Cardano price to provide a long opportunity before rallying 55%

- Cardano price hit $1.20 after experiencing massive buying pressure over the past three days.

- Investors can expect ADA to retrace to $1 before triggering a 55% ascent to $1.55.

- A daily candlestick close below $0.857 will invalidate the bullish thesis.

Cardano price exploded after consolidating for a few days in the second week of March. This run-up pushed ADA through multiple hurdles – it is now ready for a retracement before another leg-up.

Cardano price comes back to life

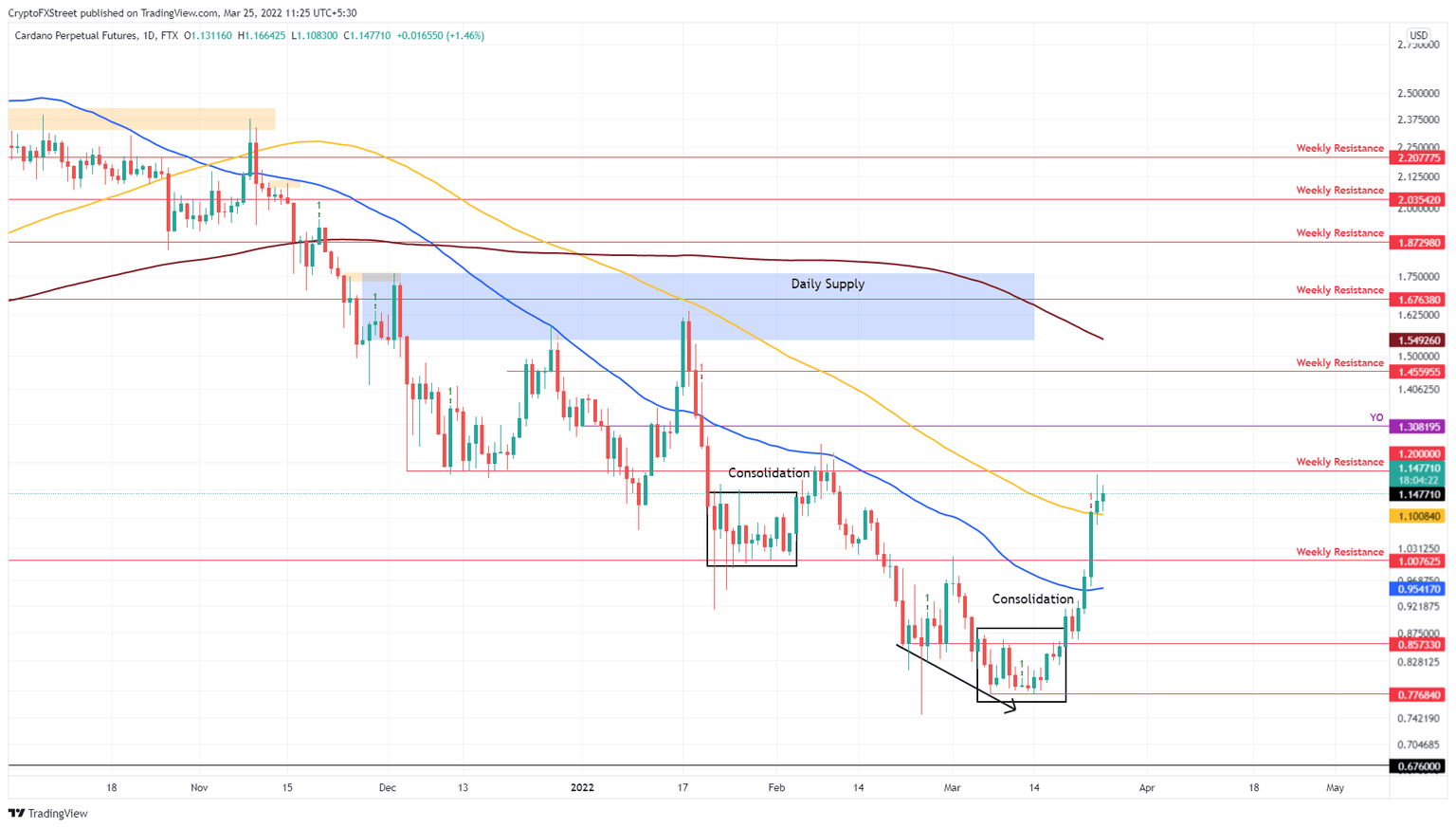

Cardano price moved sideways from March 7 to 18 and before beginning a 50% rally that pushed it past the 50-day Simple Moving Average (SMA) and the 100-day SMA at $0.954 and $1.1, respectively.

This uptrend, while impressive, has caused the Momentum Reversal Indicator (MRI) to trigger a red ‘one’ sell signal. The technical formation forecasts a one-to-four red candlestick downswing, so, sidelined investors can prepare to pick up ADA at a discounted price.

The resulting pullback is likely to shatter the 100-day SMA and push Cardano price to retest the $1 psychological level. Here, buyers can accumulate long positions in expectation of ADA reversing and going higher again.

The rally that originates here is likely to slice through the yearly open at $1.31 and tag the $1.45 weekly resistance barrier. Here, buyers might face a slight issue but clearing it could propel ADA toward the daily supply zone extending from $1.55 to $1.76.

Interestingly, the 200-day SMA coincides with the lower limit of the said demand zone and that is where Cardano price is likely to form a local top.

ADA/USDT 1-day chart

While the outlook for Cardano price is bullish, a minor pullback seems likely. However, if the selling pressure is heavier, leading to a breach of the $1 barrier, it will signal a more profound weakness among buyers.

A daily candlestick close below $0.857 will invalidate the bullish thesis for Cardano price. This development will open the path for ADA to revisit the $0.776 support level. Here, buyers may set up a double bottom, however, and give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.