Cardano Price Prediction: ADA prepares for 35% run-up to pre-crash levels

- Cardano price shows that its 22% upswing has exhausted the momentum, leading to a correction.

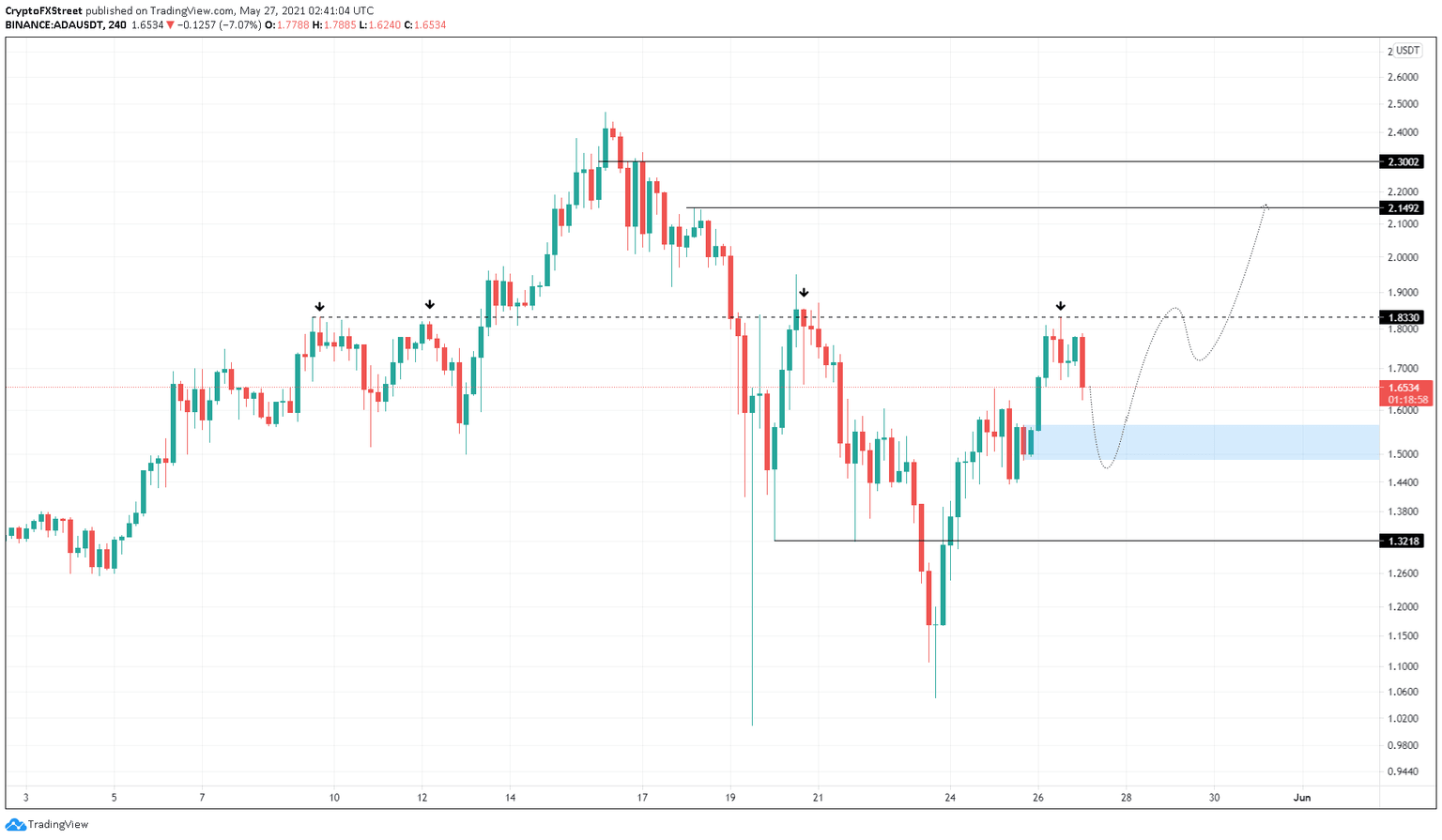

- A bounce from the demand zone extending from $1.488 to $1.566 will most likely trigger a 35% bull rally.

- The bullish narrative will face invalidation if the support barrier at $1.322 is breached.

Cardano price is currently experiencing a minor pullback that could push it down to a critical support area. A resurgence of buyers in this zone will propel ADA to pre-crash levels.

Cardano price eyes a higher high

Cardano price rallied roughly 26% between May 25 and 26, but the momentum that pushed it higher seems to be fading away as it tested a ceiling at $1.833. This barrier has prevented ADA from rallying roughly four times in less than three weeks, starting from May 9.

Therefore, the so-called “Ethereum-killer’s” recent attempt at crossing this barrier appears to have failed. A continuation of investors booking profits around this barrier will lead to a 15% retracement to the demand zone, ranging from $1.488 to $1.566.

Investors can expect the bullish momentum to rejuvenate as it dips into this area. A quick bounce from this support zone that breaches $1.833 will allow ADA to climb toward $2.193, the first area of interest.

Here, Cardano price could either consolidate or experience a small retracement.

Following this, if the buying pressure continues to persist, there is a high chance ADA revisits $2.30 or retests its all-time high at $2.47.

ADA/USDT 4-hour chart

Although unlikely, a breakdown of the support area that stretches from $1.488 to $1.566 will put a nail in the bulls’ coffin. If such a scenario were to evolve, Cardano price would likely experience an 11% sell-off to $1.322.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.