Cardano Price Prediction: ADA upswing hangs in balance, but on-chain metrics reveal trouble

- Cardano price rose 12% after dipping below a crucial support level at $1.451.

- ADA is currently hovering inside a critical resistance level, ranging from $1.525 to $1.624.

- Only a decisive close above $1.636 will confirm the start of a run-up.

Cardano price created a bottom on June 12 after a massive downswing since June 3. The higher high set up on June 13 signaled the start of a new uptrend.

While the rally has taken shape, there is no confirmation that it will continue to head higher. Moreover, on-chain metrics reveal that ADA will face stiff resistance as it ascends.

Cardano price awaits confirmation

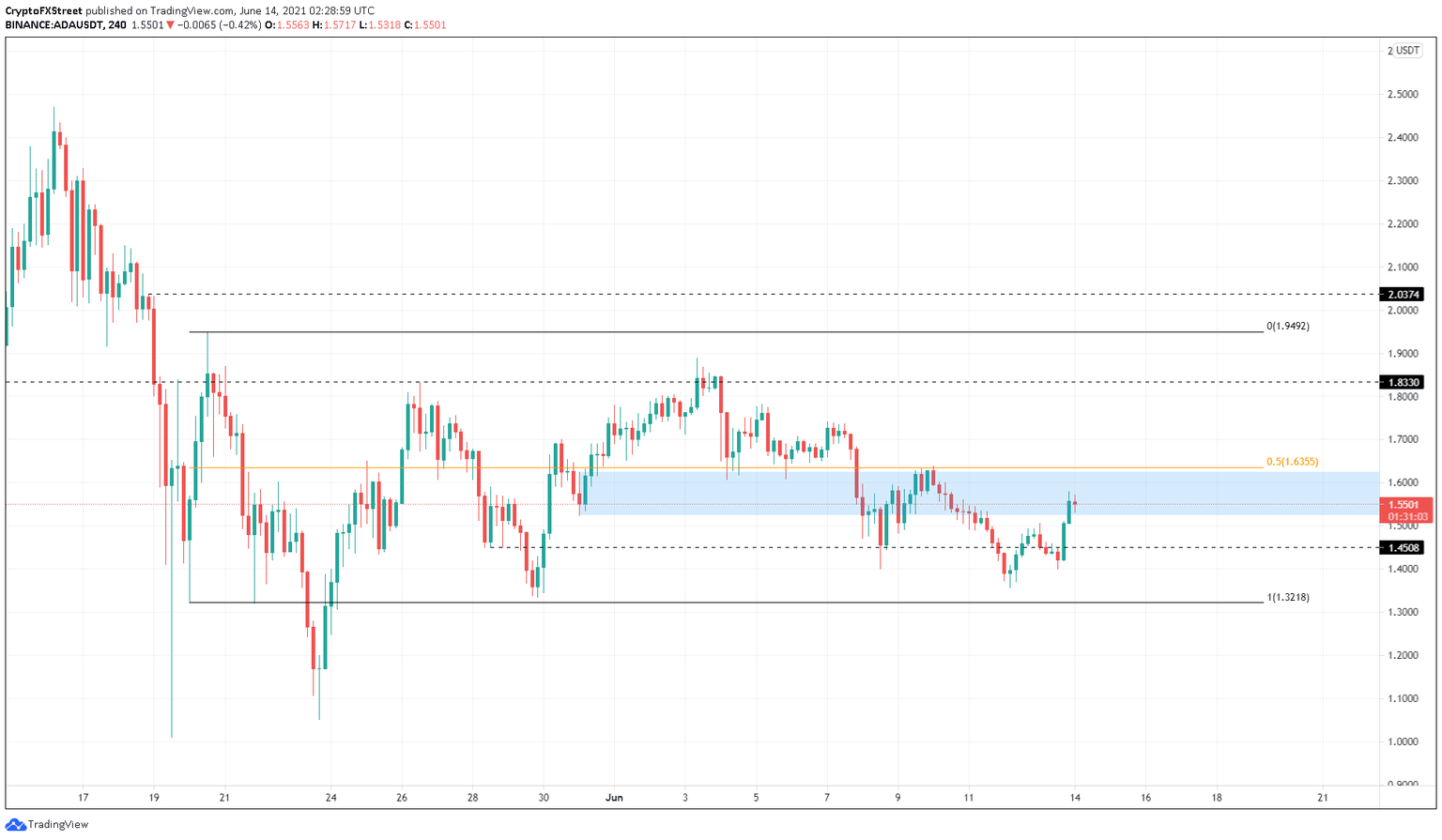

Cardano price set up two swing lows at $1.356 and $1.40 on June 12 and June 13, respectively, after a 28% sell-off since June 3. While ADA has rallied nearly 13% over the past 12-hours, it needs to produce a decisive close above the 50% Fibonacci retracement level at $1.636 to have any shot at the swing highs at $1.833 or $1.949.

Currently, Cardano price is trading inside a supply zone that extends from $1.525 to $1.624. This area will provide the most resistance for the bulls and might even halt the upswing.

Failing to breach this barrier will result in a downswing that could push ADA to the support level at $1.451. If the selling pressure continues to mount, the so-called “Ethereum killer” might retest the swing low at $1.322.

ADA/USDT 4-hour chart

Supporting this downswing is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, revealing stacked resistance levels of underwater investors.

From $1.57 to $1.71, roughly 408,000 addresses purchased nearly 6.16 billion ADA tokens. These investors are “out of the money” and might want to sell to breakeven if Cardano price rises. Therefore, a short-term surge in bullish momentum will not be enough to surge past this thicket of underwater investors.

ADA IOMAP chart

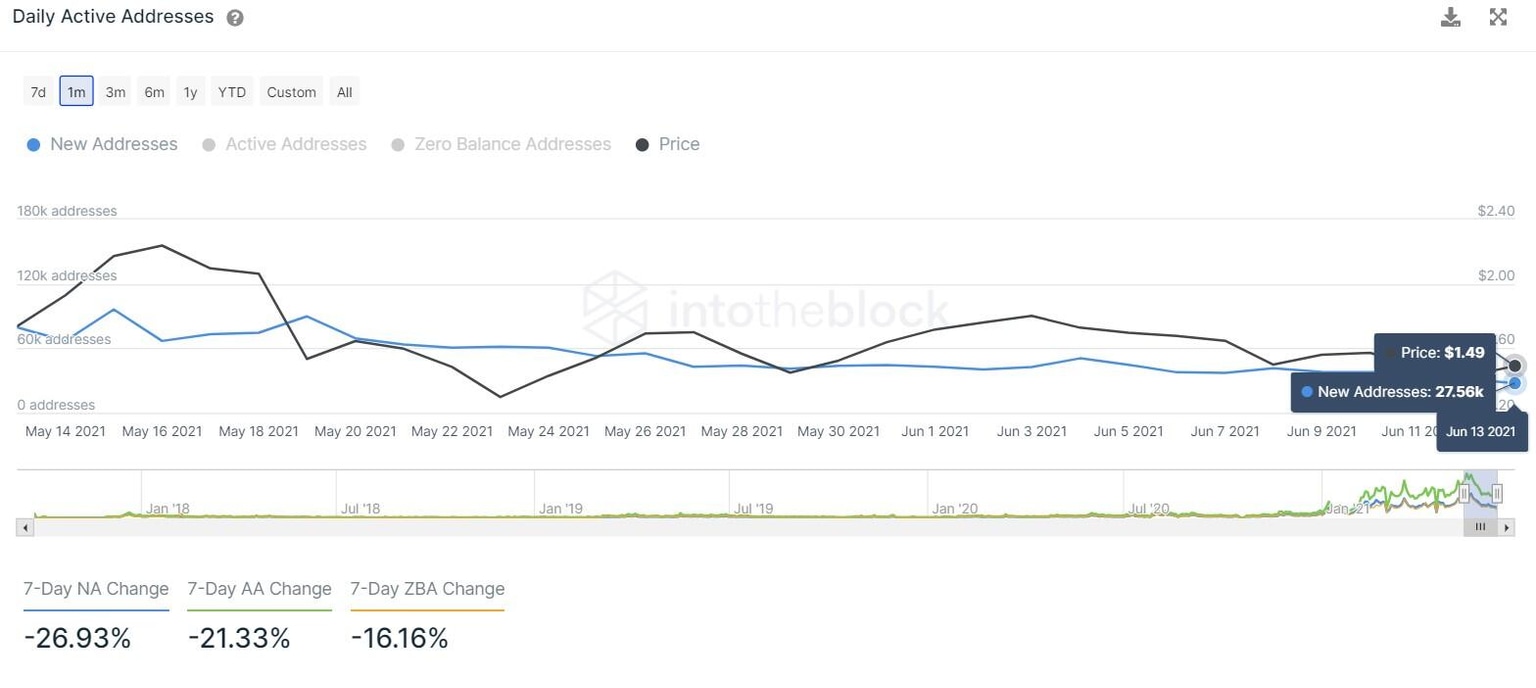

Moreover, the number of new addresses joining the Cardano network has reduced from 79,500 to 27,560 over the past month. This 65% decline indicates that investors are not interested in ADA at the current price levels and are either reallocating their funds or booking profits.

ADA new addresses chart

On the flip side, if ADA bulls manage to climb above $1.636, it will invalidate the bearish thesis and signal a new uptrend. In that case, Cardano price might surge 11% to tag the swing high at $1.833. Breaching through this level opens up the path to $1.949, the range high and the resistance level at $2.037.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.