Cardano Price Prediction: ADA to return to $1

- Cardano price founds sellers near the $1.20 value area.

- Thus far, sellers have been restricted to the Thursday close/Friday open.

- A pullback to the $1.00 value area is increasingly likely.

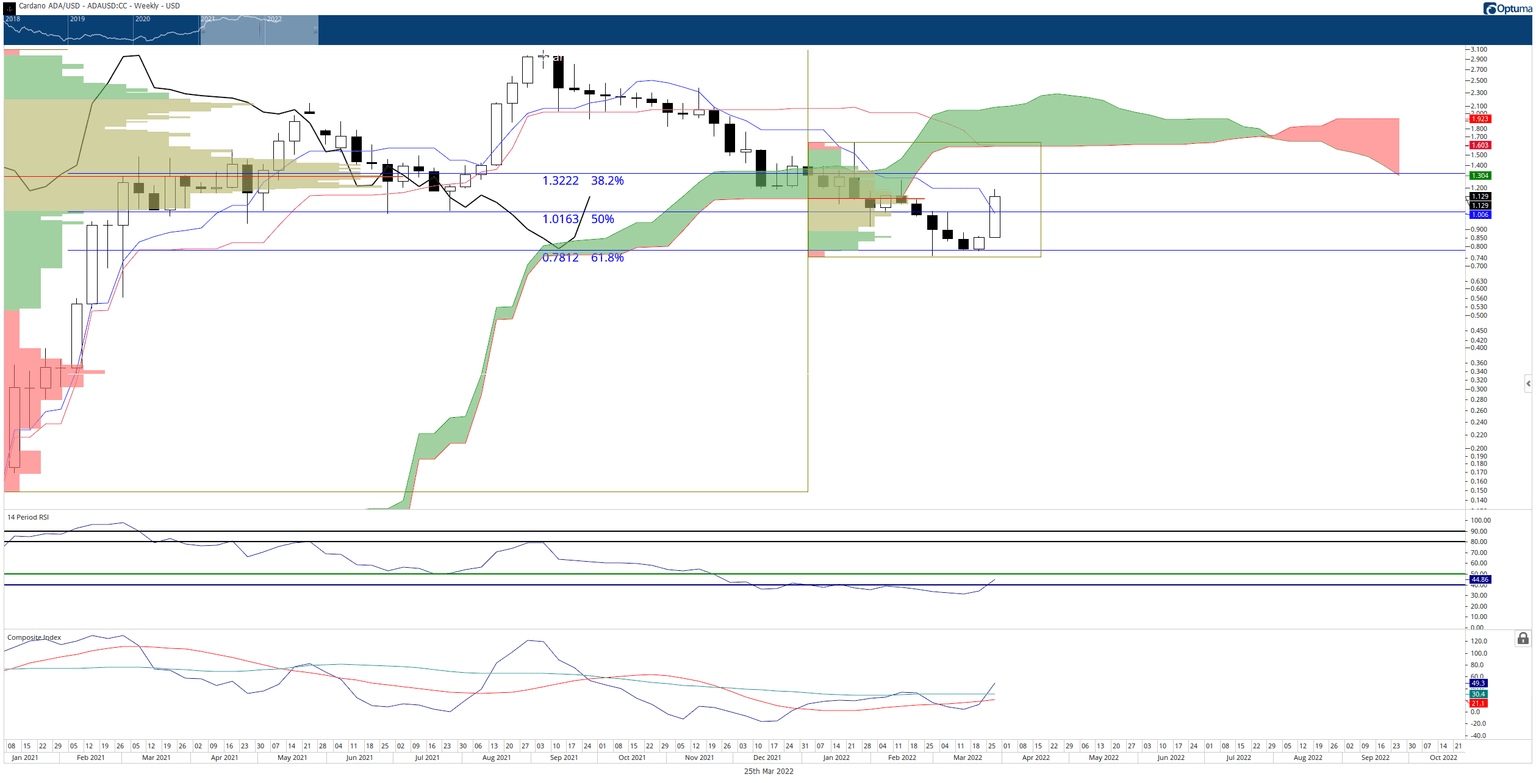

Cardano price action this week has had its best performance since August 2021. Unless something dramatic occurs, the weekly candlestick will swallow the bodies of the past eight weekly candlesticks. ADA is up over 45% from last week’s open and has been more than 50% higher. As a result, some profit-taking should be expected.

Cardano price likely to see some selling pressure occur as bulls take profit before another push higher begins

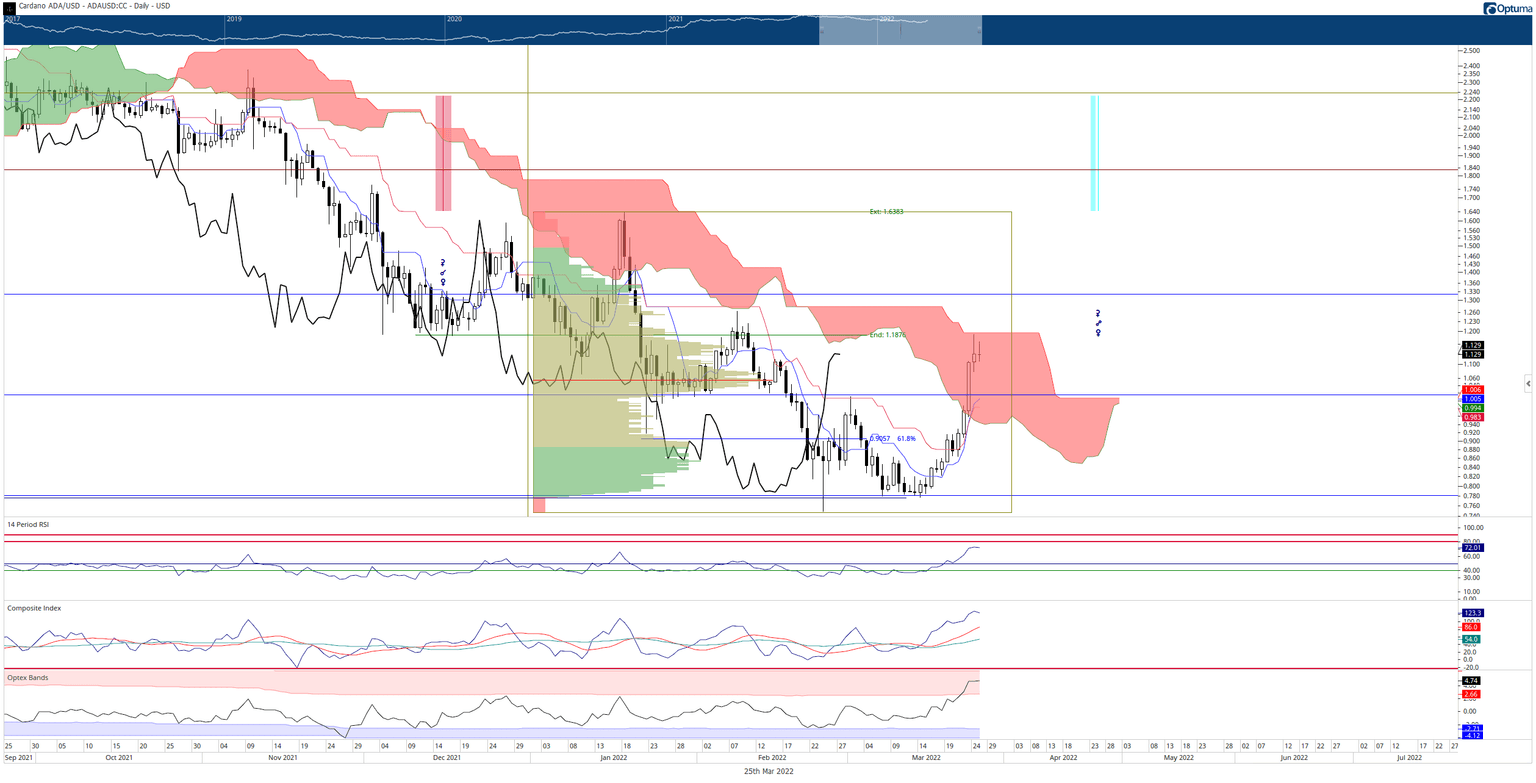

Cardano price action has performed remarkably this week, holding onto the majority of its gains and signaling that further bullish momentum for Cardano is likely. However, when ADA approached the top of the Ichimoku Cloud (Senkou Span B), it promptly sold off – almost exactly on Senkou span B.

ADA/USD Daily Ichimoku Kinko Hyo Chart

If bulls become nervous about their recent gains, Cardano price will likely experience some downside price action as traders take profits off the table. But the downside risks are probably limited to the $1 value area, which has become a very strong support level. The $1 value area now contains the 50% Fibonacci retracement, the Tenkan-Sen, and the Kijun-Sen. In addition, order books on various exchanges already see large limit buy orders placed between $0.98 and $1.05, anticipating a short-term pullback.

A pullback to $1 may not occur. Given how oversold and extended the downtrend, it may continue to rally. The Composite Index oscillator has crossed above its moving averages from neutral conditions and the Relative Strength Index is turning higher from the final overbought level, 40.

ADA/USD Weekly Ichimoku Kinko Hyo Chart

Cardano price may continue to spike higher to the bottom of the weekly Ichimoku Cloud, and Kijun-Sen shared the $1.60 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.