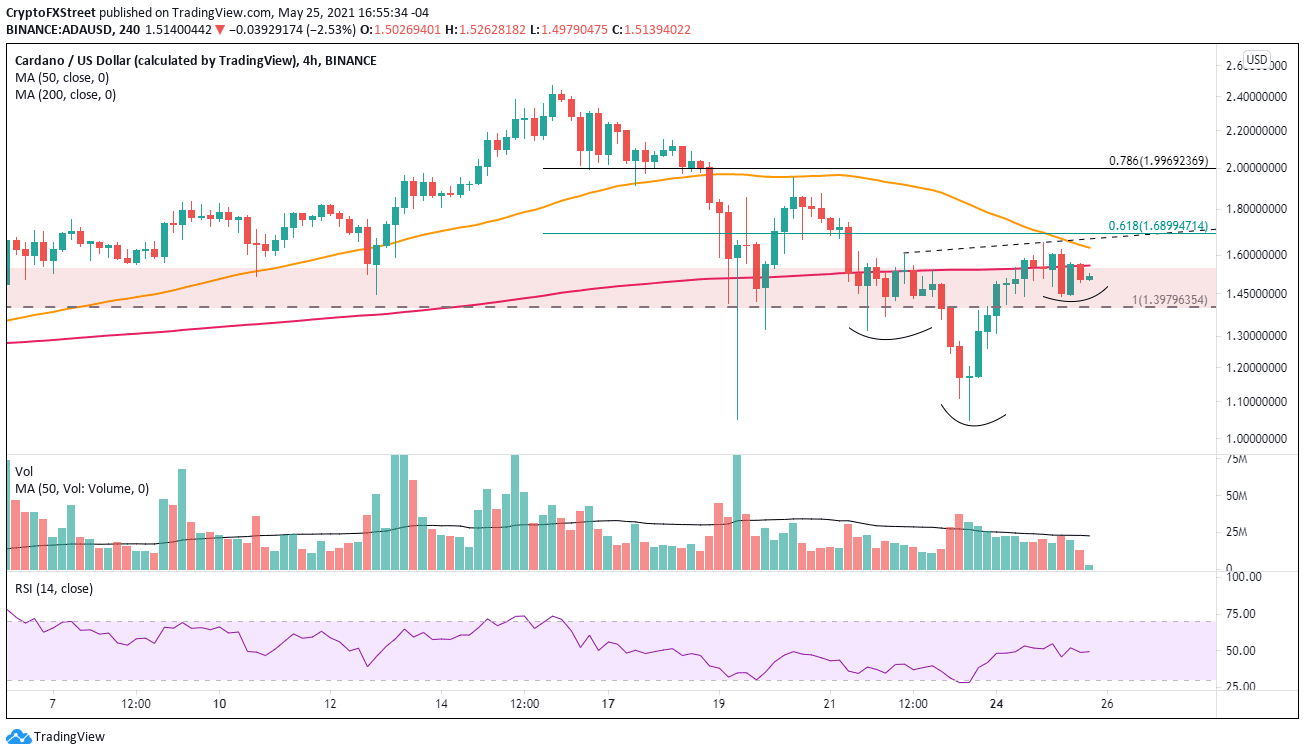

- ADA may be developing an inverse head-and-shoulders pattern on the four-hour chart.

- Institutional inflows into ADA investment products jumped by $10 million last week while Bitcoin and Ethereum saw outflows.

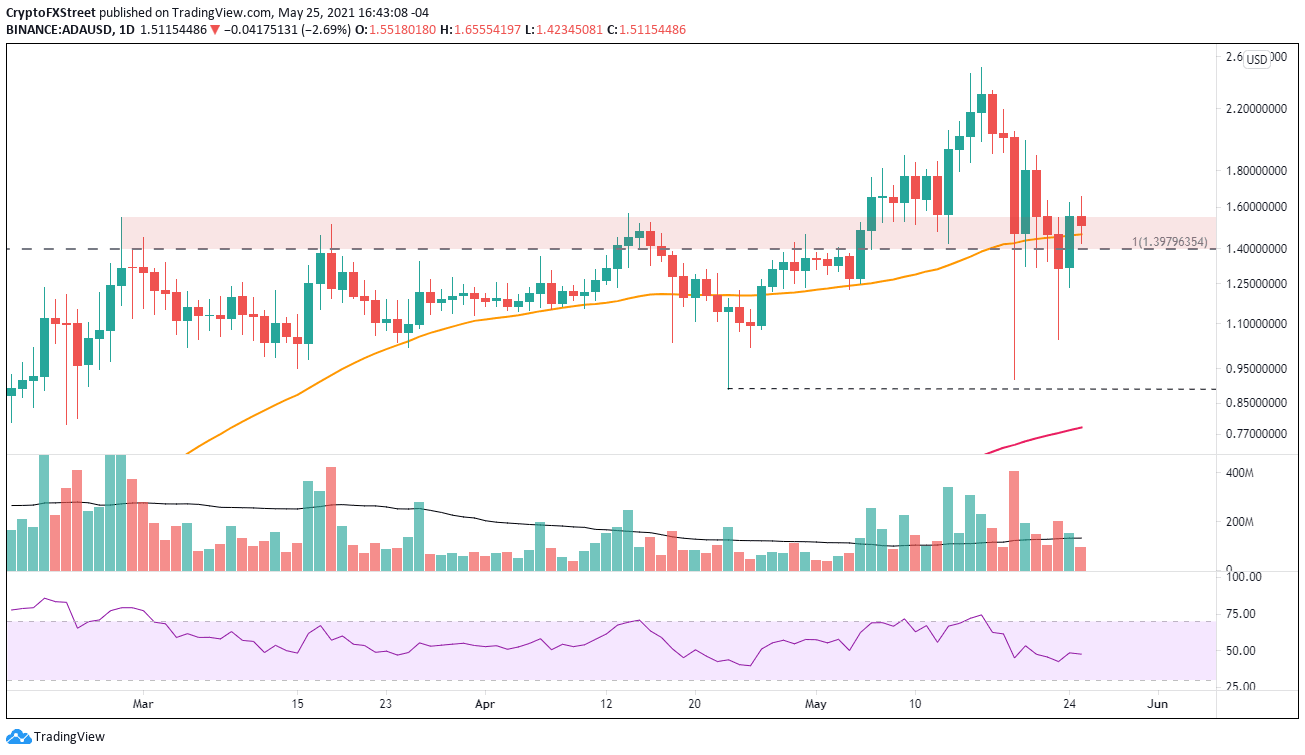

Cardano price has traded around the 50-day simple moving average (SMA) for the past seven days, and it is on pace to close May with a double-digit gain. ADA will confront more volatility daily, but it remains well-positioned to be one of the leading digital tokens moving forward.

Cardano investment products attract more capital than any other digital asset

According to the latest CoinShares Digital Asset Fund Flows Weekly report, digital assets saw net institutional outflows for the second consecutive week, totaling $97 million and marking a new record for outflows. To provide perspective, it represents just 0.2% of total assets under management (AUM), and it does not compare to the total YTD net inflows of $5.5 billion.

Bitcoin had total outflows of $110.9 million following outflows of $115 million in the previous week. It was the second consecutive week that BTC recorded outflows of over $100 million. Ethereum showed $12.9 million in outflows, but it is a minor setback in a year of record-breaking inflows for the smart contracts token.

Altcoins saw continued positive sentiment with inflows totaling $27 million. Cardano showed the largest institutional inflows at $10 million. It was the second consecutive week of ADA inflows, lifting the YTD inflows to $24 million for Cardano institutional investment products. Coinbase suggested that the robust inflows may “represent investors actively choosing proof of stake coins based on environmental considerations.”

Indeed, environmental considerations have taken center stage in the cryptocurrency complex due to the notable impact mining has on the earth. Elon Musk was instrumental in elevating those concerns to mainstream media when he decided that Tesla would no longer accept BTC as a payment method because of the tremendous power usage, primarily derived from fossil fuels.

Cardano price searching for stability in a market overwhelmed with apprehension

At the May 19 crash low, Cardano price had fallen over 50% for the day, over 60% from the all-time high at $2.51, and the decline had dismantled the 180% rally from the April 23 low. However, by the end of the day, ADA had rebounded by 50%, lifting it above the tactically important 50-day SMA.

On May 23, Cardano price suffered another wave of heavy selling pressure, knocking the digital token down almost 30% at the intra-day low, but again, ADA rebounded by 25%.

Despite the volatility over the last six days, Cardano price has respected two crucial price levels. The 2018 high at $1.39, and the February 27 high at $1.54. Locked in between the two price levels is the 50-day SMA at $1.46.

ADA/USD daily chart

In the short term, there is a high probability that Cardano price will oscillate along the two price levels and the 50-day SMA, releasing the price compression from the last week’s volatility.

It is essential to note that Cardano price on the four-hour chart is shaping an inverse head-and-shoulders pattern that could trigger in the next few hours. The trigger price for the opportunistic formation is $1.66, slightly above the 50 four-hour SMA at $1.63.

Key resistance levels include the 61.8% Fibonacci retracement of the May crash at $1.68, the May 20 high at $1.98 and then the 78.6% retracement at $1.99.

ADA/USD 4-hour chart

A daily close below yesterday’s low at $1.23 would alert investors to another steep drop in Cardano price, potentially down to the May 23 low at $1.04 or even to the May 19 low at $0.91. A decline below the April low at $0.89 would introduce a deeper, secular decline for ADA.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.