Cardano Price Prediction: Patience will save you from heartbreak

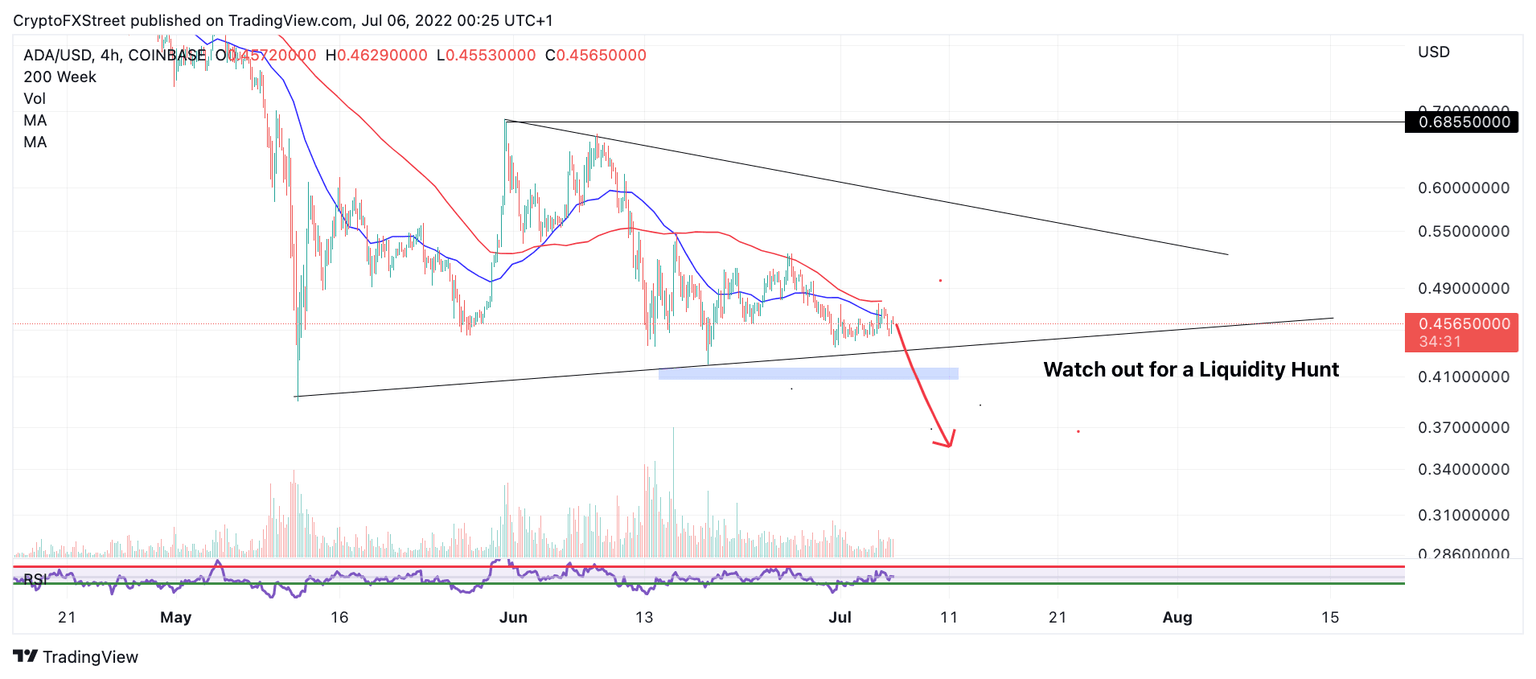

- Cardano price, like other cryptocurrencies, coils in a triangular fashion.

- ADA price sees rejection from both the 8- & 21-day simple moving averages.

- Invalidation of the downtrend is a breach above $0.48.

Cardano price could experience another sell-off. The swing lows established in June are unstable. Traders should also be hesitant to use the swing low on May 12 as a bullish invalidation level.

Cardano price looks like a smart money trap

Cardano price looks like it is setting up for a "sweep the lows" event targeting a retest of the $0.40 barrier and possibly the May 12 swing low at $0.39. Like many other cryptocurrencies in the market, the alternative-smart contract token coils in a triangular fashion. However, unlike its peers, the ADA price never established a progressive rally throughout the last weeks of June.

Cardano price has been trading range bound within the mid-$0.40 zone for the last 23 days. Its recent sideways nature only pales in comparison to USD stablecoins.

Cardano price currently trades at $0.456. On July 4, 2022, the bears successfully rejected the ADA price beneath the 8- and 21-day simple moving averages (SMA). ADA price could induce traders to open an unjustified long position, believing that the triangular pattern will continue to hold.

An additional retest of the $0.43 barrier could become the catalyst to breach the swing lows established in June at $0.42. Furthermore, attempting to catch a knife in the $0.41 region while using the June 12 swing lows at $0.39 is ill-advised. Ultimately, this thesis concludes that a plummet to $0.37 and lower will be unsurprising.

ADA/USDT 4-Hour Chart

Invalidation of the bearish trend lies above the 21-day SMA at $0.48. If the bulls can reconquer this resistant barrier, they may be able to rally as high as $0.60, resulting in a 32% increase from the current ADA price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.