Cardano Price Prediction: ADA remains indecisive

- Cardano price shoots up roughly 20% in under 12 hours and as it approaches the 200 six-hour SMA at $1.458.

- An uptrend seems likely if ADA produces a six-hour candlestick close above $1.458.

- Rejection at $1.458 might trigger a 30% downswing to $1.01.

Cardano price has seen a healthy uptick over the past 24 hours but is currently hovering under a critical resistance level. Therefore, ADA shows no bias. A clear trend will establish after the so-called “Ethereum-killer” breaks past the supply barrier or gets rejected by it.

Cardano price at crossroads

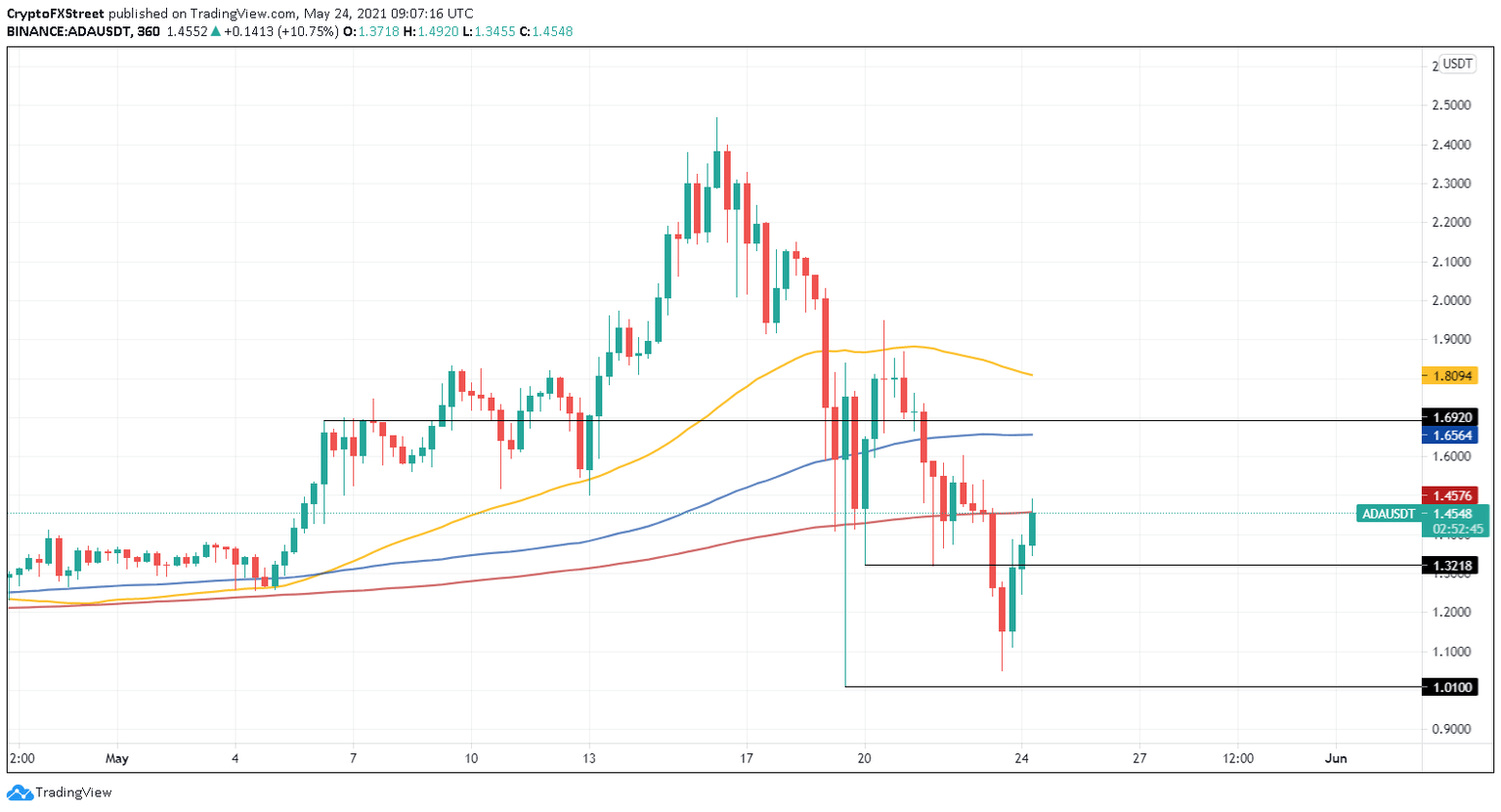

Cardano price is trading at $1.454 after a 37% upswing over the past 18 hours. The 200 six-hour Simple Moving Average (SMA) at $1.458 supplies overhead pressure, preventing the bulls from rising higher. Despite its bullish rally, ADA needs to slice through this barrier to establish a proper trend.

Assuming a potential spike in buying pressure that produces a decisive close above $1.458, investors can expect the so-called “Ethereum-killer” to rally 13% to tag the 100 six-hour SMA at $1.656, which is in the proximity of the resistance level at $1.692.

If the buyers continue to bid, Cardano price could rise another 7% to test the 50 six-hour SMA at $1.809.

ADA/USDT 6-hour chart

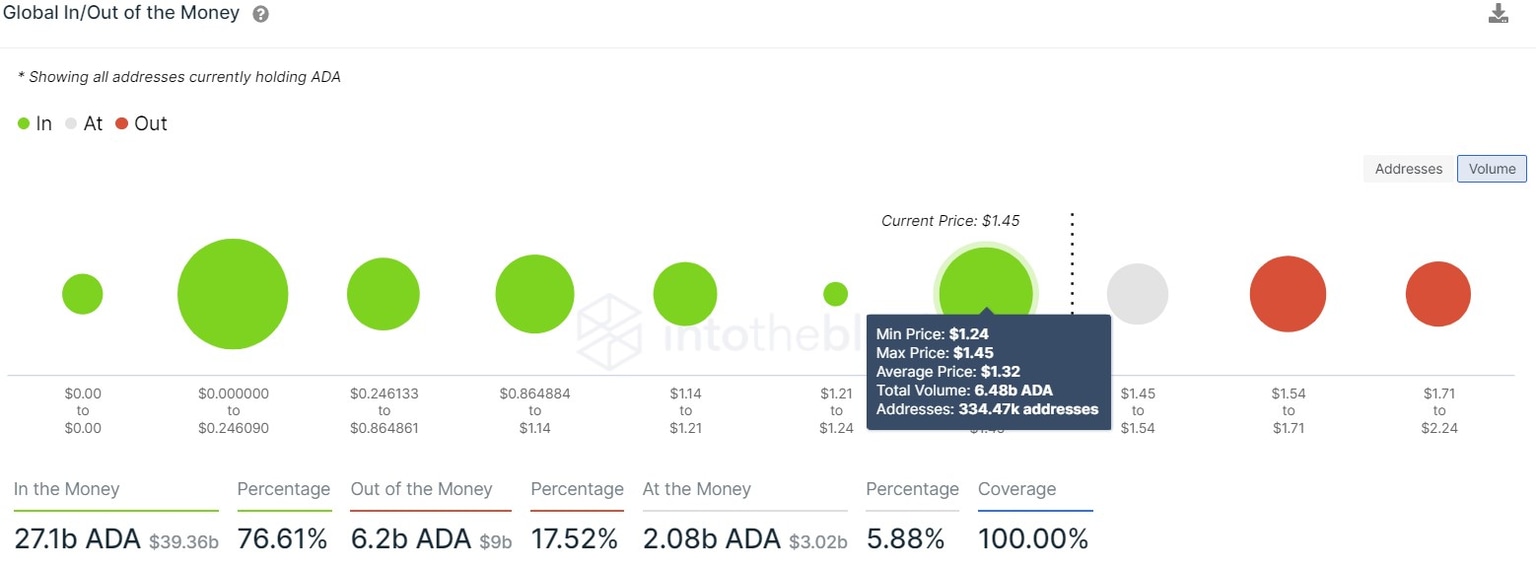

Adding credence to this optimistic narrative is the stacked support levels portrayed by IntoTheBlock’s Global In/Out of the Money (GIOM) model. Roughly 334,000 addresses that previously purchased nearly 6.5 billion ADA are present at $1.32. Therefore, short-term selling pressure is unlikely to push through these investors.

In fact, these holders might add to their holdings if Cardano price comes to this level, dampening the bearish momentum.

ADA GIOM chart

Despite the bullish narratives explained above, a sudden spike in ask orders could easily cut through the support levels detailed above. Moreover, rejection around the 200 six-hour SMA signals weak buying pressure.

In that case, slicing through $1.32 will put the investors in this area “Out of the Money.” If these holders sell, it will add to the bearish momentum and confirm the start of a new downtrend. Under these bearish circumstances, ADA could slide 23% to tag the swing low created on May 19 at $1.01.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.